Following a cooling off period, special purpose acquisition companies (SPACs) are climbing back into the spotlight thanks to a spate of recent activity.

That activity consists of all the things that initially make clients curious about blank-check companies, including SPAC initial public offerings (IPOs), announced deals, finalized transactions and alterations to previously announced mergers, including some on the heftier side of the ledger. It may not yet be 2020 all over again in SPAC-land, but it's obvious things are heating up again.

Data confirm as much and that's one reason, and a good one at that, advisors may need to prepare for more SPAC-related conversations. As of June 2, there are 574 blank-check companies in the U.S. and that doesn't count the nearly 300 in the pre-IPO stage, according to SPAC Track data.

Of that group of 574, 425 are searching for merger partners. Many clients may not realize this, but SPACs have two years to get a deal done or be forced to liquidate and return capital to investors. Point is, advisors should be making clients aware there are probably more blank-check companies out there than there are credible targets.

With SPACs, Details Matter

Obviously, blank-check equities or the related exchange traded funds aren't going to be significant positions in client portfolios and if a client wants such an indulgence, advisors should steer them away from that. However, there's no denying clients are hearing about blank-check companies from other sources and the aforementioned increase in activity is an avenue for advisors to get involved – usually to the betterment of client expectations and outcomes.

“With a large number of active SPACs now looking for merger targets, the playing field has grown increasingly competitive,” according to Charles Schwab research. “Given the two-year limit on the search process, a potential risk is that companies settle for lower-quality targets—thus risking future success—or fail to find a target outright and are forced to liquidate.”

Something else that's lost on many clients in all the blank-check hoopla is that SPAC transactions aren't all mirror images of each other. Many de-SPACed companies aren't as financially sturdy as investors are led to believe and significant dilution can occur – dilution that usually harms ordinary investors.

“Importantly, fee structures vary widely and may not be as attractive as proposed,” adds Schwab. “After taking into account the sponsor’s equity stake—which usually amounts to 20%—and other banking fees, the cost to public investors at the time of the SPAC’s IPO and/or merger with a target company is at times much higher than what is normally seen for a traditional IPO.”

Don't Forget About Returns

An avenue in which advisors can really add value for SPAC-hungry clients is to articulate what happens in many de-SPAC scenarios because clients may be thinking DraftKings (NASDAQ:DKNG) and Virgin Galactic (NYSE:SPCE) are the norm. Hint: They're not.

“In general, SPACs have seen their strongest gains from the time of their IPO up until they find a merger target; conversely, their weakest performance has come after a successful merger. Researchers found that between 2010 and 2020, buying a SPAC at its IPO and selling it at the time of merger would have yielded a return of 9.3% annually. For SPACs held for a year after a merger, the annualized loss was 15%,” according to Schwab.

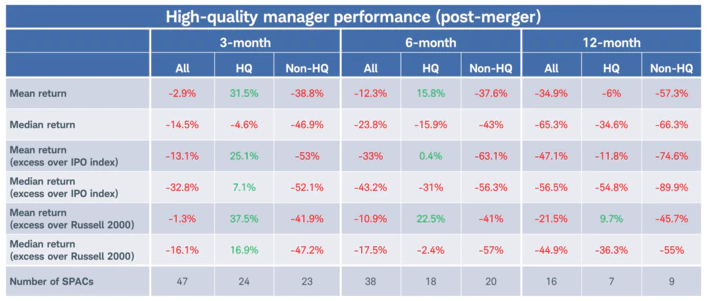

As the chart below indicates, SPACs are like any other asset class in at least one way: Quality matters.

Courtesy: Charles Schwab

At the end of the day, advisors play a vital role in the SPAC conversation. They can steer clients toward better options than individual blank-check companies and away from some of the speculative excessd fueling this market.

Advisorpedia Related Articles:

SPAC Speculation Made More Sensible in Fund Form

Finding Gems and Giants Before They Go Public

New Sports ETF Aims to Be MVP Portfolio Addition

Yes Advisors, You're Likely Going to Talk About SPACs This Year