Written by: iCapital

Alternative investments provide access to investment opportunities generally not available in a traditional stock/bond portfolio allocation.

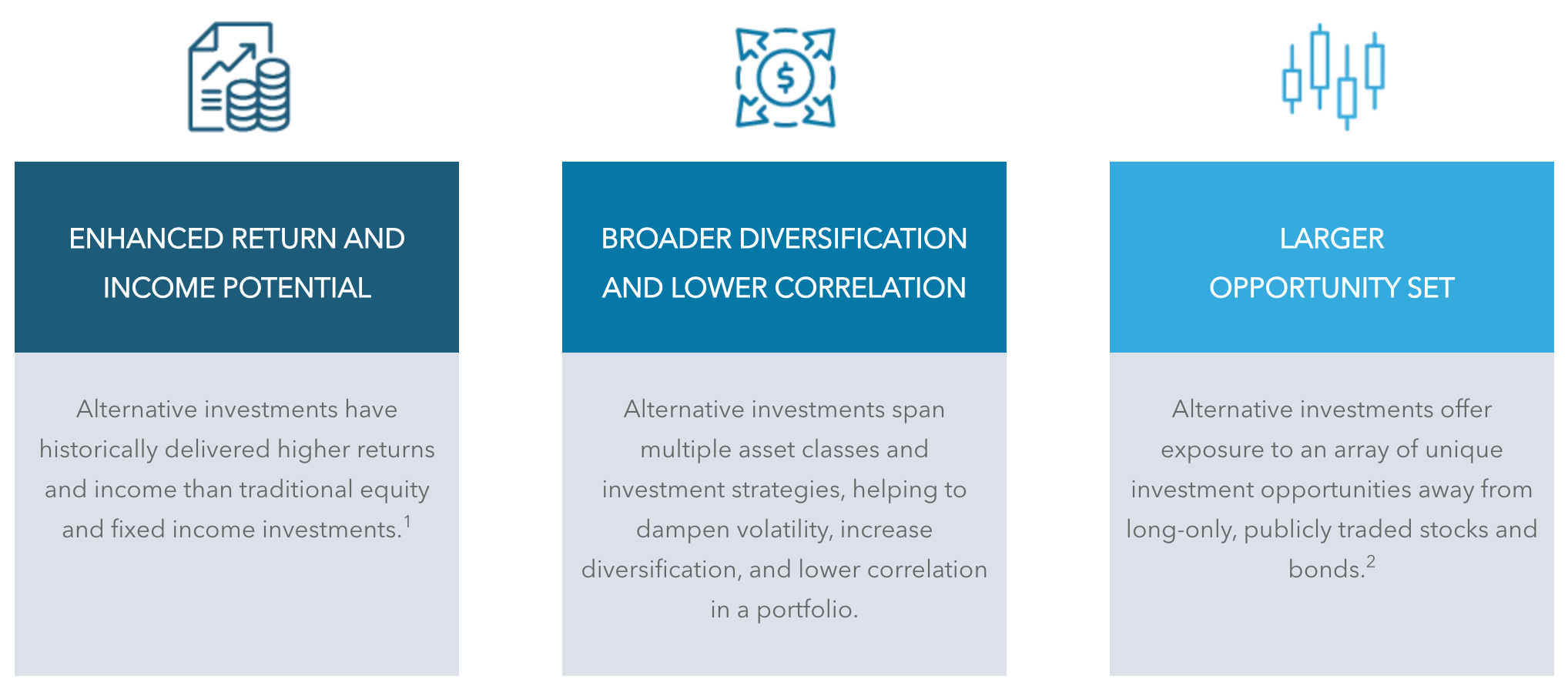

With enhanced return and income potential, and a wide array of diversified strategies, alternative investments can be a valuable addition to a portfolio. They can also be highly effective when the markets are experiencing greater volatility, higher inflation, and increased correlations in traditional assets.

What Can Alternative Investments Offer?

Using Alternative Investments in a Portfolio

Benefits

- Alternative investments may help investors achieve their long-term investment goals and objectives andserve as an attractive complement to traditional stock/bond allocations.

- Alternative investments do not represent a single solution, but a diverse set of strategies that can fulfillmultiple roles in a client’s portfolio.

- Alternative investments are versatile tools for building diversified portfolios.

- Technology and product innovation have made it easier for investors to access these investments.

Key Risk Considerations

- Transparency: Alternative investments may not offer the same level of transparency as traditional investments, which are required to provide frequent and full disclosures.

- Liquidity: Alternative investments should be considered longer term investments. Depending upon the strategy, investors may be subject to a lockup period which will prevent them from redeeming their capital for an extended time (e.g., 5-10 years).

- Fees: Alternative investment fees are generally higher than those associated with traditional investments.

- Leverage: Alternative investment strategies may use some form of leverage, which offers the potential for higher returns, but also increases the downside risk.

- Concentration: Alternative investment strategies may be highly concentrated in a few funds or holdings.

ENDNOTES

1. Source: Pitchbook. Public markets include S&P 500, Russell 3000, and MSCI World. Data as of 12/31/21.

2. There are only 2,800 public companies with annual revenues greater than $100 million. That’s a small slice of corporate America, where there are 18,000 private businesses of that size. Source: Hamilton Lane. “Private Market Investing: Staying Private Longer Leads to Opportunity.” April 14, 2022.

Related: The Importance of Private Markets

The material herein has been provided for informational purposes only by iCapital, Inc. (“iCapital”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is not intended as and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. For full disclosures, please see Why Allocate to Alternative Investments.