Written by: Andrew Schardt

In most contexts, the middle seat is perhaps one of the most loathed places to be. However, if you are facing an investable landscape filled with growing uncertainty – and are (finally) convinced that trying to time the market is a bad idea – then a heightened focus on the middle-market buyout segment may be warranted. That is more than a ‘hunch’ or ‘gut-feeling,’ rather that statement is based on real private market data.

This vanilla buyout strategy has performed especially well both during and after times of greater uncertainty since 2000. Particularly, if you compare middle-market buyout performance to returns which could have been generated by investments in public market strategies. Where does this land us?

Look no further than the present – buyout category portfolios have been up modestly in 2023, and that performance has fared quite well compared to choppier, publicly listed assets since the outset of 2022. Their relative outperformance tends to be greatest in more volatile times, and post-downturn vintage years can offer buying opportunities. Breaking this segment down further, the data tells us that middle-market-focused buyout exposure has the potential to create even greater long-term outperformance within a balanced portfolio.

Anyone Hungry?

One of the benefits of modern private market offerings is that there are now many more flavors to choose from. You can build custom portfolios that account for risk, return, liquidity, duration and so many other factors that it can feel like building your own ice cream sundae from dozens of fund flavors. This is no longer your grandparents’ asset class with buyout and venture as your only two choices. Investors have strategies upon strategies upon sub-strategies from which to choose.

While this flexibility is phenomenal and there are now great tools to help you understand why rocky road really is better than cookie dough, let’s not forget about good old vanilla. After all, some flavors are timeless for a reason and what was once old news will soon be in vogue again. For example, in the last five to seven years, we have gone from a macroeconomic environment that focused on ‘growth at any cost’ to one in 2023 where a new normal of lower purchase prices is beginning to re-emerge. Sound familiar? Of course it does. That’s because profitability matters – just like it used to. As we have written previously, this is an environment in which the governance model of private equity – the ability to control your destiny by actively managing the private company – really matters.

