Written by: Arkadiusz Sieron, PhD

The coronavirus strikes back! It’s bad news for almost everyone and everything… except for merciless gold.

So, were you hoping that the epidemic was over? After all, millions of people got vaccinated, and the economy is booming. Restrictions have been generally lifted, the Fed removed the parts related to the pandemic from its monetary policy statement… why bother then?

The answer is: Delta. And I’m referring to the Sars-Cov-2 variant that causes Covid-19. As you know, viruses mutate from time to time as they spread and replicate. Delta is one of such mutations. Most mutations are not dangerous or even dumb (they weaken the viruses). But the problem with Delta is that it’s “the fastest and fittest” of all coronavirus variants, as the WHO described it. Just think about Rambo on steroids or a witcher that has just taken all his potions. Oh… Anyway, you got the point.

In particular, Delta is much more contagious than the original strain, and is spreading about twice as fast. A person infected with the classic version of the coronavirus can spread it to 2.5 other people, while a person with Delta can infect 3.5-4 other people. Delta might also be more severe and more lethal than the original strain.

The good news is that many people have been vaccinated and the vaccines (especially the mRNA-type) protect nicely against Delta. However, the bad news is that many people still haven’t gotten the shots, for many reasons. The tricky part here is that, given the high transmission rate of Delta, we would need 90% or even more people to be vaccinated to reach herd immunity, which is still a song of the future.

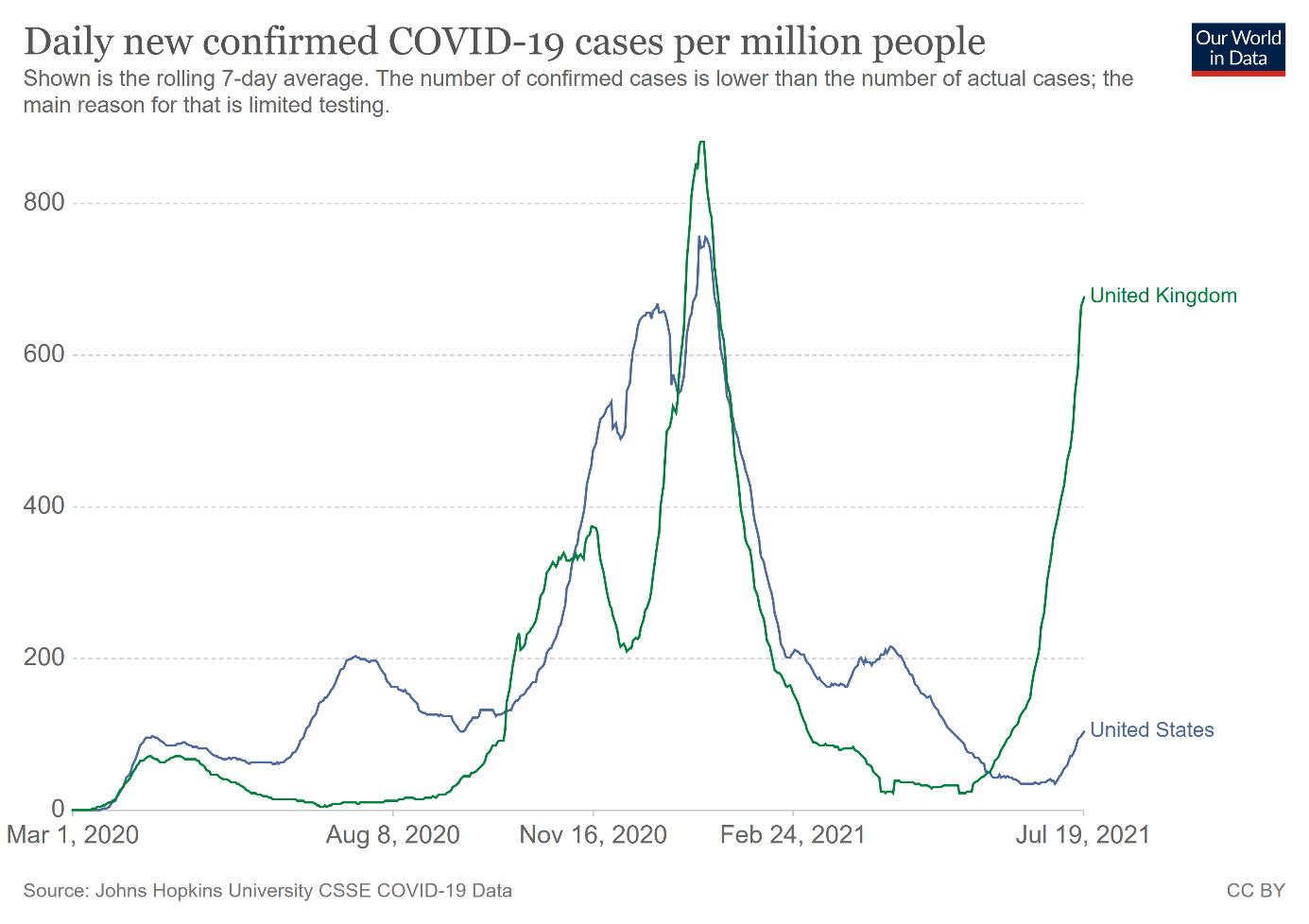

High transmissibility is the reason why Delta has become the dominant strain in the globe. It also increases the risk of further, potentially even more dangerous, mutations (more transmissions, more chances to evolve into Terminator). In other words, Delta’s fast transmission could reignite the pandemic. As the chart below shows, this is actually already happening.

