The hedge fund industry is dynamic, comprising of numerous strategies that attract varying degrees of interest over time. Demand for each strategy is impacted by many variables including capital market valuations, expectations of economic growth, inflation, market liquidity, and risk appetite, among others. Industry professionals spend a great deal of time analyzing these variables in order to identify which strategies they believe offer the best opportunities for out-performance. One way to consider this is to ascertain which strategies are attracting current investor interest.

In this paper, we compare and analyze data submitted by investors for our October 2020 cap intro event, which was one of the largest in the industry, with data recently collected from investors planning to attend our upcoming Gaining the Edge - Global Virtual Cap Intro event taking place April 26 - May 7, 2021. In the registration process, investors complete a detailed survey about which types of strategies and managers they are currently interested in meeting. This gives us broad insights into both overall demand for each strategy as well as trends in demand. Following is a comparison of our survey results. Our commentary is based on feedback we are receiving from thousands of investors globally.

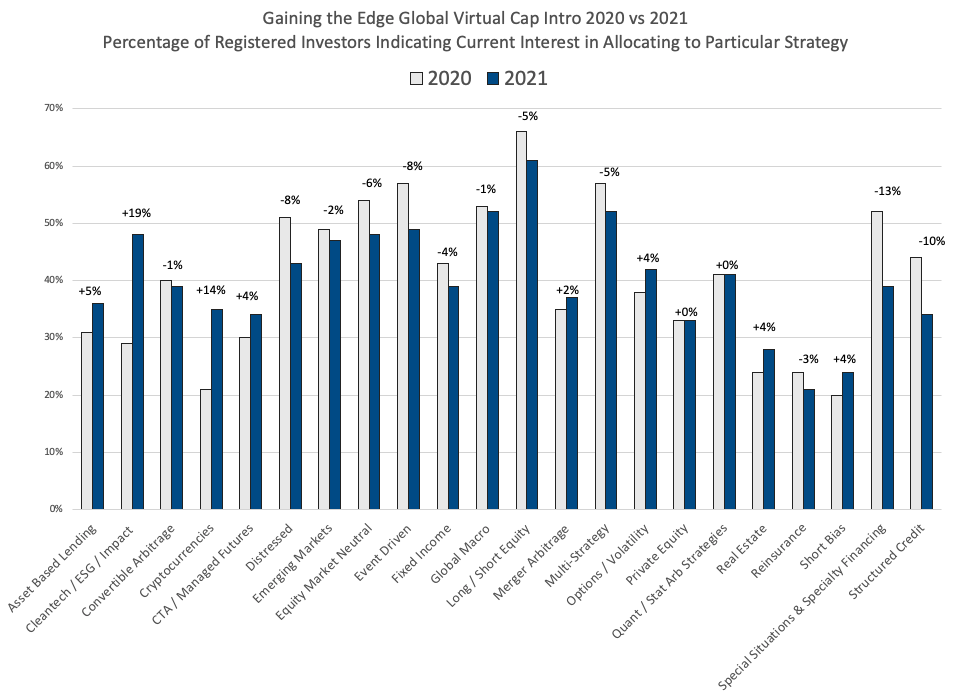

Long/short equity captured 61% of Q1 2021 respondents, the largest share among all strategies, indicating the continued positive change in investor sentiment regarding fund managers’ abilities to generate alpha in stock selection. This was slightly below Q3 2020 results (-4%) which may be attributed to higher equity valuations. The S&P 500 increased 12.2% in the 4th quarter and MSCI EAFA was up 16.1%. This bull market has extended into the 1st quarter of 2021 with new highs reached this week. Over the past 6 months, we have seen a large rotation of assets away from large cap tech stocks into both small/mid cap stocks and value stocks, causing significant outperformance for the latter. This has partially offset the wide disparity in valuations created over the past decade. We expect this rotation to continue and result in increased demand for managers focused on smaller companies. Investors are cautioned to be particularly aware of the capacity constraints of these managers. The demand for long/short equity varies by investor type but remained consistent across both data sets, with higher demand from family offices and endowment funds, and less demand from pension funds that are increasingly focused on uncorrelated strategies.

