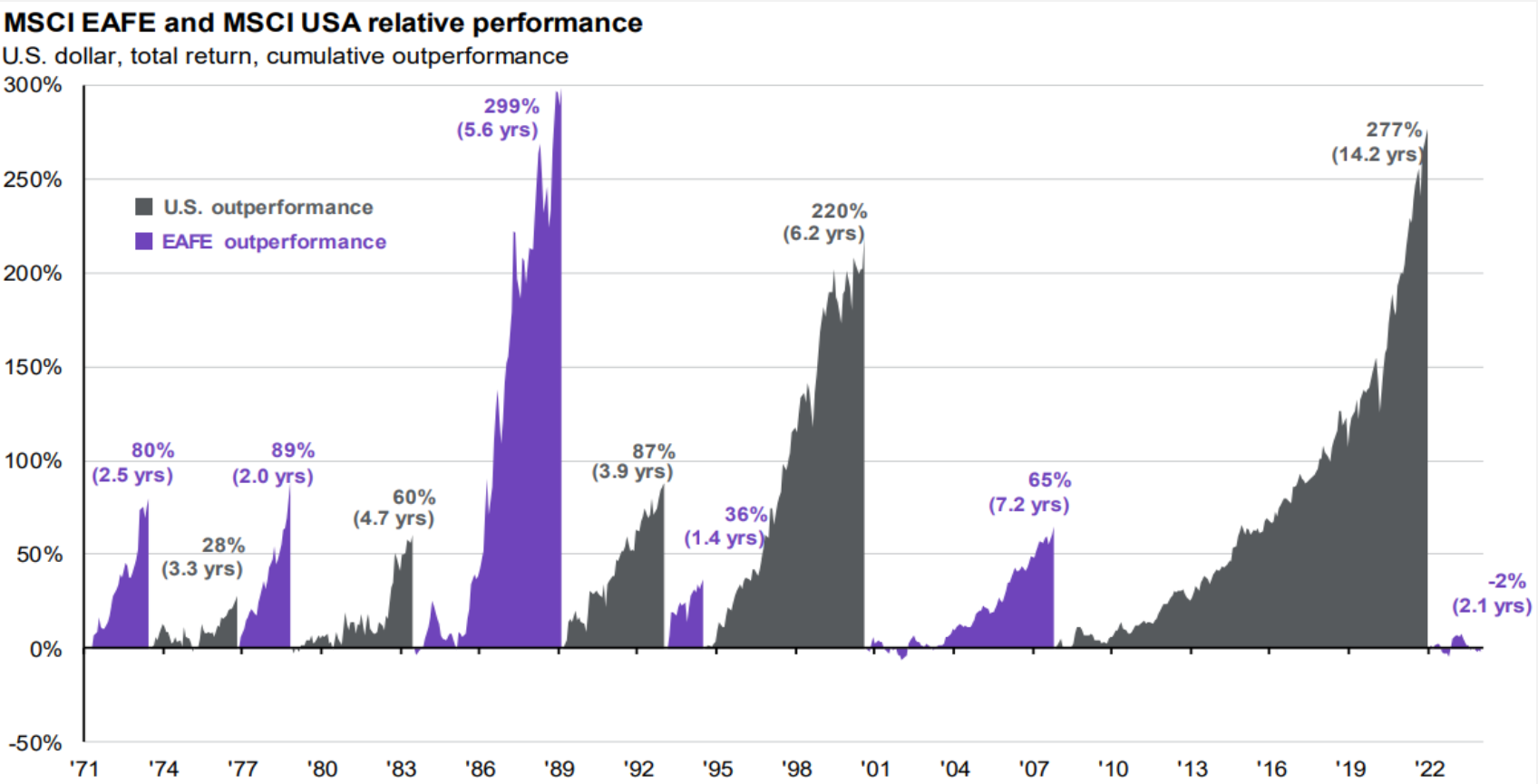

Cycles of U.S. equity outperformance

Over the past 50 years, there have been different regimes of U.S. vs. international outperformance. In other words, outperformance comes in waves. After a long period of U.S. outperformance, it is worth considering whether we may be transitioning to a new wave. The regime changes are determined when cumulative outperformance peaks and is not reached again in the subsequent 12-month period.

Source: FactSet, MSCI, J.P. Morgan Asset Management. Regime change determined when cumulative outperformance peaks and is not reached again in the subsequent 12-month period. *Peak MSCI EAFE outperformance vs. MSCI USA occurred in April 2023. If this is sustained for 12 months, the regime will switch in April 2024.

Guide to the Markets – U.S. Data are as of January 31, 2024.

Past performance does not guarantee or predict future performance. Index performance is for illustrative purposes only. You cannot invest directly in the index. Source: J.P. Morgan Asset Management, as of January 31, 2024.