Written by: Arkadiusz Sieron, PhD

A new sheriff is in in town, and he’s making some rearrangements. Will the new order of things support the price of gold?

Joe Biden certainly wastes no time in signing executive orders. Since inauguration, he introduced several policies, including mandating masks on federal property, in airports and on certain public transportation, and the end of a travel bank on some countries. Biden also terminated the construction of the wall at the Mexican border, halted the withdrawal from the WHO and placed the U.S. back on the path to rejoining the Paris climate accord.

We’re seeing a reversal of many of Trump’s policies. The new President’s actions shouldn’t materially affect the gold market , but if they manage to restore widespread confidence in the U.S. government, they could limit the safe-haven demand for gold .

Biden also modified the government’s stance on the epidemic in the U.S., treating it very seriously. He undertook several executive actions intended to speed up the production of COVID-19 supplies, thereby increasing testing capacity, and hopefully reducing the spread of the coronavirus . Biden also started a “100 days mask challenge”, urging Americans to wear masks, and announced a “National Strategy for COVID-19 Response and Pandemic Preparedness”, arguing that “America deserves a response to the COVID-19 pandemic that is driven by science, data, and public health — not politics”.

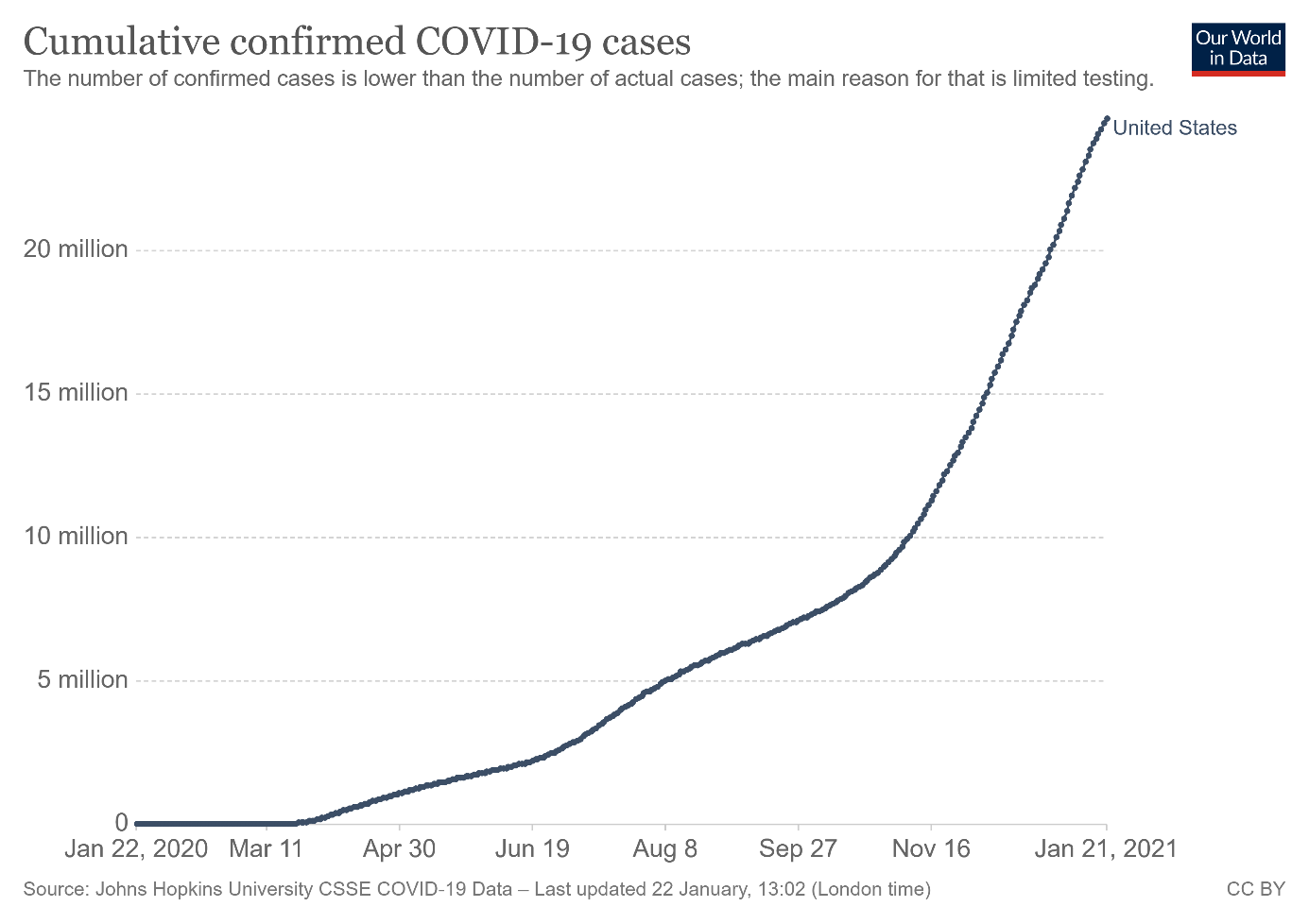

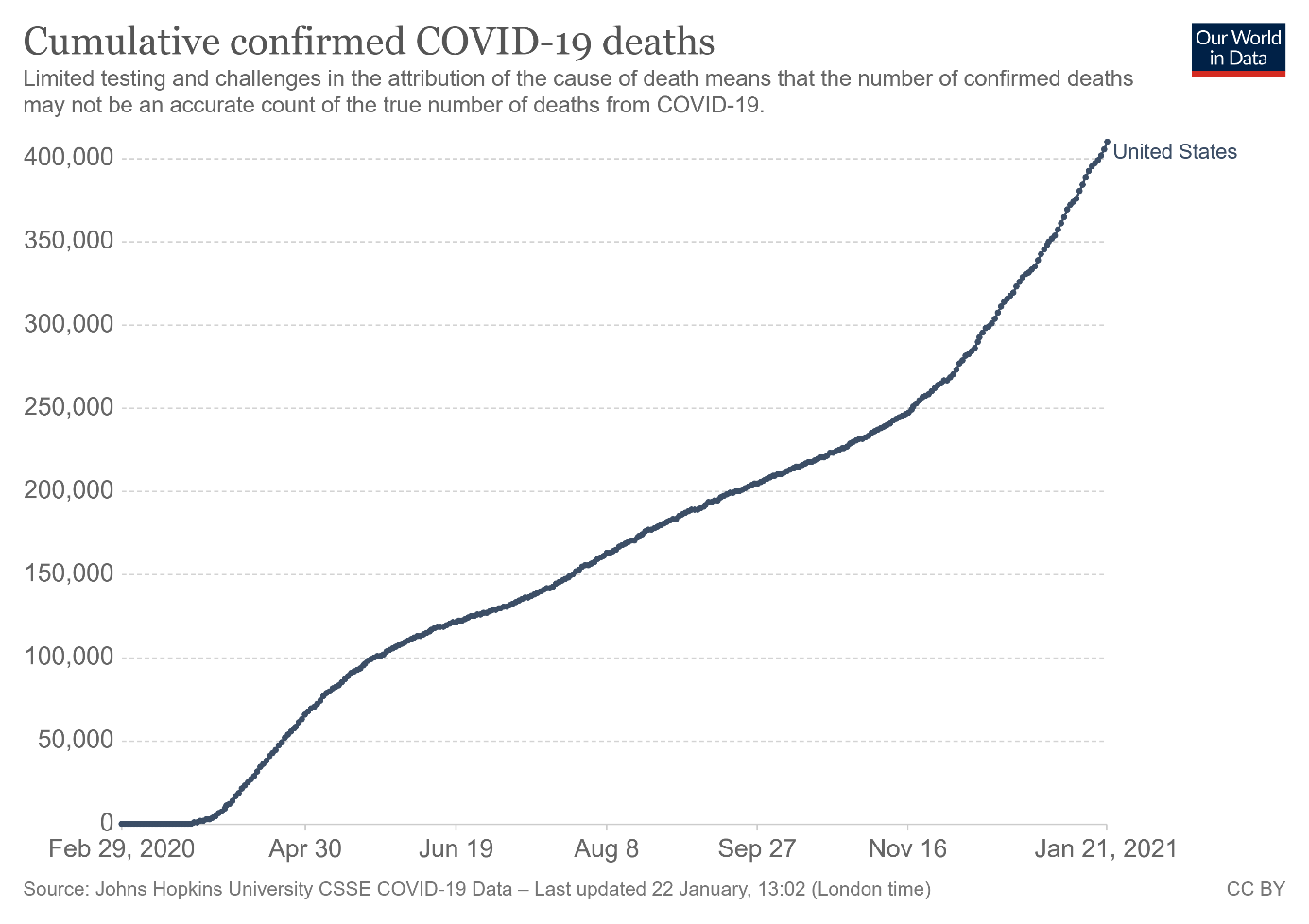

All these actions show that combatting the pandemic will be Biden’s priority and that he intends to deliver a more centralized federal response to the epidemiological threat. It’s high time! As the charts below show, the coronavirus has already infected almost 25 million Americans while killing more than 400,000.

Figure 1

Figure 2

The U.S. equity markets welcomed Biden’s actions by reaching new record highs. However, these gains and increased risk appetite among investors didn’t prevent the modest jump in gold prices in the aftermath of the inauguration. As the chart below shows, the price of the yellow metal increased to above $1,860 on Thursday (Jan. 21).

