Written by: Richard Fisher | AGF

It’s only fair that investors have bank stocks in their crosshairs right now. That’s what happens when two U.S. banks suddenly collapse and one of Europe’s oldest lenders is taken over by its peer to prevent a similar fate from occurring. Yet, for all the concern about the sector’s financial health, there is plenty of evidence to suggest it’s not nearly as bad as some people might think.

This may be especially true of the banks’ commercial real estate (CRE) exposure. Indeed, while parts of the CRE market are under threat from the rise in both interest rates and vacancies, there’s few signs to date that this pressure is having a negative impact on the banks that are exposed to the market the most.

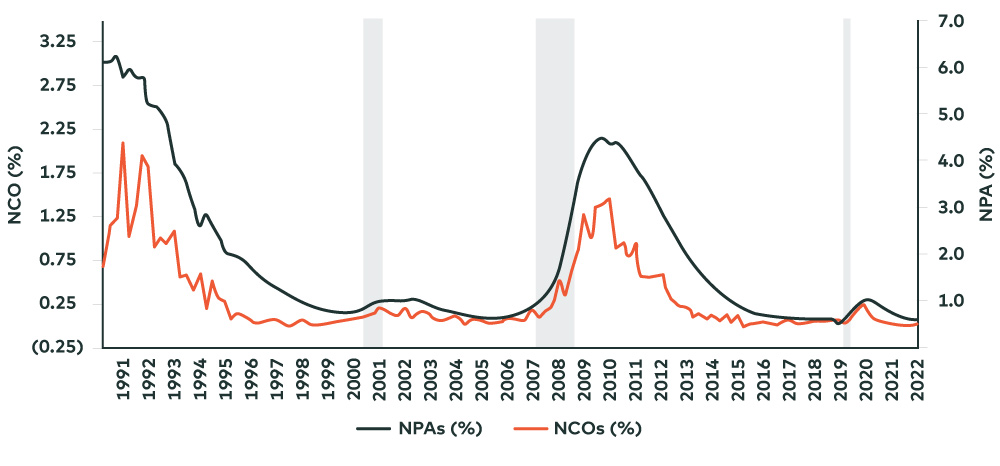

In the United States, for example, recent data on CRE mortgage credit ratios from the Federal Deposit Insurance Corporation (FDIC), show both net charge-off (NCO) and non-performing asset (NPA) rates are still below cycle averages and nowhere near levels seen during the Global Financial Crisis.

Commercial Real Estate Mortgage Credit Ratios

Source: Federal Deposit Insurance Corporation. Figures are as of the fourth quarter of 2022. Shaded areas denote periods of recession.

Of course, that doesn’t mean losses from commercial real estate loans won’t become a bigger issue as the current interest rate cycle matures. But even if CRE losses do begin to mount, there are reasons to believe the fallout from such a scenario is manageable for many of the largest banks in the U.S. and Canada.

First, capital levels are stronger today than in past cycles. At the same time, most banks are now regulated to employ some form of expected credit loss regime whereby allowances for credit losses begin to build well before actual credit stress materializes, thus cushioning the blow.

Moreover, when it comes to troubled markets like commercial real estate, their loan exposure seems reasonable, by historical standards. For the “Big 5” banks in Canada, for instance, CRE loans represent between 9% to 10% of each of their loan portfolios and are generally well diversified across geography, business and property type. In fact, to that end, exposure to office properties – which is one of the riskier segments of the CRE market – only add up to about 2% of the Big 5’s total loans outstanding.

It should also be noted that CRE exposure is regularly stress tested by Canada’s biggest banks for more adverse capitalization rates and operating income. Additionally, exposure is well rated and benefits from strong collateral.

For U.S. banks, meanwhile, commercial real estate exposure is slightly more nuanced than it is in Canada, but still seems manageable on the whole. As a case in point, while some of the large regional banks in the country have relatively high CRE exposure right now, office loans represent less than 5% of total loans at each of the largest universal banks in the U.S. and just 1.9% on average, according to Deutsche Bank.

Beyond this data, a recent stress test by the U.S. Federal Reserve also suggests U.S. banks can weather an increase in CRE loan losses during even the most severe economic conditions.

In its 2022 analysis, the Fed considered the impact of a global recession and estimated a cumulative two-year loss rate of 9.8% for all commercial real estate loans outstanding. In turn, these losses would equate to a reasonably low 44 basis points of bank-owned CRE loans.

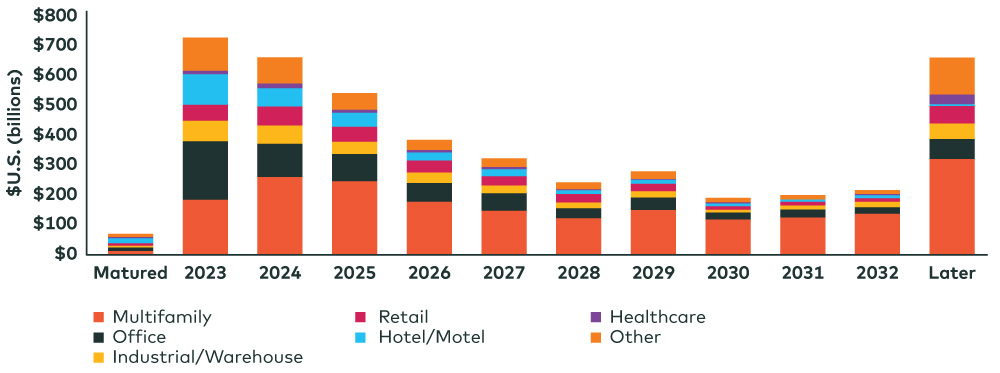

Granted, these numbers are debatable based on a March 31, 2023 report from Strategas Securities that used the Mortgage Bankers Association’s latest U.S. commercial and multifamily survey results. The firm’s research isolated office and retail loans maturing in 2023/24 and made two assumptions: 1) That 45% of these loans are owned by banks; and 2) that all these loans defaulted simultaneously to calculate possible losses.

Estimated Total Commercial Mortgage Maturities

Source: Mortgage Bankers Association as of March 10, 2023

In doing so, the report concluded that cumulative losses would be in the 29% range and that banks could see loan losses between US$60 billion to US$70 billion, resulting in a cumulative loss ratio in office/retail loans somewhere in the range of 65 basis points of bank-owned CRE loans.

Clearly, that’s more pain than what the Fed’s stress test might suggest, but even these higher CRE loan losses are seen as manageable for the banking system overall. So, while some investors may fear another full-blown financial crisis is now in the works, it seems unlikely that it will be the bank’s exposure to commercial real estate that will cause it.

Related: Bitcoin Store Launches Innovative Walk-in Exchanges