Written by: Anastasia Amoroso, Peter Repetto and Nicholas Weaver

Despite the current market uncertainty, we believe seasonality is not an excuse to sell. The truth is sometimes seasonality works, sometimes it doesn’t. Rather, we have to couple seasonality with what we otherwise fundamentally believe will drive markets. And what we fundamentally believe is the economy is slowing but still growing and the AI growth story is still intact. Read more for ideas on where to steer portfolios in September and beyond.

The first week of September has lived up to expectations of seasonal weakness, with the S&P 500 down – 4.16% month to date, and the Nasdaq faring worse at – 5.84%. Today’s payrolls report was weaker than expected and came with negative revisions for prior months. This coupled with a weaker-than-expected ISM and disappointing performance from the semi complex weighed on markets to start the fall.

It seems to us market participants have managed to convince themselves of three myths that in our view may not be realities. First, seasonality is a good reason to sell equities. Second, the economy is heading toward a recession (a reprise from early August recessionary worries). And third, Nvidia’s earnings event was underwhelming and therefore, has a negative readthrough for the semiconductor space.

We don’t subscribe to these myths. Instead, we believe seasonality is not always a good predictor of future returns; economic data is weaker than expected but by no means recessionary; Nvidia was a story of high expectations, not poor delivery, and AI growth is still intact.

What does this mean for investors? Rather than making any major portfolio changes based on seasonality alone, we would continue with a barbell investment strategy for a slowing economy and start of a rate cutting cycle environment, which we detailed here and here. This approach includes favoring defensive sectors such as utilities and rate cut beneficiaries like real estate and financials/regional banks, while opportunistically adding to cyclical trades like semiconductors.

Seasonality is not always a good excuse to sell

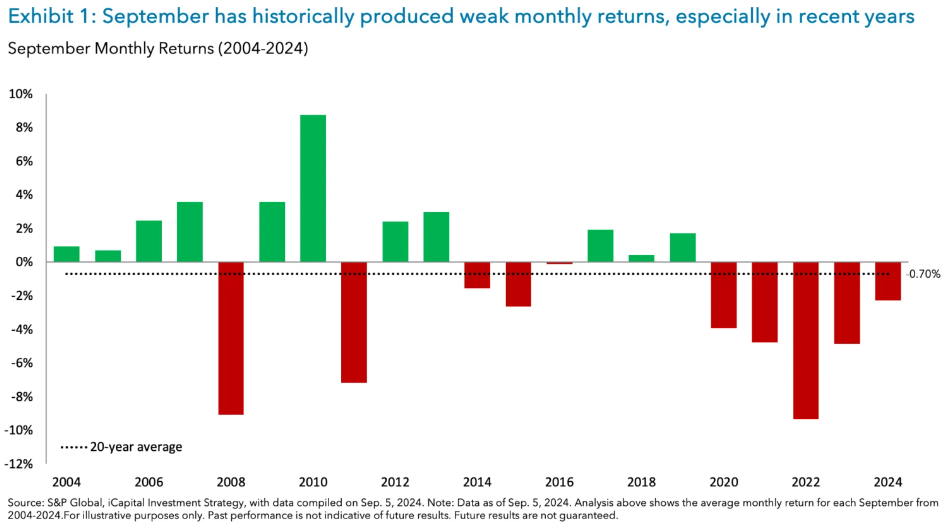

The saying goes, “sell in May and go away.” Well, it seems market participants have now swapped May for September. Yes, it is true, September is a historically weak month and has produced negative returns the last four years (2020-2023), with the last two weeks of September being the weakest two-week period of the year.1 However, while September has produced an average monthly return of -70bps over the last 20 years, 11 out of the 20 observations actually produced positive returns (seen in exhibit 1).2 This shows that while September is a weak seasonal part of the calendar, investors still need to have a catalyst or reason to sell.

The truth is sometimes seasonality works, sometimes it doesn’t. As investors, we should be aware of seasonality, but we can’t be 100% beholden to it and we can’t make wholesale changes to portfolios based on seasonality alone. Rather, we have to couple seasonality with what we otherwise fundamentally believe will drive markets. And what we fundamentally believe is the economy is slowing but still growing and the AI growth story is still intact – read more below.

Economic indicators are not recessionary

Today’s nonfarm payroll report for August showed employment trends continue to slow – as seen in a weaker headline reading and negative revisions over the last two months. But layoffs also remain low as claims have trended down since the end of July and temporary layoffs in August reversed July’s jump. Together this signals the labor market is likely coming into balance or normalizing to a more sustainable rate of job creation. However, it now requires Fed action, and several officials noted this post the jobs release on Friday.

Outside of the rise in the unemployment rate, we find most indicators still do not imply high odds of a recession – and we know what’s going on with the unemployment rate (rising labor supply via re-entrants and temporary layoffs). Indeed, if you look at the indicators the NBER uses to determine a recession, they have all expanded since the start of 2023 (seen in exhibit 2). Payrolls, household employment, personal consumption, real income, manufacturing, and trade sales are all above prior levels.