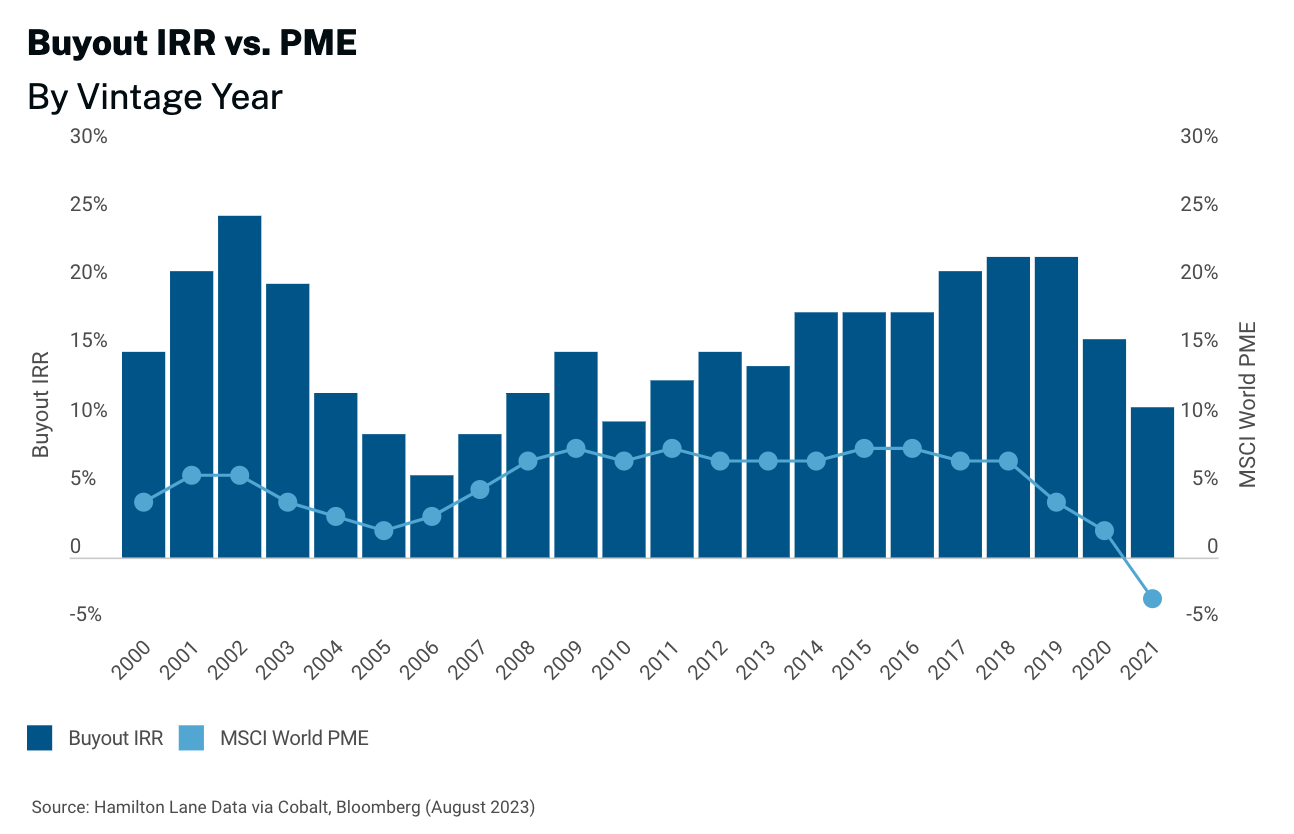

Another key point to acknowledge when looking backwards is: “Data don’t lie.” The perception of private equity performance during periods of stress was shaped by studies immediately following the Global Financial Crisis (GFC), which relied on nascent (and largely unrealized) data. Questions asked during this time included, “Are the valuations real? Is performance sustainable? Are the investor experiences likely to be the same going forward?” The good news is that, this time around, we now have much more robust private market data. That data is now ‘crystalized’ and buyout deals, assets and funds from those eras are nearly fully realized. The outperformance of buyouts versus public market equivalents (PMEs) was particularly heightened in the post-dotcom and GFC vintage years. Not to mention that, for the left-hand side of the chart above, these results and outperformance statistics aren’t hypothetical. They are predominantly actual, realized results at this point.

