At Fiat Wealth Management, we pride ourselves on being independent fiduciary wealth managers. Our independence combined with our fiduciary obligation is what ensures that we are constantly putting our clients’ best interests ahead of ours. During our Discovery Process, our primary goal is to get to know the person we are trying to help so that we can eventually help them with recommendations.

A pivotal step in that process is walking through an exercise we created called “The Product Bias Exercise”. Being independent affords us access to quite literally any financial product under the sun. There are hundreds of different “tools of our trade” we have access to and can ultimately use as part of a financial plan with the goal of helping our clients achieve the outcomes they desire. The Product Bias Exercise helps us work with clients to uncover what specific biases they have to any number of financial products available. One of the most common negative biases we hear - Fixed Annuities.

Fixed annuities tend to be a polarizing topic leading to the two most common feelings. People either like them or people tend to hate them. In 2022, there is an endless amount of information that can be researched online within a matter of seconds. The same applies to annuities. You can find articles that praise fixed annuities and position them as the best thing in the world. You can also find articles that position fixed annuities as the worst product created.

At Fiat Wealth Management we feel that both types of articles are dangerous. There is an endless amount of information but a lack of wisdom. Fixed Annuities aren’t inherently “bad” or “good”. We feel that everyone’s specific situation and goals are what should be the sole driver of whether a fixed annuity is the right recommendation. For some people, the answer is yes, for some the answer is no.

Fixed Annuity

So then, what is a fixed annuity? A fixed annuity is an insurance contract that promises to give the buyer a guaranteed interest rate on their contributions to the contract. These contracts are typically funded with a lump sum of money. Fixed Annuities can generally serve two purposes - providing safe growth (accumulation annuities), providing a guaranteed income (income annuities).

Fixed annuities are what is known as an “Insured Investment”. What this means is that the insurance companies which back fixed annuities charge a fee for the guarantee on not only principle but also interest earned on principle. It may seem counterintuitive to pay extra in fees just to guarantee what you would potentially get but what these fees are doing is taking on what would be an unknown risk to the investor. For a fixed annuity investment to provide any benefit, the investor must stay invested in the contract for an unspecified amount of time (defined by the state insurance code).

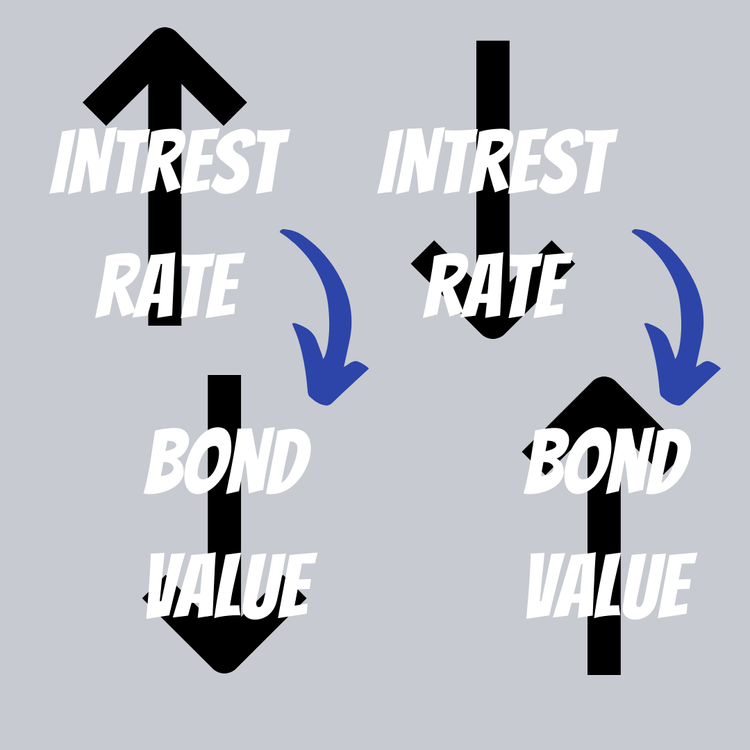

Accumulation annuities offer buyers protection from the volatility that the stock market inherently has. They ensure that you will never lose money while also giving the buyer the opportunity to participate in the upside of the market. The downside protection these contracts offer comes at a cost, that cost is often via caps which will limit some of the upside potential. In today’s low-interest-rate environment, accumulation annuities can often be used as a “bond replacement”. Bonds have an inverse relationship to interest rates. As interest rates rise, bond values fall. As interest rates fall, bond values rise.

That begs the question, where are interest rates now? Where are interest rates likely to head? Interest rates are at historical lows while the federal reserve is talking about increasing rates. Those two facts put retirees in a tough spot. Historically, retirees have been able to use bonds as a haven which traditionally helps de-risk a portfolio. However, given the current interest rate putting money in bonds is a tough sell. If interest rates rise, the 1-2% average yield could lead to losing money in bonds. Accumulation fixed annuities offer retirees a substitute that arguably can serve as a better bond than what bonds are currently.

Income annuities can offer buyers an income stream that they can’t outlive. An income stream that is contractually guaranteed and is not impacted by any market volatility. An income annuity is arguably no different from social security or a pension - all of which gives retirees confidence in spending their money. Income annuities can be purchased by anyone and will begin to pay out what would typically be immediate.

Fixed Annuity Tax Treatment

Both accumulation annuities and income annuities offer the added benefit of giving you favorable tax treatment under both state and federal law. When it comes to fixed annuities, we encourage you to be cautious of what you read from other financial advisors. The one-size-fits-all approach that many financial planners take is what leads to what we see as a lack of transparency in the financial industry. While fixed annuities are an insured investment, that doesn’t mean they are always right for all investors.

At Fiat Wealth Management, we teach our clients how to spend their money.

An important metric we pay attention to is the “Income Stability Ratio” (ISR). The ISR helps determine the amount of guaranteed income that a retiree has during their retirement. Example: Somebody wants to spend $100K per year with a 2% inflation adjustment over a 30-year retirement. The total retirement income to make that happen comes out to roughly $4.2M. In this example, if someone’s ISR is 40% that means that only 40% of the $4.2M needed over their retirement is coming from guaranteed income sources. Since pensions are all but extinct, most retirees' only source of guaranteed income comes from Social Security. Income annuities are a useful tool that can help increase the amount of guaranteed income over retirement. Behaviorally, it is a lot easier to spend money in retirement when clients know that the same paycheck will be coming each month regardless of whatever happens in the stock market thus giving peace of mind.

Fixed annuities can be a useful tool in a retiree’s financial plan. There are other strategies out there that may work for clients, but what is important is what specifically works for each person or what they feel comfortable with given their specific situation and goals. The major factors that determine whether a fixed annuity is right for your future comes down to what you want to achieve and what risk tolerance you have. Our job at Fiat Wealth Management is to help our clients get thereby giving them the confidence they need to enjoy what retirement has in store for them.