Written by: BGO

Heading into the home stretch of the year, the U.S. commercial real estate (CRE) market has endured a year of transition. Industrial and apartments are transitioning back to pre-pandemic environments after a few years of outsized demand, followed by a period of excess supply. Retail has quietly transitioned to its tightest market in history, as measured by CoStar’s national vacancy rate. Office is still transitioning to its post-pandemic equilibrium. And CRE capital markets are transitioning from a period of rising interest rates and negative returns to a period of stable to declining interest rates and a swing back to positive returns. 2024 will likely see a continuation of all those trends. Yet our proprietary forecasting and market targeting, which uses both advanced artificial intelligence and econometric techniques, continues to show compelling investment opportunities ahead and an outlook that has brightened over the last quarter.

Industrial

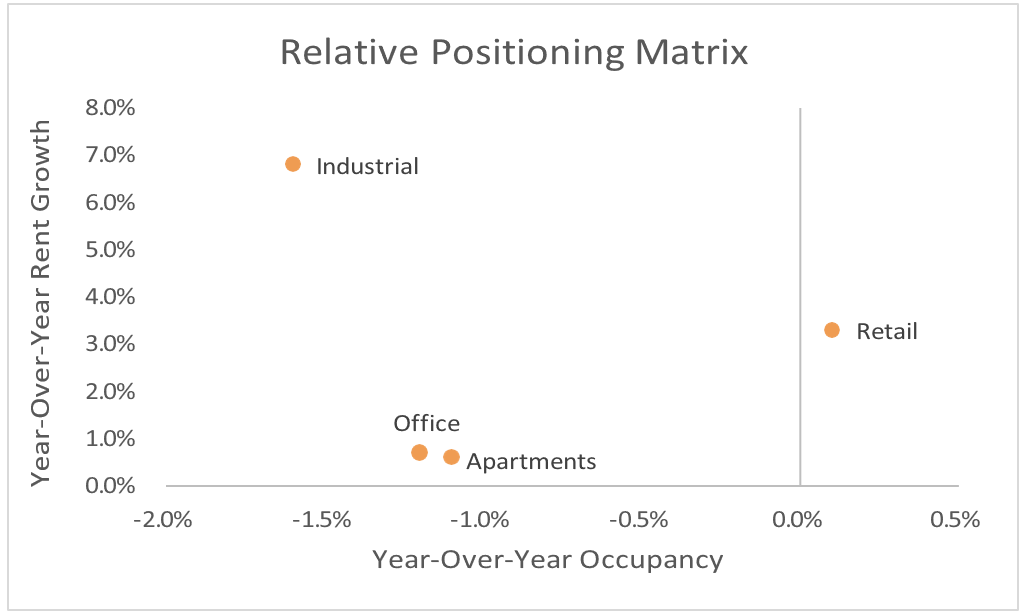

After a period of inordinate and unsustainable strength, the U.S. industrial market continues to normalize as it reverts to pre-pandemic conditions. While some have characterized this development as a slowing, that outlook — while technically correct — is misleading. Although the national vacancy rate has now risen for five consecutive quarters, reaching 5.5%, it sits only marginally above the pre-pandemic level of 5.1%. Asking-rent growth remains robust but is slowing accordingly as the vacancy rate rises. Why are these changes occurring? In short, supply and demand are coming back into balance. Strength in space market fundamentals spurred new construction to take advantage of low vacancy and incredibly strong rent growth. And that bounce in construction persists. Of the top 25 markets by inventory size, 24 of them should see average annual completions over the next three calendar years exceed average annual completions during the last 10 years. During the quarter, the top five markets ranked by year-over-year rent growth showed a concentration in Sun Belt markets: Orlando, Phoenix, Charlotte, Jacksonville, and Fort Lauderdale.

Our proprietary modeling suggests that normalization should persist throughout 2024. But by the end of next year, we project that the national vacancy rate should stabilize and thereafter start declining once again. Correspondingly, rent growth should slow throughout next year and then reaccelerate once the market stabilizes. We continue to forecast that the industrial market should produce the strongest rent growth of the major property sectors over our five-year forecast horizon.

