When global equity markets tumbled in early August, investors got a glimpse of what a deeper correction could like for the US giants, and it wasn’t pretty. The so-called Magnificent Seven have dominated US and global equity market returns since late 2022—and valuations have soared—as earnings growth rebounded and on expectations that they will be the big winners from artificial intelligence (AI).

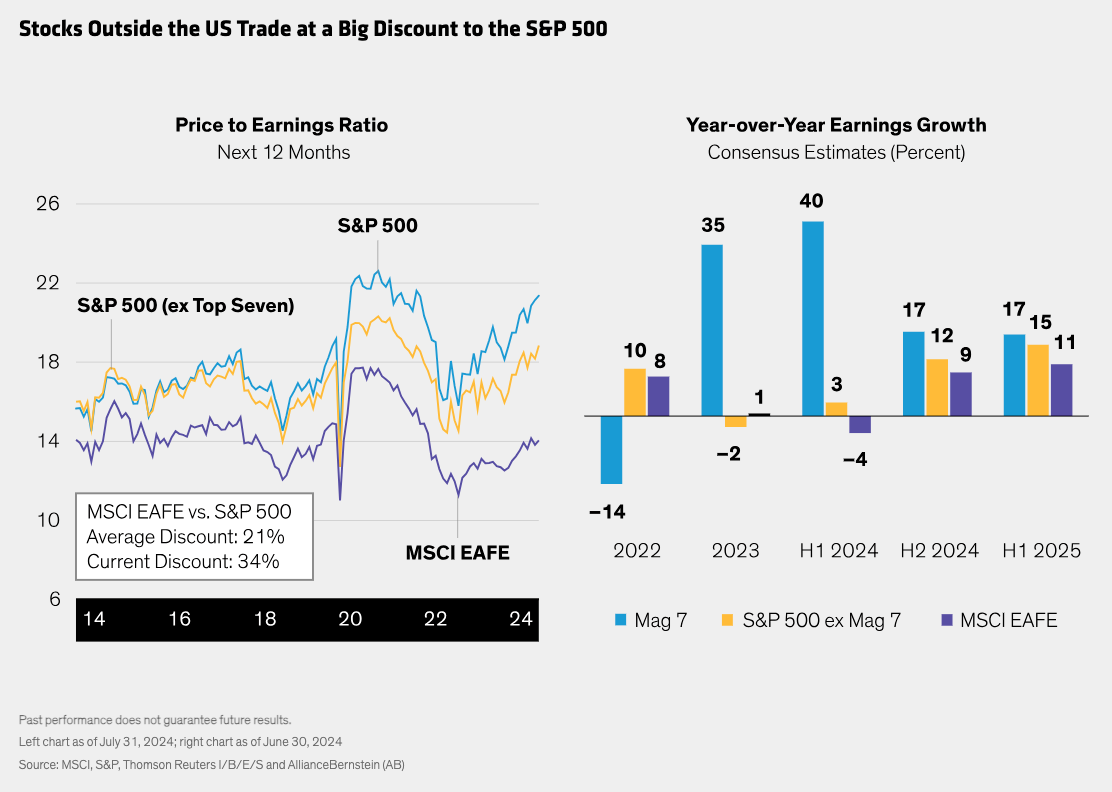

Markets have since recovered, and the jury is still out on whether a rotation away from the mega-caps is underway. But it’s not too soon to scrutinize valuations. Our research shows that the price/earnings ratio of US stocks excluding the seven largest names was much lower than valuations of the broad market at the end of July (Display). The MSCI EAFE Index of non-US stocks traded at a 34% discount to the S&P 500—much deeper than average over the past decade.

Earnings Growth Is Poised to Converge

Meanwhile, earnings growth forecasts also bode well for the broader market. While earnings growth for the Magnificent Seven towered above the rest of the market during 2023 and through the first half of this year, other stocks in the US and around the world are poised to close the gap through the first half of 2025, according to consensus estimates.

The Magnificent Seven includes some excellent businesses. Still, we believe holding the entire group can present risks, given their high valuations and concentration. Deciding whether to own each company and how to position its relative weight should be considered based upon a portfolio’s investing philosophy. And solid growth opportunities can be found in other parts of the market at much more attractive valuations.

Valuation Cushion for Downside Risk

AI isn’t the only growth game in town. In the healthcare sector, for example, new products targeting diabetes and obesity can help investors capture the growth potential for unmet medical needs.

Even in technology, the software industry includes companies that are benefiting from the ongoing migration to the cloud. Increasing demand for digital payment services is likely to create opportunities for financial technology companies.

Across sectors, some important business features may not be reflected in valuations. Intangible assets, for example, are often overlooked, yet they can augment quantifiable intelligence on a business. Intangible assets include research and development, culture, brand and patents. Strong intangible assets often point to long-term competitive advantages that may warrant a higher future equity valuation than a company is being given credit for today.

What do these examples have in common? We believe active equity investors can find stocks with quality business features around the world that trade at attractive valuations relative to their growth potential—and relative to the US mega-caps. Including companies like these in a lower-volatility equity portfolio can provide a valuation cushion to help curb downside risk before volatility strikes again.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.