Written by: David Lebovitz

Energy keeps the economy moving forward – it powers the cars that get us to work, gives us the electricity we need to power our homes and employs millions of people around the world. As we think about the trajectory of the energy industry going forward, it is evolving in more ways than one: technological advancements have led the U.S. to become a net exporter of oil, renewable energy sources continue to increase their share of overall electricity production and energy companies are increasingly focused on cash flow and profitability, rather than just production.

Energy prices are dictated by supply and demand, and right now, the world is awash in oil; following the shale boom in 2015, the U.S. became the world’s marginal producer of oil, undermining the dynamic that had previously been at play. Going forward, oil supply should remain readily available, as U.S. drillers have demonstrated an ability and willingness to increase drilling activity in response to higher oil prices. In the long-run, however, economic tailwinds should continue to support the transition from fossil fuels to more sustainable sources of energy.

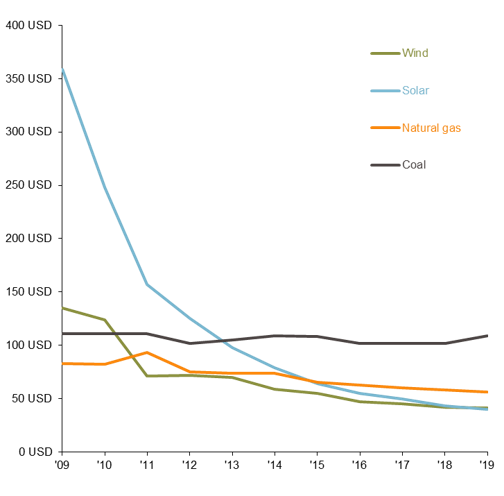

We expect the United States to remain a net exporter of petroleum, but at the same time recognize the global economy will continue to increase its reliance on renewable sources of energy. According to the Energy Information Administration (EIA), renewables are expected to be the fastest-growing source of U.S. electricity generation through 2050, with more favorable costs for solar and wind power driving this transition. In fact, electricity generation from renewable energy sources is set to rise from 17% in 2019 to 22% in 2021.

Energy has been one of the worst performing sectors year-to-date, but the stage has been set for a bounce in energy stocks as the economy comes back online. In the interim, investors should focus on companies with manageable dividend break evens, quality balance sheets, a deep inventory of drilling prospects and low costs. Furthermore, a focus on renewables seems prudent given the energy transition that is currently underway, as well as the income that these assets tend to generate. Energy may be an unloved sector today, but there are significant opportunities as we look toward tomorrow.

Cost of wind, solar, natural gas and coal

Mean LCOE*, dollar per megawatt hour

Source: Lazard, J.P. Morgan Asset Management.

*LCOE is levelized cost of energy, the net present value of the unit-cost of electricity over the lifetime of a generating asset. It is often taken as a proxy for the average price that the generating asset must receive in a market to break even over its lifetime.

Data is based on availability as of October 13, 2020.

Related: Why Should Investors Consider Sustainable Investing?