As one can see, Delta reversed the trend of the declining number of new cases, spreading particularly quickly in the United Kingdom. But the U.S. Covid-19 cases also soared, surging 70% last week, while deaths went up 26%.

Implications for Gold

What do rising cases of Delta mean for gold? Well, I would say that Delta is fundamentally positive for gold and could mutate it into a more bullish strain. If the pandemic accelerates, governments may reintroduce some of the sanitary restrictions or even lockdowns. A new wave of the epidemic would also increase the chances of a big infrastructure bill in the US and other fiscal stimuli, while the Fed would likely remain dovish for longer than it would without Delta. So, inflation could intensify even further, while the real interest rates would drop. Therefore, concerned investors would turn to inflation hedges and safe havens such as gold.

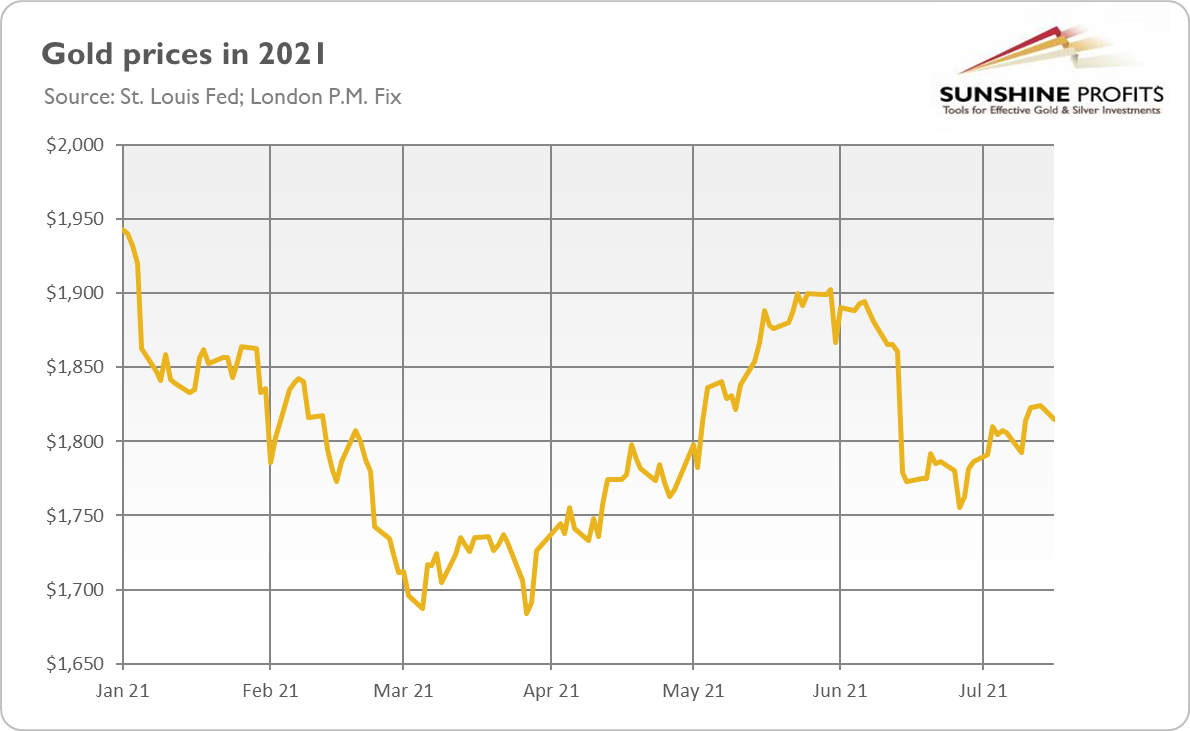

However, what’s described above is the medium-term effects that Delta would cause if it triggered a new wave of cases and restrictions. In the short run, however, gold may decline, as worried investors would sell the assets and turn to the US dollar. This is what we saw in March 2020 but also on Monday (July 19, 2021). As the chart below shows, the London price of gold has declined, as the stronger greenback counterweighted the decline in the equities (Dow plunged more than 2%) and bond yields.

Furthermore, the next Great Lockdown is unlikely. Even if the government reintroduces some restrictions, their economic impact will be much smaller than during the earlier waves, as economies have adapted to operating under the epidemiological regime. Importantly, a new wave would be mainly limited to unvaccinated people, which would reduce the burden of health care systems and chances of hard lockdowns.

However, Monday’s equity selloff suggests a change in the market narrative. Investors have possibly realized that they had too optimistic expectations – economic growth may actually be slower than they thought. They have priced in a very strong recovery, which doesn’t have to materialize if a new pandemic wave hits the economy. Slower growth plus high inflation equals stagflation, gold’s favorite environment.

Having said that, it may take a while until gold rallies, as the end of reflation trade may also imply that some investors will sell commodities, including, to some extent, gold. Also, please note that the optimism and gains have quickly returned to the stock market, so the economic impact of Delta may be limited.

Related: Gold Asks: Has Inflation Already Peaked?

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.