Written by: Megan Harris | Preqin

From implementing robust legal frameworks to improving DEI data, three industry experts share their recommendations on retaining talented women in the workplace

Preqin's Women in Alternatives 2023 report shows that women occupy less than 22% of employees across the alternative asset classes. This figure declines even further when it comes to senior positions. Although this is a slight improvement from 20.9% in 2022, each asset class has recorded less than a 10% change from 2019. Hedge funds achieved the greatest percentage increase, with 7% over that period.

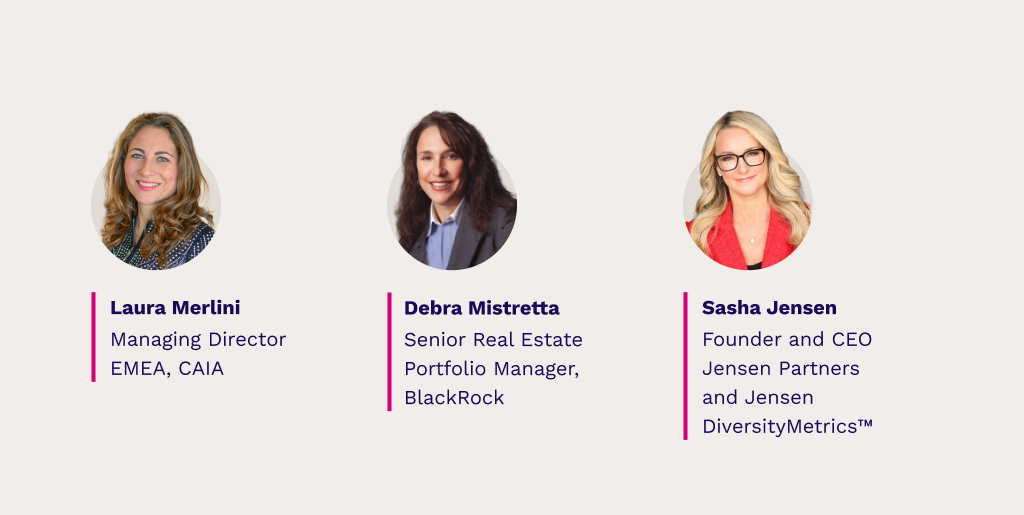

We asked three experts to weigh in on the progress the alternatives industry has made so far, and what more must be done to drive greater gender equity at senior levels.

What challenges are still facing the industry? What new practices to address those challenges make you hopeful?

Laura Merlini, Managing Director, EMEA, CAIA Association

The alternative investment industry has a way to go in enabling more women to take senior positions, not just in the industry relations, marketing, or compliance departments, but as CIOs and board members. While asset managers have improved their entry-level talent pipeline, attracting more women into junior roles, there is still much to do to retain them and encourage progression to senior roles. Investors have recently accelerated this trend by advocating for greater diversity. But there is still a long way to go to secure equal pay and rights to promotion for many female alternative investment professionals. Improving gender balance would start with a robust corporate legal and compensation framework supporting equality, direct sponsorship from leadership, and a sound professional education, ultimately opening up the possibility for women to succeed and thrive in leadership positions.

Debra Mistretta, Senior Real Estate Portfolio Manager, BlackRock

Starting in real estate in the 1990s as an acquisitions analyst covering the Northeastern US and transitioning to a portfolio management position, the industry was less institutionalized and the market’s most notable firms were led by men, many of whom ran in the same social circles. Real estate was (and still is) a relationship-based business, and while this didn’t necessarily mean women were unable to succeed, the environment wasn’t particularly supportive of women’s career mobility. Being the only woman in the room made it more difficult to be heard. As the industry matured and attracted more institutional investors, a greater emphasis was placed on performance and creativity. This created opportunities for more diversity and for women to stand out among their peers. Today, as part of a growing group of diverse leaders within BlackRock’s US real estate equity business, I see the firm and other leading players in the real estate industry offer the necessary benefits to support women in their careers. These include building an environment of good sponsorship for high-quality talent and implementing hiring and promotion processes that ensure the employment of diverse candidates. While we still have work to do, these practices were uncommon in the 1990s, so there’s hope for the continued advancement of gender diversity in years to come.

Sasha Jensen, Founder and CEO, Jensen Partners and Jensen DiversityMetrics™

Despite progress on gender equity in the alternative asset management industry, there’s still much left to achieve, especially in the C-suite. Diversity matters. For example, recent Jensen DiversityMetrics™ research showed that hiring women into senior capital roles increases retention rates of women in junior roles by a factor of 3.5. Furthermore, BCG’s analysis of five years of investment and revenue data revealed that women-led companies have higher returns, generating 78 cents for every dollar of funding compared with just 31 cents for male-founded companies.

The fact that companies industry-wide are increasingly tracking and being held accountable for hiring and retaining diverse talent is a positive sign. At Jensen Partners, we launched Jensen DiversityMetrics™ in 2021, a data-driven platform to help firms in the alternative investment industry benchmark, manage, and champion diversity progress. The resulting data is already telling a clear story: DEI helps drive innovation, boosts profits, and improves decision-making. Our metric also showcased a remarkable 150% increase in gender diversity from 2021 to 2022 in the alternative space. While many challenges remain, data collection and retention are promising signs of momentum in fostering a more inclusive future for all.