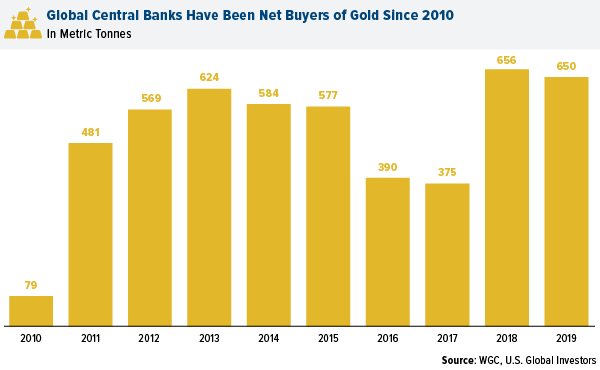

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold. In 2019, official sector activity declined 1 percent from the year prior, with central banks adding 650.3 tonnes. This is slightly lower than 2018 when banks purchased 656.2 tonnes – the second highest level this century, according to the World Gold Council (WGC).

The top 10 central banks with the largest gold reserves have remained mostly unchanged for the last few years. The United States holds the number one spot with over 8,000 tonnes of gold in its vaults – nearly as much as the next three countries combined.

15 central banks made net purchases of one tonne or more in 2019, highlighting the continued demand for bullion globally. Turkey was the number one buyer – adding 159 tonnes to reserves. Poland made the single largest purchase for the year when it bought 94.9 tonnes in June.

WGC notes that central banks bought 5,019 tonnes in the last decade, which more than offsets the 4,426 tonnes of net sales from 2000 to 2009. Gold reserves are now only 12 percent below the all-time high of 38,491 tonnes in 1966.

Below are the top 10 countries with the largest gold holdings, beginning with the Netherlands, which was recently overtaken by India. Figures are as of August 2020 and do not include the International Monetary Fund (IMF) as a country, or else it would hold the number three spot.

10. Netherlands

Tonnes: 612.5

Percent of foreign reserves: 71.4 percent

The Dutch Central Bank announced that it will be moving its gold vaults from Amsterdam to Camp New Amsterdam, about an hour outside the city, citing burdensome security measures of its current location. As many others have pointed out, this seems odd, given that the bank fairly recently repatriated a large amount of its gold from the U.S.

9. India

Tonnes: 657.7

Percent of foreign reserves: 7.5 percent

It’s no surprise that the Bank of India has one of the largest stores of gold in the world. The South Asian country, home to 1.25 billion people, is the second largest consumer of the precious metal, and is one of the most reliable drivers of global demand. India’s festival and wedding season, which runs from October to December, has historically been a huge boon to gold’s Love Trade.

8. Japan

Tonnes: 765.2

Percent of foreign reserves: 3.2 percent

Japan, the world’s third largest economy, is also the eighth largest hoarder of the yellow metal. Its central bank has been one of the most aggressive practitioners of quantitative easing—in January 2016, it lowered interest rates below zero—which has helped fuel demand for gold around the world.

7. Switzerland

Tonnes: 1,040.0

Percent of foreign reserves: 6.5 percent

In seventh place is Switzerland, which actually has the world’s largest reserves of gold per capita. During World War II, the neutral country became the center of the gold trade in Europe, making transactions with both the Allies and Axis powers. Today, much of its gold trading is done with Hong Kong and China.

6. China

Tonnes: 1,948.3

Percent of foreign reserves: 3.4 percent

In the summer of 2015, the People’s Bank of China began sharing its gold purchasing activity on a monthly basis for the first time since 2009. Although China comes in sixth for most gold held, the yellow metal accounts for only a small percentage of its overall reserves – a mere 3.4 percent. China has actually been on a gold buying spree since December 2018 – buying almost 100 tonnes from then through August 2019.

China is also the number one gold producing nation. What other countries are top gold producers? Find out here!

5. Russia

Tonnes: 2,299.9

Percent of foreign reserves: 23.0 percent

The Russian Central Bank has been the largest buyer of gold for the past seven years and overtook China in 2018 to have the fifth largest reserves. In 2017, Russia bought 224 tonnes of bullion in an effort to diversify away from the U.S. dollar, as its relationship with the West has grown chilly since the annexation of the Crimean Peninsula in mid-2014. To raise the cash for these purchases, Russia sold a huge percentage of its U.S. Treasuries.

4. France

Tonnes: 2,436.0

Percent of foreign reserves: 65.5 percent

France’s central bank has sold little of its gold over the past several years, and there are calls to halt it altogether. Marine Le Pen, president of the country’s far-right National Front party, has led the charge not only to put a freeze on selling the nation’s gold but also to repatriate the entire amount from foreign vaults.

3. Italy

Tonnes: 2,451.8

Percent of foreign reserves: 71.3 percent

Italy has likewise maintained the size of its reserves over the years, and it has support from European Central Bank (ECB) President Mario Draghi. The former Bank of Italy governor, when asked by a reporter in 2013 what role gold plays in a central bank’s portfolio, answered that the metal was “a reserve of safety,” adding, “it gives you a fairly good protection against fluctuations against the dollar.”

2. Germany

Tonnes: 3,363.6

Percent of foreign reserves: 75.6 percent

In 2017 Germany completed a four-year repatriation operation to move a total of 674 tonnes of gold from the Banque de France and the Federal Reserve Bank of New York back to its own vaults. First announced in 2013, the move was expected to take until 2020 to complete. Although gold demand fell in 2017 after hitting an all-time high in 2016, this European country has seen gold investing steadily rise since the global financial crisis.

1. United States

Tonnes: 8,133.5

Percent of foreign reserves: 79.0 percent

With the largest official holdings in the world, the U.S. lays claim to nearly as much gold as the next three countries combined. It also has the highest gold allocation as a percentage of its foreign reserves at 79 percent. From what we know, the majority of U.S. gold is held at Fort Knox in Kentucky, with the remainder held at the Philadelphia Mint, Denver Mint, San Francisco Assay Office and West Point Bullion Depository. Which state loves gold the most? Well, the state of Texas went so far as to create its very own Texas Bullion Depository to safeguard investors’ gold.

Related: Is the Gold Rally Overdone? Here's What History Says May Come Next