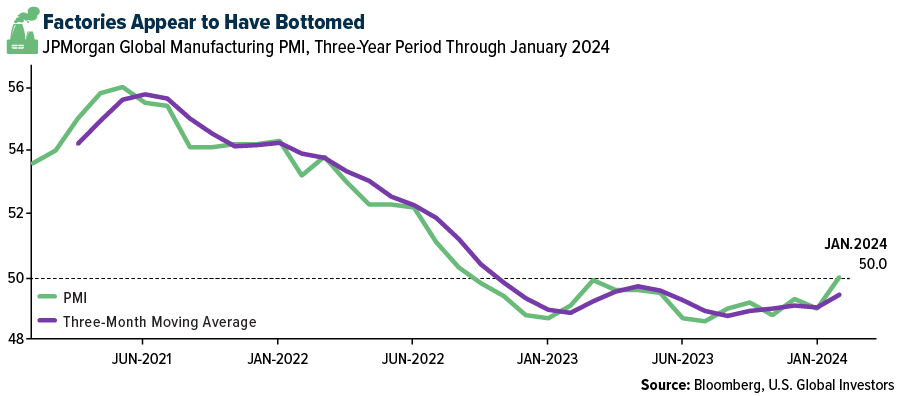

Global manufacturing is slowly stirring back to life, as evidenced by a positive purchasing managers’ index (PMI) reading in January, and industrial metals, copper especially, look poised to benefit.

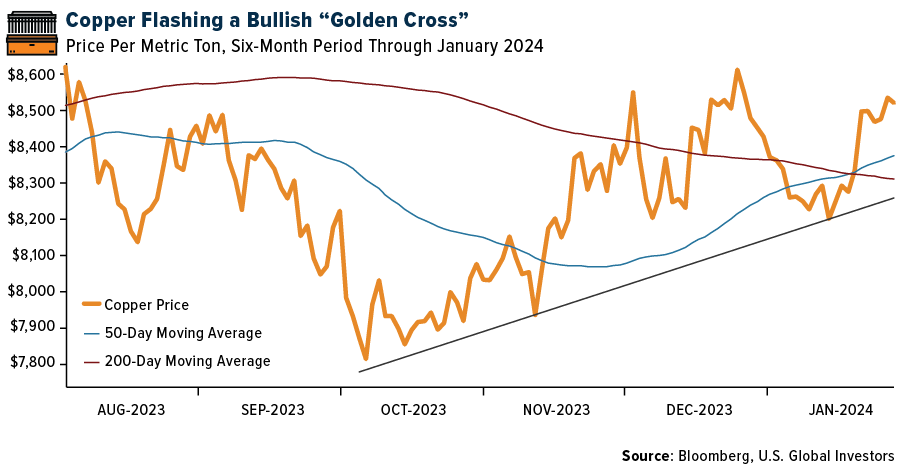

Copper was one of only two metals that finished 2023 in the black, gold being the other metal. The asset flashed a bullish “golden cross” signal, with the 50-day moving average jumping above the 200-day moving average, and prices currently look stable in the $8,400-$8,600 per metric ton range.

Some industry leaders are anticipating lofty gains in the coming months. The billionaire founder of Ivanhoe Mines, Robert Friedland, has forecast a potential surge in copper prices to $9,500 a metric ton this year. This bullish call is supported by a combination of lower interest rates later in the year and a ramp-up in demand from China, which Robert stresses has not slowed its consumption of the red metal, despite the country’s shaky real estate market. China, in fact, bought more copper in 2023 than in any other year on record, importing 27.54 million tons.

“Everybody knows about the weak real estate market in China… but military demand, national security demand, [and] demand for militarization is very high,” Robert told Bloomberg TV last week.

This, I believe, will more than offset the sluggishness in copper demand from Chinese property developers. (And for what it’s worth, Reuters reports that the country’s property sector is showing signs of recovery, with new home prices rising at the fastest pace in two and a half years and government land sales finally turning positive after 23 months.) China’s recent move to pump about 1 trillion yuan ($140 billion) into its economy acts as a further catalyst, promising to boost copper demand.

