From: DoubleLine

"The secret of change is to focus all of your energy, not on fighting the old, but on building the new." - Socrates

The U.S. election could signal a major change in the political, economic and financial landscape. With strong Republican performance, including Donald Trump’s presidential win and likely majorities in the U.S. Senate and House, the financial sector could be a significant beneficiary.

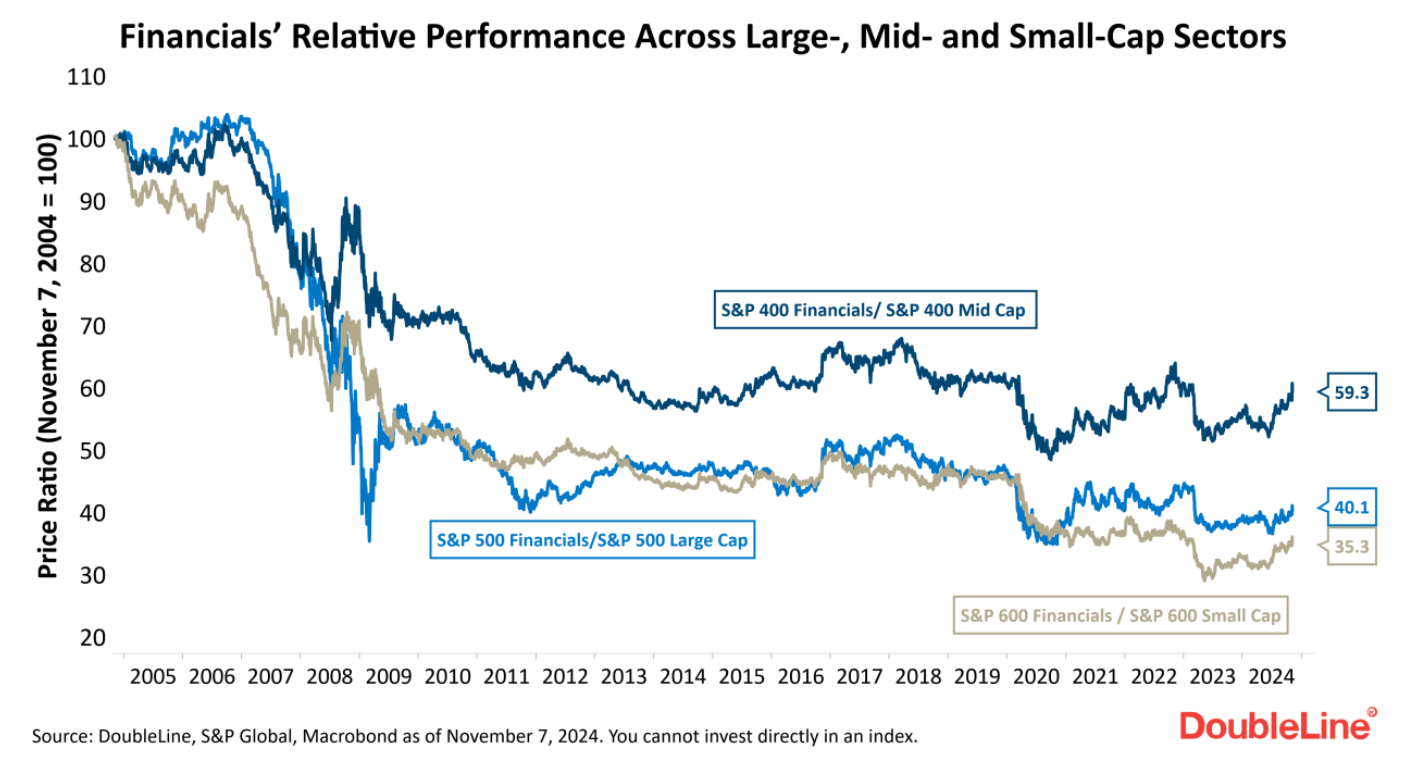

The Global Financial Crisis (GFC) of 2008-09 led to significant regulatory changes, such as the introduction of the Dodd-Frank Act, aimed at reducing leverage, mitigating risk and increasing transparency within the banking sector, which was at the epicenter of the GFC. As a result, the banking sector has since operated under heightened oversight and substantial constraints on lending types and capacity. Consequently, publicly traded financial sector shares have consistently underperformed across all market capitalization segments since the GFC. This week’s chart shows that over the past 20 years, large-cap financials underperformed the S&P 500 Index by 60%, mid-cap financials trailed the S&P Midcap 400 Index by 40%, and small-cap financials lagged the S&P Small Cap 600 Index by 65%.

With Trump’s return to the White House, could the new administration usher in a more favorable environment for financial stocks? Several factors suggest financials could indeed build on the momentum witnessed in the days since the election:

Deregulation: Trump’s administration is expected to roll back several post-GFC regulations, easing capital requirements and boosting banks’ operational flexibility. Analysts anticipate that this could free up to $191 billion in excess capital by the fourth quarter of 2026, potentially increasing demand for mortgage-backed securities and securitized credit.

Mergers & Acquisitions: Relaxed antitrust policies could encourage consolidation within the banking sector, leading to larger institutions with more market power.

Steeper Treasury Yield Curve: Banks typically borrow on short-term rates and lend at long-term rates, so a steeper yield curve could benefit their net interest margins. With the Federal Reserve expected to continue reducing the federal funds rate, a normalized yield curve should help restore banks’ profitability.

Soft Landing: Trump’s proposals, including extending tax cuts, are expected to marginally boost growth. Financial stocks, which tend to perform well during periods of positive economic growth and inflation, could benefit as well.

In conclusion, President-elect Trump’s return and expected regulatory changes could provide a tailwind to financial stocks. Following Election Day, financial stocks surged, with financials on the S&P 500, S&P 400 and S&P 600 up 6.2%, 9.1 and 10.4%, respectively, as of November 6, 2024. As the outlook for deregulation, M&As, a steeper yield curve and economic stability takes shape, financial stocks could see improved gains after an extended period of underperformance following the 2008-09 GFC. Monitoring these developments will be essential, as they could redefine the financial sector’s trajectory.

Related: Rising Yields: Where the Investment Opportunities Are