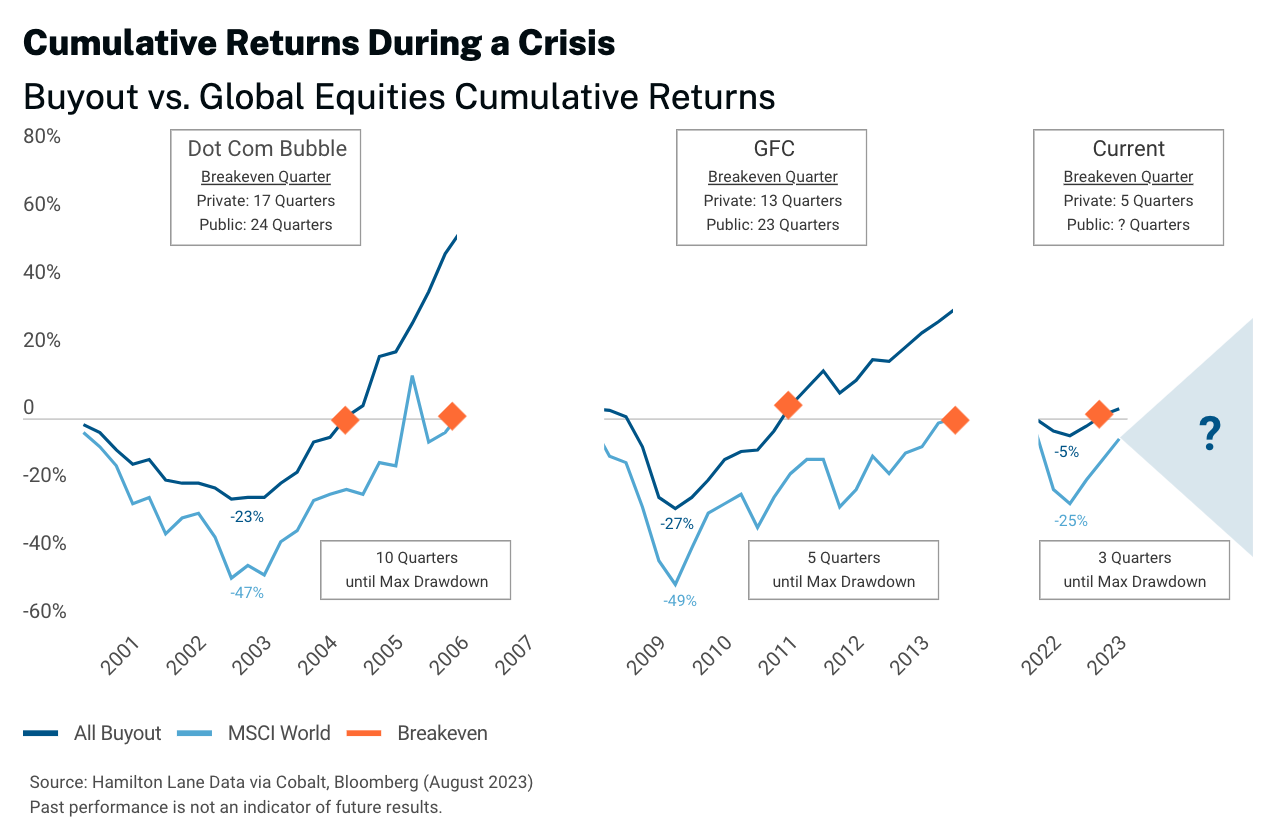

In light of today’s macroeconomic environment, seemingly vanilla strategies (such as buyouts) have the potential to deliver impressive long-term results. During the 2000–2001 dotcom bubble and the 2007–2008 GFC, public market declines continued three quarters past the official end to the crises. Coming out of both, buyouts outperformed handily, moving way ahead of public market returns as markets started to regain their footing.

Since the market downturn began in 2022, buyout purchase prices have stayed below their 2021 peak while public equity prices have been volatile. In the near term, a sharp rebound in public prices has the potential to lead to a period where short-term private equity returns lag public market returns.