Figure 3

Implications for Gold

But what do Biden’s rearrangements imply for the gold market in the medium and long run? Well, mainstream economists and the markets expect that Biden’s actions, including fiscal stimulus, will speed up the fight with the pandemic and will revive the economy. This positive sentiment could be negative for the yellow metal.

However, I believe that people overestimate the positive economic impact of the upcoming stimulus. After all, many people have money, but they can’t spend it due to widespread lockdowns, and there will be a huge price to pay for aid coming in the form of a ballooned fiscal deficit and public debt . But the problem is that neither money nor debt constitute the real wealth, so I remain skeptical about the benefits of another government’s fiscal package.

Of course, my opinion is irrelevant here. What is important is that Mr. Market likes the idea of additional stimulus, so the bonanza in the financial markets can last. The expectations of higher economic growth and accompanying stronger risk appetite could be negative for gold .

However, at some point, the fragility and limitation of the debt driven growth will become clear – you cannot print wealth – and investors will face the harsh reality of a debt trap . It will be delayed, but there will be a reaction to the increased debt and the risk of higher inflation . This reaction, in turn, should be beneficial for the yellow metal.

Not long ago, I was afraid that U.S. fiscal policy will be less dovish in 2021 – however, with Biden’s fiscal stimulus in the cards, the fiscal policy could actually become even more lavish this year than it was in 2020. It should also be a supportive factor for the price of gold, especially considering that it would force the Fed to remain very accommodative as well.

Related: Will Biden Inaugurate Gold’s Rally?

DISCLOSURE: The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.