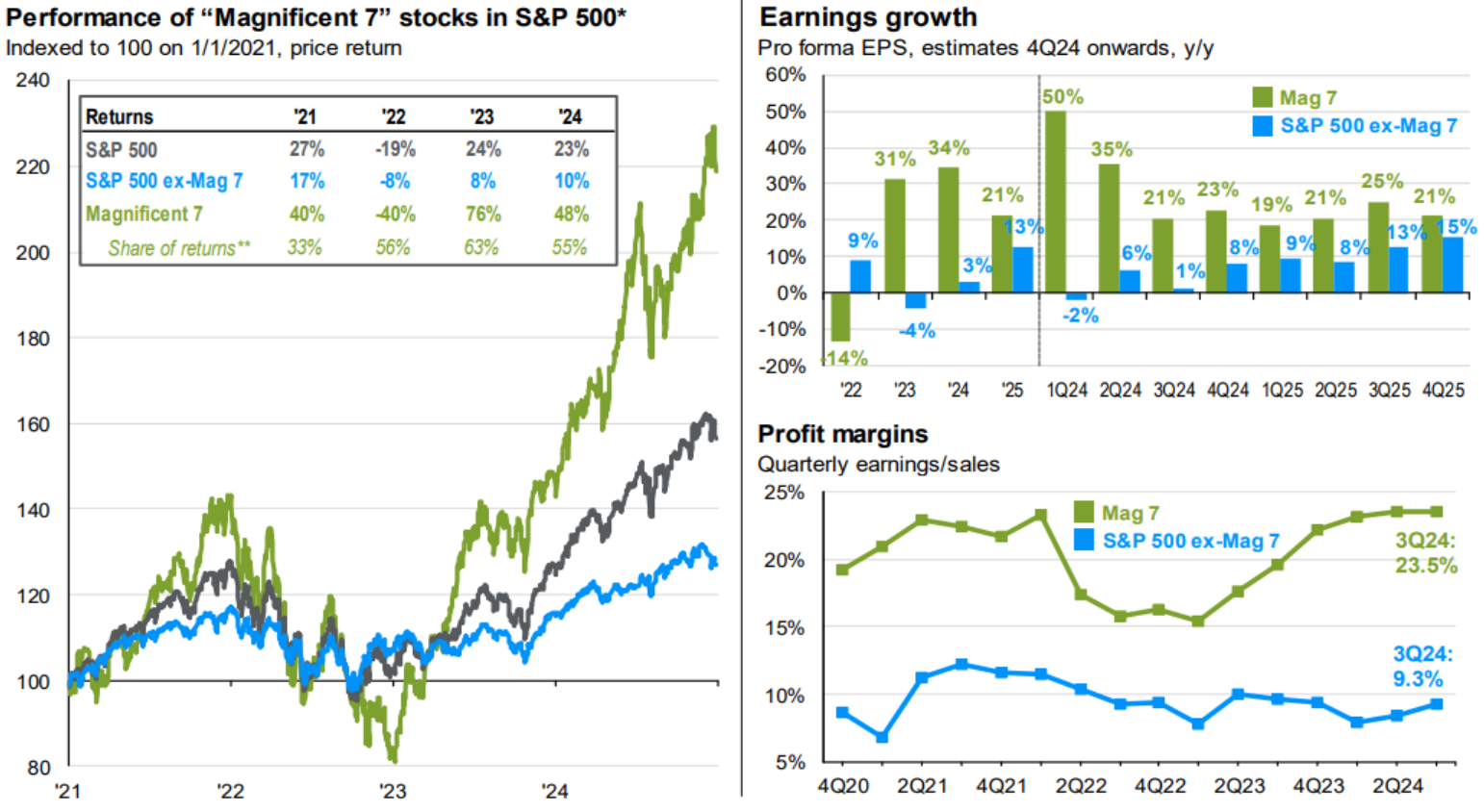

Magnificent 7 performance and earnings dynamics

The "Magnificent 7" have been the driving force behind S&P 500 returns over the past three years. On the left, we break out performance of the Mag 7 and the rest of the S&P 500. While the Mag 7 stocks contributed 63% of the positive performance in 2023, they also contributed 56% of the negative performance in 2022.

On the right, we can see their fundamental strength. The top chart shows that S&P 500 earnings growth in 2023 would have been negative without the Mag 7. Analysts are expecting EPS growth for the rest of the index to inflect positively in 2024 and accelerate to double digits in 2025.

The bottom shows that the Mag 7 have also been driving margin expansion, though the S&P 500 ex Mag 7 saw positive margin growth in 2Q24.

Related: The Mechanics of Tariffs: What You Should Know

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management.

*Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. **Earnings estimates for 2024 and 2025 are forecasts based on consensus analyst expectations. Share of returns represent how much each group contributed to the overall return. Numbers are always positive despite negative performance in 2022. Guide to the Markets – U.S. Data are as of December 31, 2024.

Past performance does not guarantee or predict future performance. Index performance is for illustrative purposes only. You cannot invest directly in the index. Source: J.P. Morgan Asset Management, as of December 31, 2024.