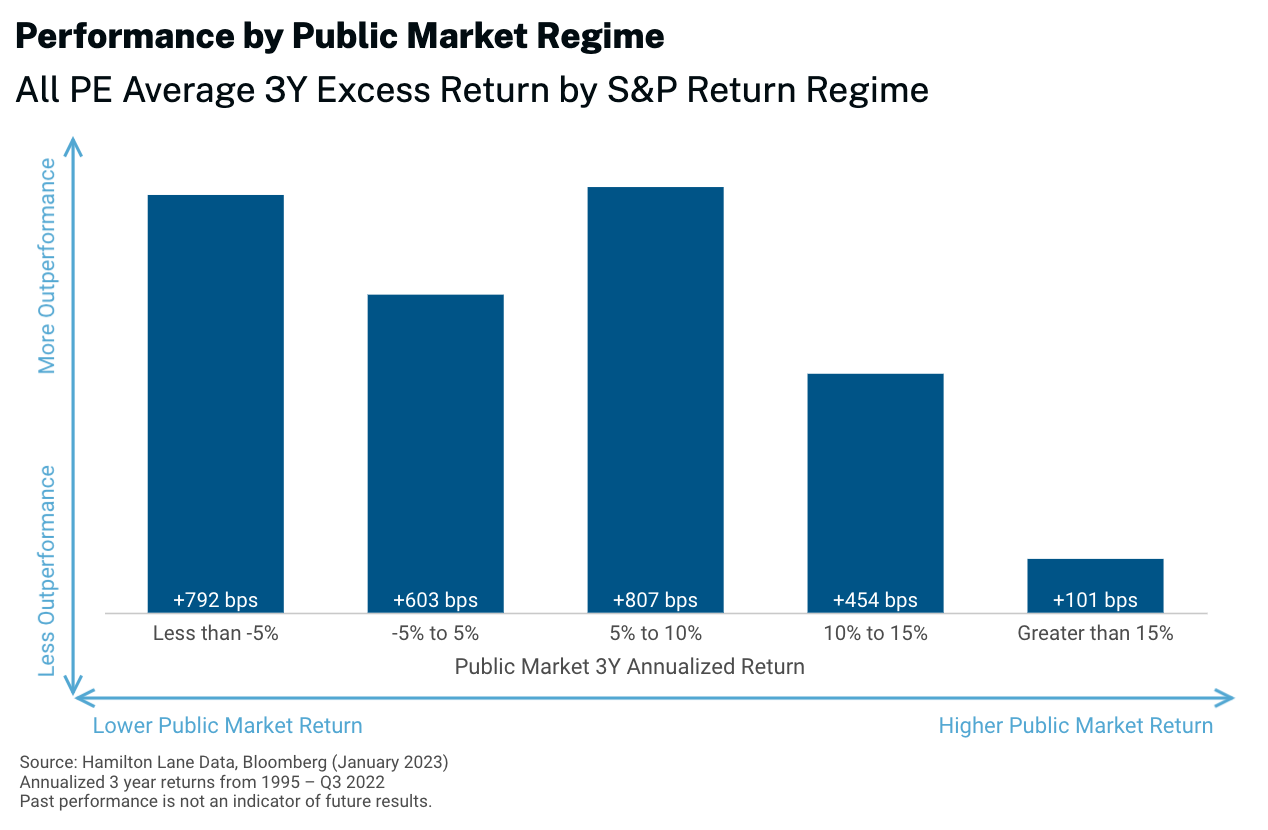

What should investors expect as we remain in a world where there is likely to be great volatility and continued uncertainties in the near term? Have a look at the chart above. To revisit an oldie-but-goodie, data reflected in this chart show that private equity’s average net outperformance tends to be greatest when public markets exhibit more mediocre or negative returns. This counterbalance can moderate the impact of down years and potentially elevate total portfolio performance in the long run – depending, of course, on the deals and funds in your portfolio.

Does Deal Size Matter?

