Written by: Pacifc Life | Pacific Life

The tax-deferred growth potential of an annuity can boost your savings for the future.

As life expectancy increases, the threat of outliving your retirement savings is real. Annuities can provide steady, reliable lifetime income and help grow and manage retirement savings, ensuring your savings last as long as you do.

What’s more, annuities are tax-deferred, which can help maximize your savings gains.

Tax-deferred savings

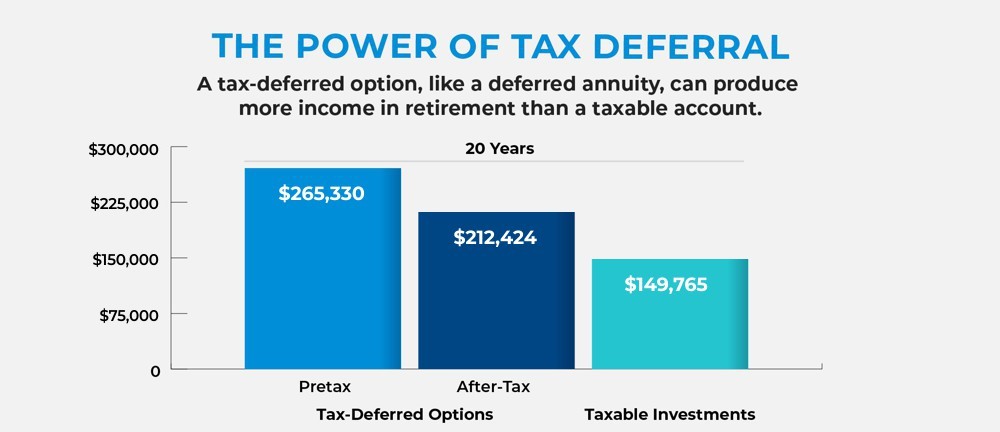

Because an annuity is tax-deferred, you won’t pay taxes until you withdraw your money. Deferred annuities take advantage of this situation by allowing your savings to grow until you start receiving income distributions. In the process, that growth can potentially experience growth of its own, with the gains compounding over time.

The opportunity to achieve tax-deferred growth can make a substantial difference in your income in retirement. For example, a $100,000 purchase payment compounded at a 5% rate annually for 20 years would grow to $265,330. If you withdrew that money in a lump sum and paid a 32% tax rate on it, you would come out with $212,424. By comparison, if you put $100,000 into a taxable investment account, you would end up with only $149,765 in that time.

Qualified vs. non-qualified assets

The type of funds you use to purchase an annuity also affect how your income is taxed. Say you purchase an annuity using after-tax money—for instance, using funds you hold in a regular savings account. When you begin receiving income in retirement, you won’t pay taxes on the annuity’s principal—that is, the money you used to fund the contract. You will pay taxes on the gains when you withdraw them, but you can’t control which part of your distributions are considered gains. If you take withdrawals before annuitization, any taxable gains come out before you start drawing down your principal. After annuitization, each payment includes a portion of gains and a portion of principal.

The situation is different if you purchase an annuity with pre-tax dollars, perhaps using funds from a 401(k) or traditional IRA. In this case, all the income you receive is taxable.

No matter which type of funds you use to purchase a deferred annuity, your money has the opportunity to grow faster, since any earnings can compound without current taxes taking a bite.

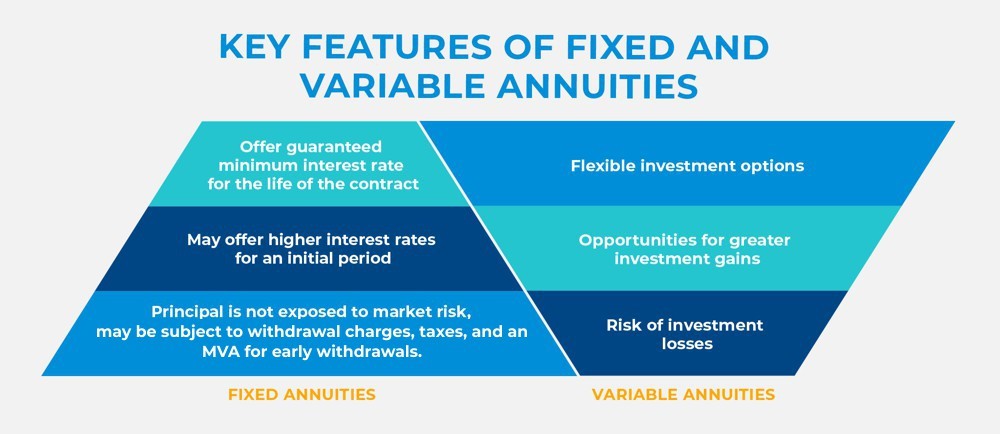

Fixed vs. variable annuities

Two types of deferred annuities offer options with different levels of comfort with risk.

Fixed annuities don’t invest your principal in the market, so they can offer a guaranteed minimum interest rate for the entire life of the annuity contract. For those willing to take a bit more risk, variable annuities offer additional opportunities to grow your retirement assets and potentially increase your retirement income. Variable annuities provide a range of investment options overseen by professional money managers. As a result, investors have more flexibility, and can even move assets from one option to another without paying taxes on any investment gains.

There’s no guarantee that a variable annuity will provide a better return than a fixed annuity, however, unlike a fixed annuity, the value of a variable annuity contract could be less than the original cost when you redeem it.

As with any retirement decision, it’s a good idea to consult a financial professional to figure out what works best for your specific situation. No matter which type of annuity you choose, however, the power of tax deferral means you can grow savings faster, make time work for you, and make decisions without tax consequences.

SOURCE: Pacific Life, 2019

Hypothetical example for illustrative purposes only. The assumed rate of return is not guaranteed. Lower maximum tax rates on capital gains and dividends would make the investment return for the taxable investment more favorable, thereby reducing the difference in performance in the examples shown. Actual tax rates may vary for different taxpayers and assets from that illustrated (e.g., capital gains and qualified dividend income). Upon withdrawal, any earnings accumulated in the tax-deferred investment will be subject to ordinary income taxes. If withdrawals and other distributions are taken prior to age 59½, an additional 10% federal tax may apply. Consider your personal investment time horizon and income-tax brackets, both current and anticipated, when making an investment decision, as the illustration may not reflect these factors. Hypothetical returns are not guaranteed and do not represent performance of any particular investment. Product-level fees and charges are not included. If they were, the tax-deferred performance would be significantly lower.

Tax-deferral assumptions: Hypothetical example for illustrative purposes only. Assumes a nonqualified contract with a cost basis of $100,000. After 20 years, the full amount before taxes equals the purchase payments plus interest, $265,330. The amount withdrawn after taxes are paid is calculated by taking the full amount and subtracting the cost basis; it is then multiplied by 0.68 (32% ordinary income-tax rate) and adding back in the cost basis, for a total of $212,424 after taxes.

Related: Why Advisors Need to Appreciate Their Clients’ Situation Outside Analytical Assessments