Apartments

Similarly, the apartment sector is undergoing a normalization after a few very strong years. After reaching an all-time low of 4.7% during the third quarter of 2021, the national vacancy rate began to increase and two years later has reached 7.3%. That also sits above its pre-pandemic level of roughly 6.7%. Asking-rent growth tumbled considerably as the market shifted from excess demand to excess supply. While this would seem incongruous with the housing shortage narrative, excess supply is not occurring on a uniform basis across markets. Sixteen markets should hit a record level of new construction during 2023, with 11 located in the Sun Belt. Why? Many developers became overzealous, spurred by narratives concerning increased levels of migration into these markets. But migration has slowed notably since the pandemic and is reverting to long-term patterns. Demand is not imploding in those markets, but it is slowing and consequently those markets’ vacancy rates are coming under significant upward pressure. Conversely, the tightest markets remain in the Northeast, the Upper Midwest, and California where development remains relatively scarce. During the third quarter the top five markets ranked by year-over-year rent growth were: northern New Jersey, Cincinnati, Chicago, Indianapolis, and Boston.

Like industrial, our proprietary modeling suggests that normalization should persist throughout 2024. But by the end of next year, we project that the national vacancy rate should stabilize and thereafter start declining once again. Rent growth should slow throughout next year and then reaccelerate once the market stabilizes. But as already evidenced in the data, the rift between markets that are performing well and markets that are struggling has widened relative to the industrial sector. Why? Because industrial development is occurring on a more widespread basis while apartment development remains concentrated in a relatively small number of markets, notably in the Sun Belt. Therefore, even though we remain bullish on the outlook for the apartment sector overall, we foresee notable benefits from market selection during the next 12 to 24 months.

Sources: CoStar, BGO Research as of 3Q2023

Retail

Not long ago, the retail sector routinely got characterized as being “overbuilt and under- demolished.” But the sector’s transformation during the last business cycle altered the reality on the ground, even if perception has yet to catch up. During the third quarter, the national vacancy rate reached an all-time low of just 4.1%. It remains the only major property sector with its vacancy rate at a record low. Supply growth for the sector remains muted and selective while demand for space remains diverse (including a decrease in store closures during the year). With the market so tight, many tenants now note a lack of desirable space available for rent in the best centers. While ecommerce growth remains robust, consumers continue to spend robustly in physical stores. Our proprietary research shows that non-ecommerce sales per square foot continues to hover near its record high set during the second quarter of 2022, demonstrating the increased efficiency of physical space. Although year-over-year asking-rent growth slowed from its peak from the third quarter of 2022, it remains elevated, more than double its historical average. Consequently, almost all markets boast positive year-over-year rent growth, with the top five during the quarter representing geographical diversity: Salt Lake City, Palm Beach, Phoenix, Orlando, and Minneapolis.

Our proprietary modeling suggests ongoing stability in the sector. Supply and demand should remain largely in balance, with both hovering at relatively modest levels. Such balance should cause rent growth to continue to slow but remain positive. Yet this relatively positive story comes with caveats that prove important from an investment and portfolio management perspective. We continue to foresee a wide divergence by retail subtypes. Of note, malls, particularly inferior class B and C malls, should continue to struggle, tainting the perception of the overall sector. Yet such a misperception presents compelling opportunity for investment on a selective basis, in our view.

Office

Of all the transitions occurring in the CRE market, the office sector is clearly proving the most painful, disruptive, and uncertain. Before the pandemic, a notable rift between new, highly-amenitized space and the rest of the sector had emerged. New space leased well and commanded record-high rents while many older properties could not find demand and many landlords struggled to plot a path forward for such assets. But the pandemic and the associated increase in working from home (WFH) massively widened that divergence and increased overall uncertainty about the office sector’s future. Consequently, the national vacancy rate continues to reach record-high levels with each passing quarter, primarily due to a pullback in demand, via both the downsizing of existing leased space and restrained new demand for space. But again, this is primarily occurring in older, inferior properties. Insofar as new construction is occurring, that space tends to lease up relatively quickly.

Our empirical research indicates that when microeconomies (such as the office market) experience exogenous shocks, those shocks tend to reverberate for roughly five to six years; only once that stops do those microeconomies reach a new equilibrium. With the onset of the pandemic in March 2020, that could mean another two to three years before the office market stabilizes into its new equilibrium. The upshot of this? While many have conjectured about what should happen to obsolete space, that likely will not be fully known for some time. Yet, our proprietary forecasting suggests caution but not outright avoidance. The CRE industry possess a notable propensity to overreact to situations such as this. For investors willing to do serious homework, we believe opportunity should abound, particularly for the more risk tolerant.