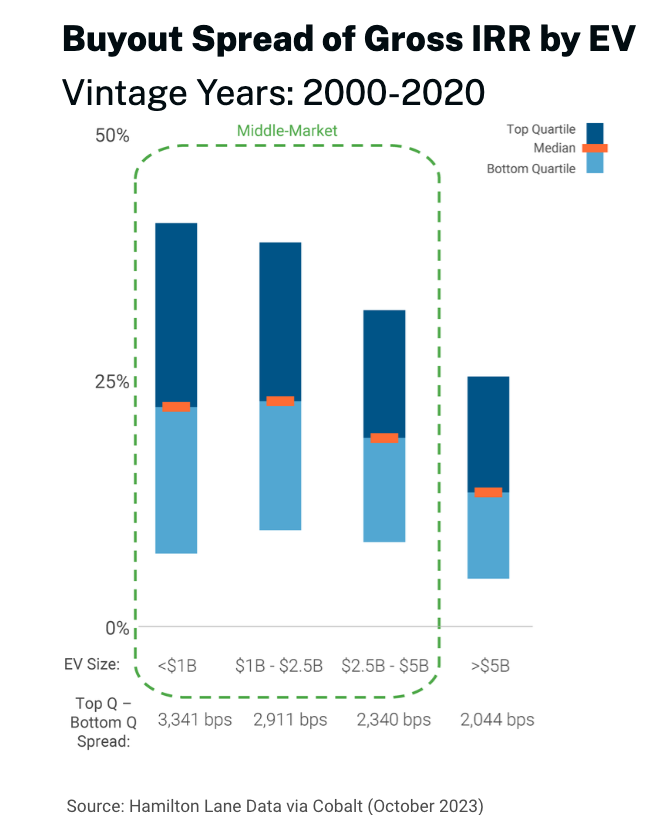

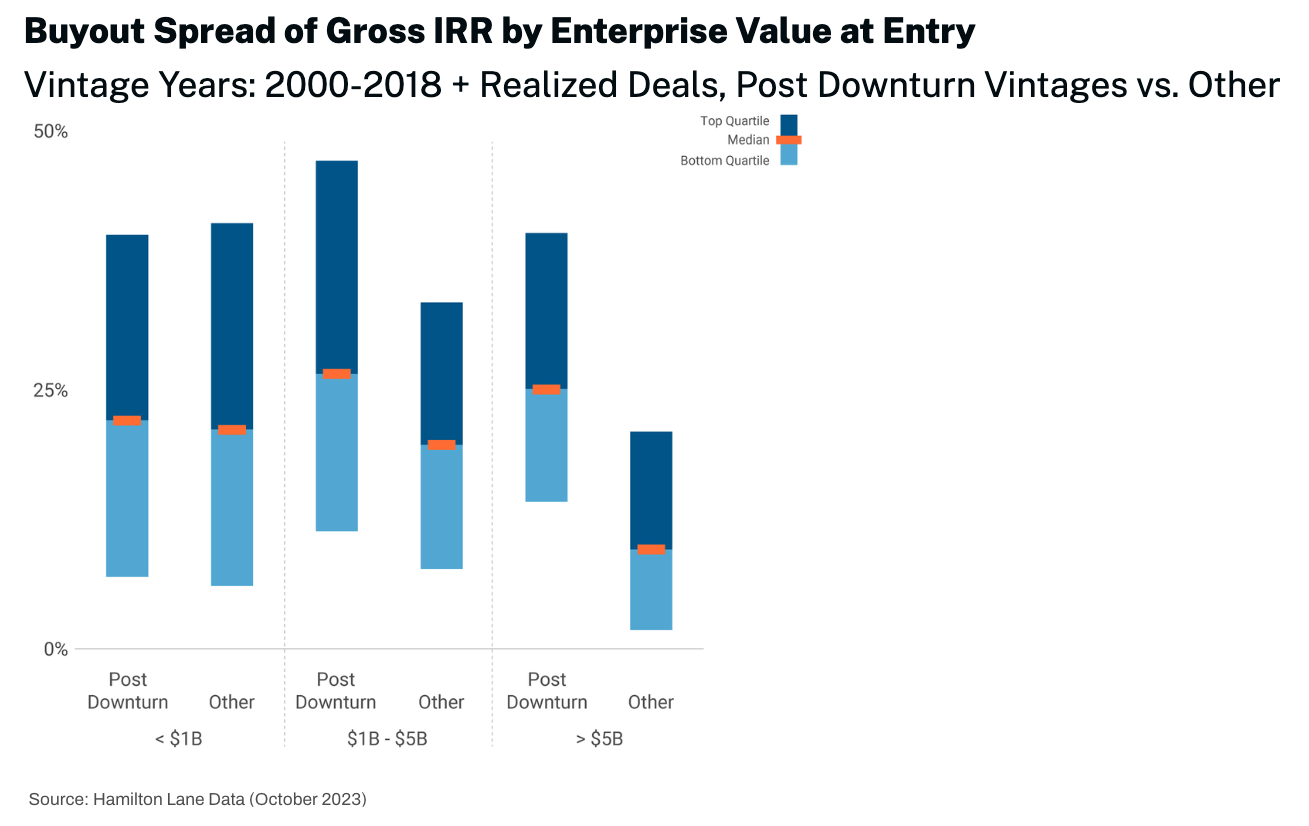

The chart above examines gross internal rates of return at the buyout deal level by enterprise value. You can see that, on average, returns in the middle market strategies have been consistently higher than those at the larger end of the deal spectrum. That makes sense given that you have a much more robust and investable landscape in terms of the numbers of private middle market companies globally. In terms of tradeoffs, there is clearly a wider dispersion of returns in this strategy, so the implications of building an adequately diversified exposure to this segment also remain critical. Especially since most single funds targeting middle-market transactions tend to be more concentrated in terms of the number of transactions relative to the upper end of the market.

What is the source of that strong performance? A greater proportion of the total value created for small-to-middle sized assets is attributable to EBITDA growth. That also makes sense – these mid-sized companies are less likely to be mature and have less likelihood of being intermediated or ‘packaged’ during a sales process. This creates opportunities for savvy operators to accelerate product research and development, enhance sales techniques, streamline procurement and professionalize back-office functions. A strategic implementation of goals around new market channels, M&A opportunities, or other non-organic growth levers may also be available. So, a buyer that can find these types of assets has multiple possibilities for value creation in a much more fragmented corporate segment with fewer institutionalized businesses. Here, the ability to strategically choose – and not settle on – investment opportunities from a target-rich environment has the potential to deliver attractive risk-adjusted returns.

This Too Shall Pass

As we are likely in the midst, close to, or already partially through an economic recession in most developed economies, we also must consider what the data tells us about performance with that type of macroeconomic and cyclical overlay. Once again, the middle-market segments – the two middle columns shown below – demonstrate a compelling case for investment, especially in post-downturn vintage years based on historical data. In other words, these strategies fare well in an economic recovery.

Don’t Overthink It...

Sometimes the best decision is the simplest. There is a reason why buyout focused strategies constitute more than 40% of all private market focused capital and why they continue to be the predominant investment strategy. Vanilla strategies like buyouts – while not always the most ‘exotic’ – historically have performed well, especially in choppier economic conditions and especially relative to listed asset classes.

Related: The Tradeoff Between Risk & Return

DEFINITIONS

Corporate Finance/Buyout: An investment in a controlling equity position in a corporate entity, typically with substantial leverage.

IRR: The internal rate of return (IRR) is the discount rate that sets the net present value of a stream of cash flows equal to zero. IRR is commonly used to express the rate of return of an investment.

MSCI World Index: The MSCI World Index tracks large and mid-cap equity performance in developed market countries.

Vintage Year: The year of the first cash flow of a private markets investment.

Mid-Market – Buyout deals with an enterprise value at entry up to $5B.