The two strategies that saw the largest increases in demand were Cleantech/ESG/Impact Investing and Cryptocurrencies, both of which saw a 65% increase. These changes in demand are not cyclical but reflect strong, long-term trends within the industry. ESG investing has gained meaningful momentum in the U.S. over the past 18 months as large institutional investors have begun incorporating these criteria into their investment policies. Opinions of what qualifies as an ESG strategy are fairly broad and vary from one investor to the next. Thus far, incorporating ESG objectives has led to a broad range of definitions and guidelines. We expect the ESG criteria to become more standardized across the industry. The standards will influence not only the qualifications for designation as an ESG compliant strategy but also set expectations as to how managers across all strategies should incorporate ESG awareness into their investment processes.

Cryptocurrency strategies are evolving from being considered exotic and speculative to being more broadly accepted. Beyond the staggering returns, several factors are leading to the increased recognition and demand. They include a broader understanding of block chain technology, an increase in the size of the industry to over $1 trillion, growth in inflation concerns due to massive government stimulus, and the backing of well-respected industry leaders. This last category includes not only Elon Musk, but also Fidelity Investments and Goldman Sachs.

Strategies that saw the biggest decline in demand were those associated with concerns over rising interest rates. Interest in specialty finance fell by 25%, structured credit by 20% and distressed debt by 15%. The decrease in demand for distressed debt might also be related to the improving economy and the view that there may be fewer opportunities in the near future. We expect negative asset flows from most fixed income strategies with the exception of higher turnover, relative value, low net managers who can take advantage of increased volatility as interest rates increase and credit spreads widen.

Event driven strategies also saw a 15% decline in demand. The definition of this strategy has not found a consensus across market professionals or industry databases. Most investors use it as a broad term that incorporates strategies associated with corporate activity or change. These strategies include merger arbitrage, distressed debt, activist, capital structure arbitrage and some long/short managers. The decline in demand is probably most attributable to the sub-strategies of distressed debt mentioned previously and activist managers, many of whom have struggled with performance over the past few years.

Another high-level trend we see is the divergence by investor type in how hedge fund strategies are being considered in the portfolio allocation process. Specifically, many pension funds have evolved their hedge fund strategy from outperforming hedge fund indices to building portfolios of diversifying strategies. This has narrowed their broad interest across strategies to a focus on those strategies with low correlation to the capital markets.

We expect pensions to have net positive inflows to the hedge fund industry as their assets are reallocated away from low yielding traditional fixed income mandates into diversified hedge fund strategies. This transition is expected to enhance risk adjusted returns to their overall portfolios. Since average pension fund allocations tend to be multiple times larger than those from other types of investors, their strategy preference has a disproportionate impact on industry flows. The data we shared from the surveys gave each investor equal weighting. Practically speaking, strategies with higher interest from pension funds, such as CTAs and reinsurance, will likely see much higher asset flows than the survey data would indicate. For CTAs, demand tends to be higher for short term trading oriented strategies versus medium-term trend, where many pensions already have exposure. Reinsurance is seeing increased demand from large pension funds due to rising prices across the industry and its low correlation to the capital makers. In contrast, flows into cryptocurrency strategies will likely be proportionately smaller than the survey indicates as this is currently not a strategy many large institutional investors will consider in the short term.

Other strategies showing high investor demand include Global Macro (52%), Multi-Strategy (52%), Equity Market Neutral (48%) and Emerging Markets (47). A full list of results are posted in the chart below.

In addition to indicating strategies of interest, investors were also asked to indicate the minimum fund size to which they would consider making an allocation. Of the Q1 2021 respondents, 36% would consider new fund launches, 68% were open to funds with less than $100 million and only 2% said they required a fund to be $1 billion or larger. They were also asked about the minimum length of track record with 39% willing to invest with less than a one year record and 94% with a three year record. These results indicate that the minimum asset requirement for various investor types has been reduced over time and especially in the past several years. This may be, in part, attributable to the significant investment large pension funds have made into improving their internal processes. A majority have built out their research staffs and, in so doing, have increased their confidence and comfort with investing in smaller and emerging managers.

As we head into the 2nd quarter of 2021, we anticipate an increase in hedge fund allocations due to pent up demand and turnover from the past year. This survey should provide good guidance on the strategies to which assets will flow. Additionally, as most investors and managers have become comfortable using Zoom and other virtual meeting providers, most will adopt this technology as part of their ongoing due diligence process. It will likely become a highly used tool to facilitate introductory meetings. In some cases, as we have already seen, investors may use virtual communication to facilitate their entire due diligence process.

Gaining the Edge - Global Virtual Cap Intro to benefit at risk youth is expected to be one of, if not the largest, virtual cap intro events in the industry and is complimentary for approved investors. If you would like to see more information on the event please visit.

Related: Private Markets Have Become Accessible to Individual Investors