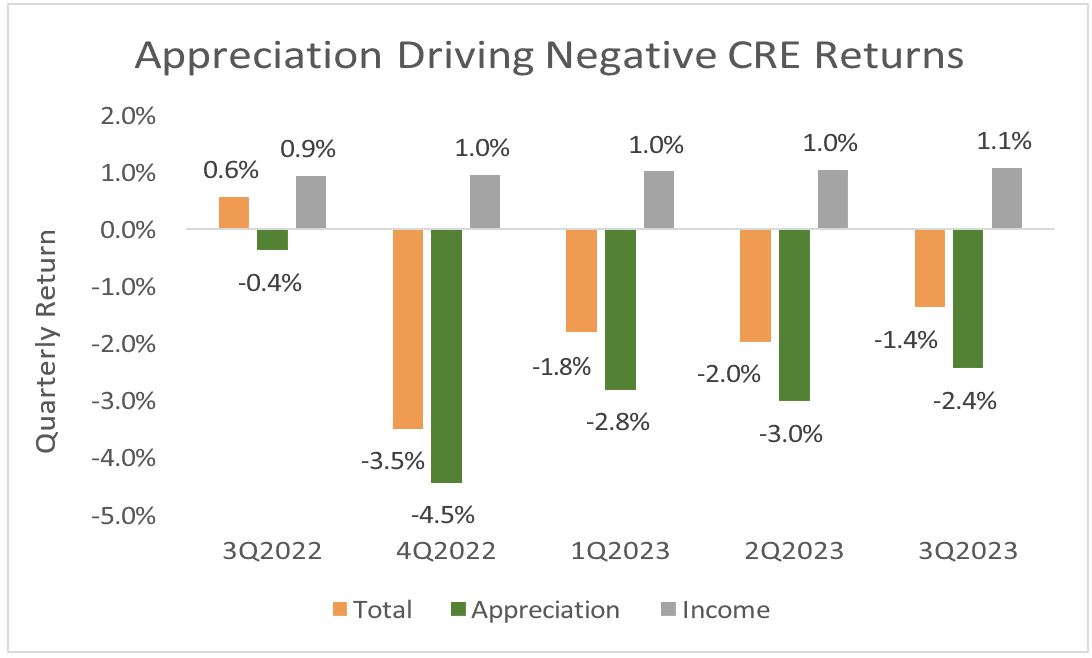

Capital Markets

For the CRE capital markets, signs of an anticipated transition are slowly emerging. During the third quarter transaction volume declined on a year-over-year basis for the fourth consecutive quarter, continuing a trend that began in August 2022. Yet quarterly transaction volume appears to have stabilized, remaining virtually unchanged during the last three quarters. Meanwhile, cap rates across the major property types increased by roughly 50 to 70 basis points (bps) versus the same quarter last year. Such a pricing adjustment produced negative appreciation returns during the quarter which in turn drove total returns into negative territory for the fourth consecutive quarter. But during those last four quarters total returns have gradually improved as appreciation returns became less negative while income returns held steady.

That is bringing CRE closer to a turning point when total returns revert into positive territory. Why? As we have previously written, returns should largely hinge on Federal Reserve policy. Historically, once the Fed stops raising rates CRE returns swing from negative to positive relatively quickly, largely due to the notable improvement in appreciation returns. As noted above, we already see tentative signs of this transition. As the Fed slowed its pace of rate hikes, CRE returns have become less negative. While that is nothing to cheer (yet), our modeling increasingly suggests that inflation should continue to slow and consequently that the Fed’s tightening cycle has ended. If so, the market could see positive returns once again. But the market needs confidence that tightening has ended for this to occur. Does it have such confidence?

Sources: NCREIF, BGO Research

Closing Thoughts

After a challenging 12 months, CRE is inching closer to more fertile ground. The path forward appears more positive than any point since the Fed began its tightening cycle in March 2022; yet the next few quarters could prove bumpy. Space market fundamentals should continue to support income returns. Therefore, total returns will hinge on appreciation and relatedly Fed policy. If the Fed has finished hiking, returns should stabilize and then accelerate, especially if the Fed begins cutting rates in 2024 as we and the futures market expect to occur.

Related: 3 Funds To Watch for 2024