Realized Deals – A deal that has been fully exited or has a RVPI < 0.2.

Post Downturn Vintages – Deal Vintages during 2001-2004, 2009-2012 and 2021-2022.

Other – Deal vintages between 2000 to 2018 plus realized deals that do not have a post downturn deal vintage.

DISCLOSURES

This presentation has been prepared solely for informational purposes and contains confidential and proprietary information, the disclosure of which could be harmful to Hamilton Lane. Accordingly, the recipients of this presentation are requested to maintain the confidentiality of the information contained herein. This presentation may not be copied or distributed, in whole or in part, without the prior written consent of Hamilton Lane.

The information contained in this presentation may include forward-looking statements regarding returns, performance, opinions, the fund presented or its portfolio companies, or other events contained herein. Forward-looking statements include a number of risks, uncertainties and other factors beyond our control, or the control of the fund or the portfolio companies, which may result in material differences in actual results, performance or other expectations. The opinions, estimates and analyses reflect our current judgment, which may change in the future.

All opinions, estimates and forecasts of future performance or other events contained herein are based on information available to Hamilton Lane as of the date of this presentation and are subject to change. Past performance of the investments described herein is not indicative of future results. In addition, nothing contained herein shall be deemed to be a prediction of future performance. The information included in this presentation has not been reviewed or audited by independent public accountants. Certain information included herein has been obtained from sources that Hamilton Lane believes to be reliable, but the accuracy of such information cannot be guaranteed.

This presentation is not an offer to sell, or a solicitation of any offer to buy, any security or to enter into any agreement with Hamilton Lane or any of its affiliates. Any such offering will be made only at your request. We do not intend that any public offering will be made by us at any time with respect to any potential transaction discussed in this presentation. Any offering or potential transaction will be made pursuant to separate documentation negotiated between us, which will supersede entirely the information contained herein.

Certain of the performance results included herein do not reflect the deduction of any applicable advisory or management fees, since it is not possible to allocate such fees accurately in a vintage year presentation or in a composite measured at different points in time. A client’s rate of return will be reduced by any applicable advisory or management fees, carried interest and any expenses incurred. Hamilton Lane’s fees are described in Part 2 of our Form ADV, a copy of which is available upon request.

The following hypothetical example illustrates the effect of fees on earned returns for both separate accounts and fund-of-funds investment vehicles. The example is solely for illustration purposes and is not intended as a guarantee or prediction of the actual returns that would be earned by similar investment vehicles having comparable features. The example is as follows: The hypothetical separate account or fund-of-funds consisted of $100 million in commitments with a fee structure of 1.0% on committed capital during the first four years of the term of the investment and then declining by 10% per year thereafter for the 12-year life of the account. The commitments were made during the first three years in relatively equal increments and the assumption of returns was based on cash flow assumptions derived from a historical database of actual private equity cash flows. Hamilton Lane modeled the impact of fees on four different return streams over a 12-year time period. In these examples, the effect of the fees reduced returns by approximately 2%. This does not include performance fees, since the performance of the account would determine the effect such fees would have on returns. Expenses also vary based on the particular investment vehicle and, therefore, were not included in this hypothetical example. Both performance fees and expenses would further decrease the return.

Hamilton Lane (Germany) GmbH is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (Germany) GmbH is authorised and regulated by the Federal Financial Supervisory Authority (BaFin). In the European Economic Area this communication is directed solely at persons who would be classified as professional investors within the meaning of Directive 2011/61/EU (AIFMD). Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane (UK) Limited is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA). In the United Kingdom this communication is directed solely at persons who would be classified as a professional client or eligible counterparty under the FCA Handbook of Rules and Guidance. Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane Advisors, L.L.C. is exempt from the requirement to hold an Australian financial services licence under the Corporations Act 2001 in respect of the financial services by operation of ASIC Class Order 03/1100: U.S. SEC regulated financial service providers. Hamilton Lane Advisors, L.L.C. is regulated by the SEC under U.S. laws, which differ from Australian laws.

Any tables, graphs or charts relating to past performance included in this presentation are intended only to illustrate the performance of the indices, composites, specific accounts or funds referred to for the historical periods shown. Such tables, graphs and charts are not intended to predict future performance and should not be used as the basis for an investment decision.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein.

The calculations contained in this document are made by Hamilton Lane based on information provided by the general partner (e.g. cash flows and valuations), and have not been prepared, reviewed or approved by the general partners. As of October 24, 2023