Written by: Jack Manley

Since the start of 2023 the price of U.S. crude oil has fallen by almost 10%, and now sits over 40% below its 2022 peak. Energy prices are dynamic and can fluctuate for a number of reasons. However, despite this unpredictability, many investors have been caught off guard by the weakness in crude, and are asking: what is the outlook for oil prices?

After collapsing through the pandemic, WTI prices quickly recovered and entered 2022 at almost USD 80 a barrel. Shortly thereafter, a number of events suggested that prices should move higher. First was the Russian invasion of Ukraine – as two large exporters of liquid fuels, supply chain disruptions could reduce energy supply. Exacerbating this was the timing of the invasion – mid-winter – and the assumption that European heating energy demand would increase. Crude prices adjusted to reflect these issues, and by March 2022 WTI was trading north of USD 120 a barrel, its highest level since 2008.

As supply chain issues resolved and the European winter passed warmer than expected, energy investors turned their attention to China, which unlike most major economies was still enforcing a zero-COVID policy. This policy put downward pressure on energy prices; when China inevitably began re-opening and energy demand increased, prices would in theory stay elevated.

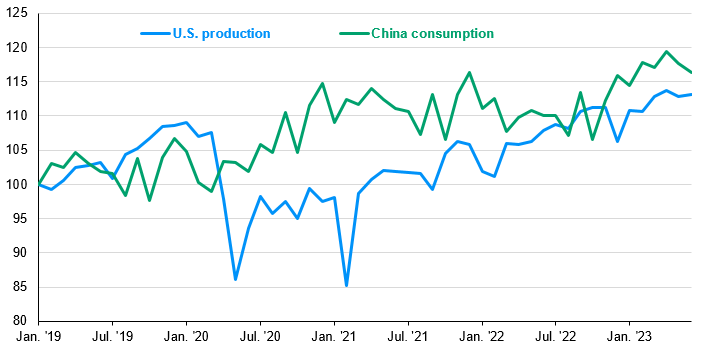

Unfortunately, the Chinese rebound has largely been lackluster, with recent second quarter GDP figures disappointing relative to consensus expectations. At the same time, crude prices have fallen, leading many investors to assume that a lack of Chinese demand is responsible for the weakness in crude. However, this is not the case: Chinese energy consumption has increased by almost 10% relative to March 2022, when WTI prices peaked.

Instead, the likely cause for declining oil prices is increased U.S. production, which is expected to reach an all-time high in 2023. Moreover, while Chinese consumption is expected to increase by 800,000 barrels per day in 2023, U.S. production is expected to increase almost 50% more than that.

This increase in U.S. production can be attributed to low breakeven prices, especially for shale oil: per the most recent Dallas Fed energy survey, the average breakeven prices for existing and new wells are USD 34.50 and USD 60.83, respectively. As a result, U.S. producers can continue to pump profitably despite lower crude prices.

Ultimately, even with Chinese energy consumption stronger than expected, global supply continues to outpace demand: this should keep oil prices rangebound. However, investors should remember that lower crude prices will drag on headline inflation, bringing PCE closer to the Federal Reserve’s 2% target. Moreover, crude prices are only part of the energy story, and the outlook for producer profitability remains robust.

U.S. production and China consumption of liquid fuels

Indexed to 100 in Jan. 2019

Source: EIA. J.P. Morgan Asset Management. Liquid fuels include crude oil, natural gas plant liquids, biofuels and other liquids. Data are as of July 18, 2023.