Written by: Bev Bachel | Jackson National

How your investments perform isn’t something you can control. But what you can control is the order in which you sell them—and that can make a big difference when it comes to making your money last.

This is called managing sequence-of-returns risk.

Do it poorly, and you may find yourself worrying about outliving your retirement savings. If you are worried about this, you’re not alone. According to the Insured Retirement Institute, only 25% of Baby Boomers believe they will have enough money in retirement.1

On the other hand, manage sequence-of-returns risk well and you could find yourself able to pursue your financial future with confidence.

Why order matters

Also called “sequence risk” or “sequence-of-investment returns,” sequence-of-returns risk is the risk you take when selling your investments during the first few years of your retirement.

If your early withdrawals take place when the market is up, it's likely you'll be in in pretty good shape.

But if you make early withdrawals when the market is down, you may run out of money. That’s because lower returns early on mean your returns in subsequent years are compounding on a smaller base.

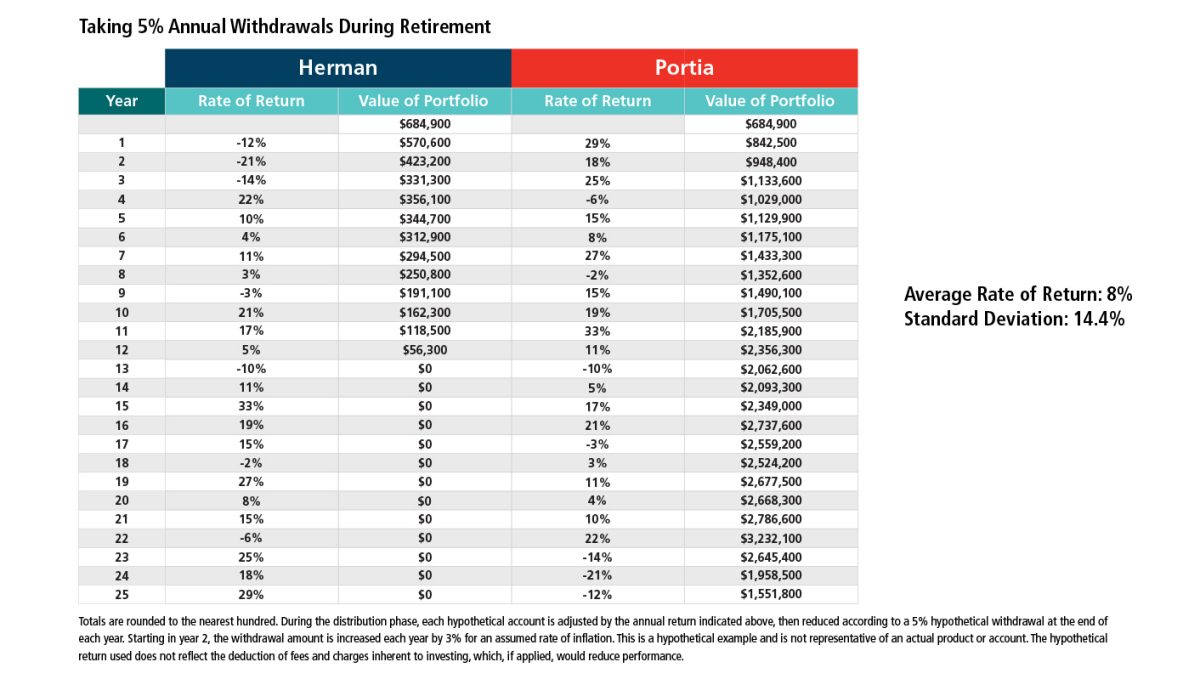

Below is an example featuring the portfolios of two hypothetical retirees, both of whom retire with $685,000 in retirement savings. Each withdraws 5 percent of the value of their portfolio at the end of every year, adjusted by 3 percent for an assumed inflation rate beginning in Year 2.

However, Herman begins his withdrawals when the market is down, while Portia begins hers when the market is up.

The impact of this is dramatic.

Herman runs out of money by Year 13, when he is just 78 years old. Yet he’s likely to live longer. According to the Social Security Administration, a man reaching age 65 today can expect to live, on average, until age 84.0, and a woman, on average, until age 86.5.2 And thanks to medical advances, longevity for both men and women will likely continue to increase.

Portia, on the other hand, sees the overall value of her portfolio grow. Her early gains, despite being offset by later losses, are beneficial. As a result, in Year 25, when she turns 90, her portfolio is still worth an impressive $1.5 million.

Ready, set … pause

No matter how much you’ve saved for retirement, you must take sequence-of-returns risk seriously. So, while it can be tempting to start spending your money as soon as you retire—perhaps by buying a second home, going on an exotic trip, paying for a grandchild’s education or even your own living expenses—consider taking a step back to make sure you truly are prepared for the next 20, 30 and perhaps even 40 years.

Focus on priorities you can control. In my mind, there are three that should take center stage:

Priority 1: Protect your nest egg.

Your nest egg is an important asset. Your goal is to keep it safe and invest it wisely.

Priority 2: Develop a withdrawal plan.

No matter how much (or little) you have saved, you want to make the most of it, which is why you need a plan for when and from where you’re going to withdraw your money. Typically, the shorter your timeframe, the more conservative your investments should be. That way, if there is a market downturn, you're less likely to have to sell at a loss.

Priority 3: Create an income stream.

According to a recent survey, 73 percent of respondents consider guaranteed income to be a highly valuable addition to Social Security.3 One of the best ways to create such income is with the help of an annuity, which can provide monthly income for a set number of years or even the rest of your life.

So, while you can’t control how your investments perform, you can make the most of them by focusing on these three priorities and by postponing your withdrawals and avoiding taking a loss. By doing so, you can not only potentially minimize your sequence-of-returns risk, you can increase your likelihood of being able to pursue your retirement with financial confidence.

1 “As They Near Retirement, Baby Boomers Remain Unprepared,” Insured Retirement Institute, April, 2018.

2 “Benefits Planner: Life Expectancy,” Social Security Administration, May, 2019.

3 “Fourth Annual 2018 Guaranteed Lifetime Income Study,” Greenwald and Associates, 2018.