Here we are at the start of the second half of 2024, and the Federal Reserve appears closer to lowering interest rates than at any point since they started raising them in early 2022. The catalyst? A cooling U.S. labor market that signals the economy may be losing some of its steam.

As the adage goes, bad economic news could be good news for gold. With this in mind, now might be the right time to consider getting exposure or increasing exposure to the yellow metal.

Rising Unemployment Could Signal Fed’s Readiness to Cut Rates

Over the past two years, the Federal Reserve has been on an aggressive rate-hiking campaign to combat inflation. However, recent economic data suggests that the labor market, a critical barometer of economic health, is starting to show signs of weakness.

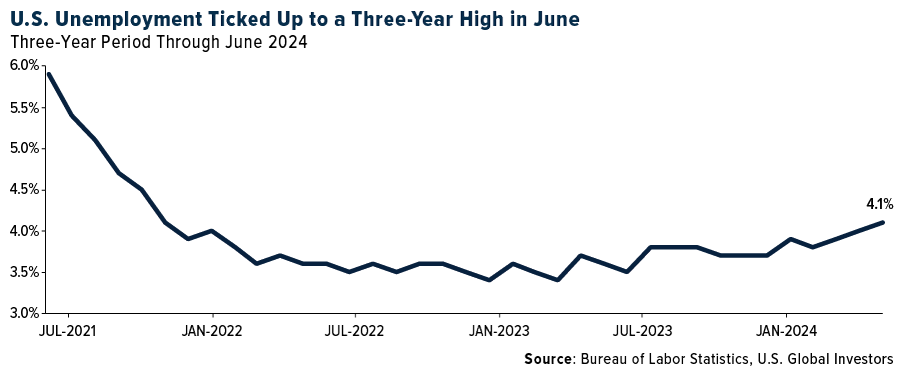

In June, the U.S. economy added 206,000 jobs, a respectable number at first glance. However, revisions to April and May’s data revealed a more rapid slowdown than previously thought, with 111,000 fewer jobs than estimated. Additionally, the unemployment rate ticked up to 4.1%, its highest level in nearly three years.

Federal Reserve Chair Jerome Powell has been clear about the Fed’s readiness to respond to a weakening labor market. At last month’s press conference, Powell reiterated that if the labor market were to weaken unexpectedly, the Fed is prepared to cut interest rates to support economic activity. This dovish shift is reinforced by the expectation that the upcoming consumer price index (CPI) report will show subdued inflationary pressures, paving the way for a potential rate cut in September.

Historically, gold has thrived in low-interest-rate environments. Lower rates reduce the opportunity cost of holding non-yielding assets like gold, potentially making it more attractive to investors. Moreover, gold is often seen as a hedge against economic uncertainty and inflation, both of which are likely to persist even if the Fed starts cutting rates, in our opinion.

Central Banks Continue to Bet Big on Gold

This year, gold has already enjoyed a stellar performance, hitting a record high of $2,449 in May. The rally has been supported by a combination of central bank buying, geopolitical tensions and expectations of a looser monetary policy.

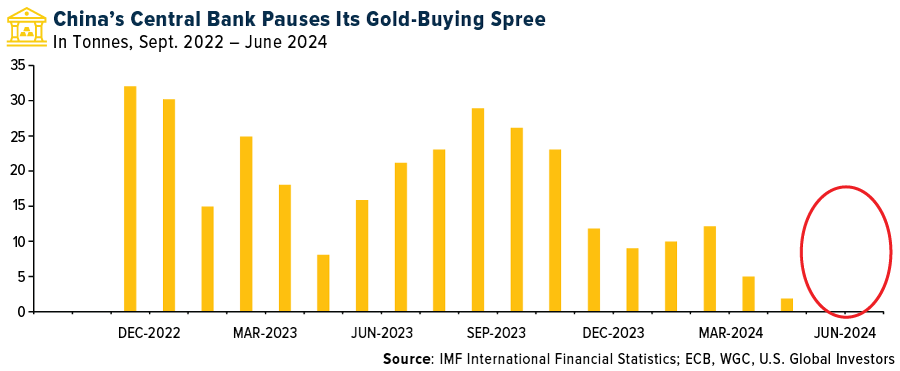

Central banks added 1,037 tonnes of gold to their reserves in 2023, the second highest annual purchase on record, according to the World Gold Council WGC). The People’s Bank of China (PBoC) has been a major buyer of gold, though it paused its purchases for two consecutive months in May and June.

We don’t believe the pause will diminish the long-term trend of central banks increasing their gold holdings. According to a survey by the WGC, over 80% of central banks hold gold as part of their total international reserves, and nearly 30% plan to increase their gold reserves this year and next.

GOAU: A Smart Beta Approach to Investing in Gold and Precious Metals

For investors seeking to benefit from these trends, the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) offers a strategic way to gain exposure to the precious metals market. With its focus on companies with strong fundamentals and robust revenue streams from gold, GOAU is well-positioned to capture the upside potential in the gold market.

What sets GOAU apart is its rules-based, smart beta 2.0 approach to stock selection. The ETF uses a dynamic model to identify precious metals companies that generate over 50% of their revenue from gold and other precious minerals. This approach aims to offer investors exposure to companies with favorable valuation, profitability, quality and operating efficiency.

GOAU’s portfolio consists of 28 common stocks or related American Depositary Receipts (ADRs) of precious metals companies. By focusing on companies with strong fundamentals, GOAU aims to provide superior risk-adjusted returns compared to traditional market-cap weighted indices.

With the Fed on the cusp of a potential rate-cutting cycle, the investment case for gold becomes even stronger, we believe. Lower interest rates not only enhance gold’s appeal as a non-yielding asset but also boost its attractiveness as a safe haven during times of economic uncertainty. As central banks continue to diversify their reserves and geopolitical tensions remain high, the demand for gold is likely to stay strong.

Related: Why Commodities Like Silver, Oil and Gold Are Soaring Amid Inflation