Copper As A Preferred Transition Metal

Copper’s allure, however, isn’t just a product of market speculation. It’s rooted in its critical role in powering the green transition. In 2023, renewable energy contributed an unheard-of 11.4 trillion yuan ($1.6 trillion) to China’s economy, more than any other sector, according to a report by the Centre for Research on Energy and Clear Air (CREA). The Asian giant invested $890 billion in clean energy technologies last year, similar in size to the GDPs of Switzerland and Turkey.

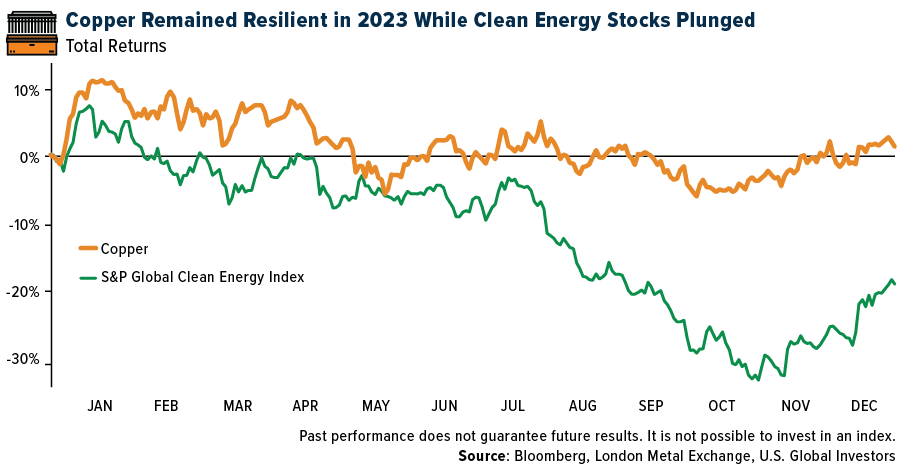

While the mining sector often finds itself at the crossroads of environmental debates, copper emerges as a more favorable bet, I believe, than traditional transition technologies like wind and solar. This is particularly notable considering the red metal finished last year with a slight increase of 1.2%, while the S&P Global Clean Energy Index sank over 21%.

In addition, the global economy appears to be on surer footing than many anticipated. With the rate of inflation on a downward trajectory, we’re likely to see a softening of interest rates by the Federal Reserve by midyear at the latest. This economic environment bodes well for industries reliant on copper, including automotive and consumer goods manufacturing.

Global Manufacturers On The Mend

The global manufacturing sector is also showing signs of a pulse. The JPMorgan Global Manufacturing PMI hit the neutral 50.0 mark in January, halting a 16-month streak of sub-50 readings. This suggests a stabilization in global manufacturing, a critical user of copper. You can watch my explainer on the relationship between the Global Manufacturing PMI and short-term commodities demand by clicking here.

U.S. manufacturers kicked off the year with renewed optimism and an uptick in demand. The S&P Global US Manufacturing PMI climbed to 50.7 in January, its highest level since September 2022. This positive shift was attributed to easing inflation and more accommodating financial conditions, alongside an increase in production and payroll numbers.

The Institute for Supply Management (ISM) Manufacturing PMI, on the other hand, showed that U.S. factories were still in contraction mode, but only barely. The Manufacturing PMI registered 49.1 in January, up from 47.1 in December and marking the 15th straight month that the reading was below the 50.0 threshold.

More Than A Metal

The confluence of economic resilience, burgeoning demand from key sectors and a revitalization in global manufacturing paints a compelling picture for copper in 2024. I’m convinced that the metal is poised not just as a material of historical significance but as a pivotal element in driving forward the next phase of economic and technological progress. In this sense, copper is not merely a commodity; it’s a catalyst for a new era of global economic growth.

Related: A New Driver of Gold?