Navigating growth and inflation: Expectations for rate cuts falling in 2025

What is this chart showing?

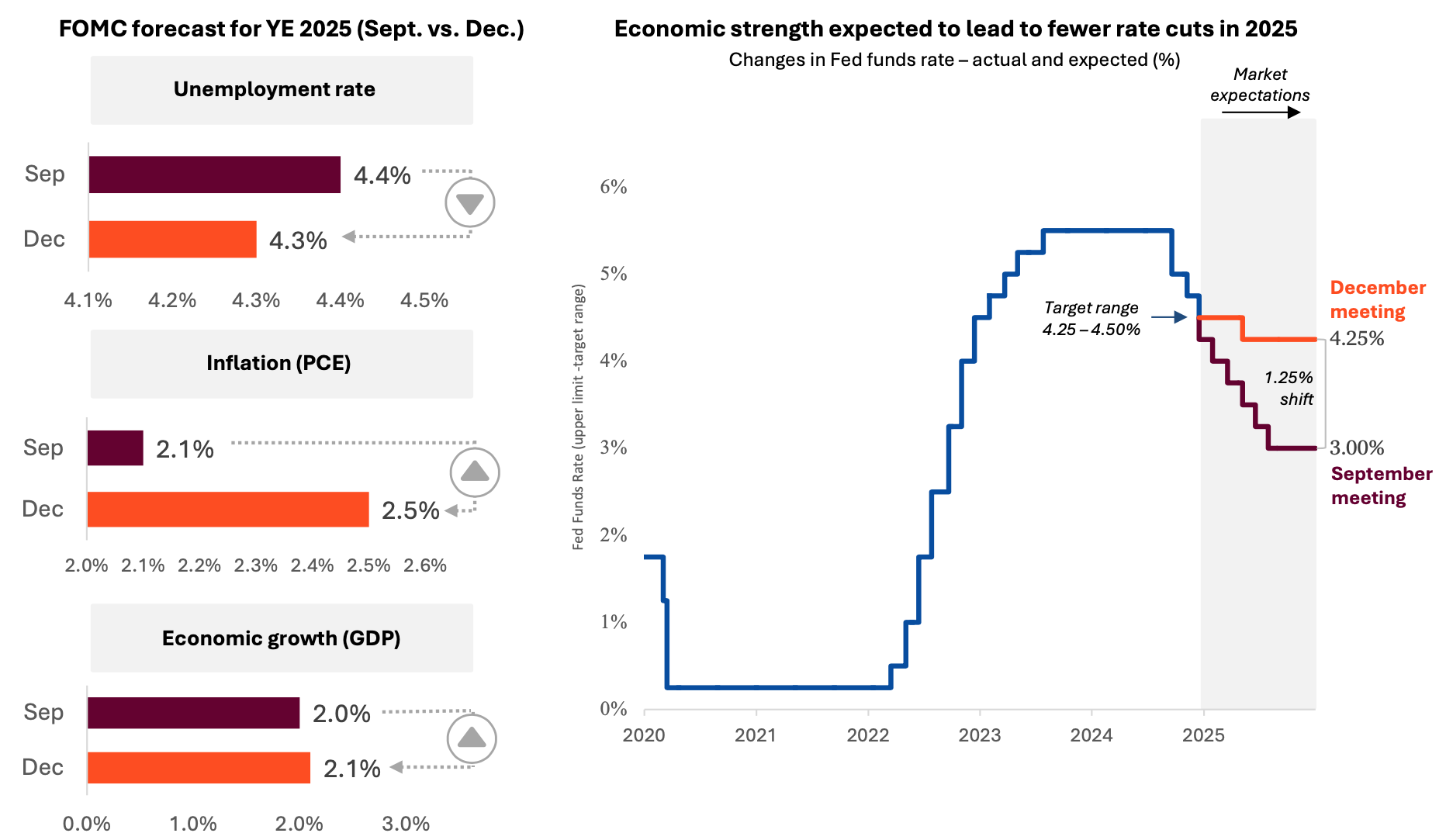

This chart shows how the Fed’s expectations for several key economic data points in 2025 changed between their September and December meetings (left), along with the actual and expected path of their policy rate (right).

Why is it important?

Relative to their September forecast, Fed officials now see a stronger economy, stickier inflation, and a more cautious approach to rate cuts ahead in 2025.

Following the central bank’s September meeting, futures were pricing in a policy rate of approximately 3% by the end of 2025. However, after lowering rates to a range of 4.25 – 4.50% during their meeting in December, only one additional cut was fully priced in by markets.

While both expectations and actual data can change rapidly, if future cuts are priced out due to a strong economy, market participants may view it as a positive development. However, if a resurgence in inflation were to blame, a more cautious sentiment may emerge.

Subscribe to the Market Intel Exchange, Lincoln’s chartbook keeps you informed on the most notable economic and market insights from this quarter.

Related: How U.S. Presidential Elections Have Shaped Market Volatility and Returns

Source: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis. Federal Open Market Committee (FOMC) forecasts for year-end 2025 sourced from the quarterly Summary of Economic Projections. Market expectations based on Fed Funds Futures (top of target range) as of 9/18 (September) and 12/18 (December). As of 12/31/24, market expectations reflect just under two full 25bp cuts by the end o f2025.