In addition, the Atlanta GDPNowcast remains above 2%3, or trend growth in the U.S., and service activity (as measured by the S&P Global PMI) remains in an expansion.4 Meanwhile, the weakness in manufacturing over the past several months – especially looking at new orders – could be due to election related uncertainty as capex is notably slower. But manufacturing momentum is stronger elsewhere – Japan, EM Asia ex China.

Finally, the Fed has plenty of room to react and deliver the rate cuts needed to support the economy and the labor market. We believe that should we encounter weak economic data, the Fed will offer support – following the latest payrolls report.

With yields already lower, reflecting rate cut expectations, the knock-on effect should be meaningful in the coming months, as more and more benefits accrue to the economy over time. For example, the 6-month SOFR rate (off which many consumer and commercial loans are priced) is 4.7% (4.3% for 12 months), which is down from 5.4% at the start of the year.5 This means relief to levered consumers and corporates has already started. Previously unaffordable loans to purchase cars and homes may become within reach again. In addition, if needed, the Fed has a large cushion of 550 bps worth of rate cuts. Therefore, if the Fed decides it needs to act in a large and swift fashion, it could provide additional support to the economy.

The AI story industry-wide is very much intact

Given the recent weakness in semiconductors and AI beneficiary stocks, there are questions if the AI theme is failing to deliver on expectations. Indeed, the Morgan Stanley AI beneficiary basket is down almost 20% from the high set in July.7

Despite the very high bar set for many of these companies coming into the earnings season, we continue to see strong results, as highlighted by Nvidia, which delivered another EPS beat and raised its guidance – albeit smaller than previous quarters.8 To us, the reason why semiconductor stocks traded poorly after that earnings report is not a story of poor delivery, but rather of high expectations. This likely means the AI growth trajectory was more fully reflected before the latest pullback.

Additionally, this is not just a Nvidia story, as other semiconductor stocks have also delivered strong results and guidance – like Taiwan Semiconductor Manufacturing Company (TSMC), Advanced Micro Devices (AMD), Marvell Technology (MRVL), and others. Even Broadcom (AVGO), which disappointed on its guidance for the upcoming quarter, noted the strength in AI-related revenue growth, which was in line with analyst estimates. For the quarter, semiconductor and semiconductor equipment companies have reported 52% year-over-year earnings growth and 26% revenue growth.

This growth in AI semiconductors is expected to continue as hyperscalers capex forecasts have recently been upgraded and semiconductors have driven the positive earnings revisions seen this quarter.8 And unlike the summer when there was a lack of catalysts to support the AI theme, there are now a number of tech conferences that are occurring over the next few weeks, which could provide relief to the space, as company leadership may offer reassuring guidance and support.

Ways to steer portfolios in September and beyond

Despite the current market uncertainty, one thing is clear – with Fed rate cuts approaching in a couple of weeks, the interest income from money markets is set to move lower. With a cumulative $3.6 trillion9 that has flowed into cash/money market funds, these flows will need to be re-positioned over the coming months – into a combination of stock, bonds, and alternative assets. Here are several ideas for how to steer portfolios in September and beyond.

- “Defensive core” makes sense in a slowing economic environment. We ultimately think the economy will avoid a recession, but in a slowing growth environment utilities, bonds, and infrastructure have tended to outperform, which we discussed here and here.

- If investors are afraid of “bad is bad” economic data (like jobs reports), they should add high quality bonds. Even with the U.S. 2-year and 10-year yields rallying by 137 and 103 bps since April, respectively, we found yields continued to decline (bonds continued to rally) after the Fed began to cut rates (as discussed here).10

- “The rate cut rotation trade” is intact and working. Since publishing our commentary on the market rotation in mid-July, Utilities are up +9% and Real Estate (REITs) is up + 7% – the top two performing sectors over that timeframe. Regional Banks are flat, but this follows the + 19% gain for the month of July. Overall Financials are still up + 3.9% since mid-July. We expect these sectors to continue to work and lead in the coming months as rate cuts become reality and the benefits begin to accrue to the economy. Additionally, in private markets, both commercial real estate and private equity stand to benefit from rate cuts.

- We’d buy the dip in semis gradually over the coming weeks. Why gradually? Because the markets may continue to fret about slow vs recessionary data and election outcomes this month and next, and cyclicals like semis may continue to struggle. But if you believe that in the longer-term, we don’t have a recession, and as valuations/expectations have reset lower on semis, this is a constructive setup to add exposure. Valuations have indeed been resetting lower on SOX given the latest pullback, and we are on watch for more.

Related: Markets in the Mood to Price in a Recession, Here Is How to Position

For additional insights on Alternative Investments, visit: Insights - iCapital

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved.

1. Goldman Sachs, as of Sep. 4, 2024.

2. Bloomberg, iCapital Investment Strategy, as of Sep. 4, 2024.

3. Atlanta Federal Reserve, as of Sep. 4, 2024.

4. S&P Global, as of Sep. 5, 2024.

5. New York Federal Reserve, as of Sep. 5. 2024.

6. Morgan Stanley, as of Sep. 5, 2024.

7. FactSet, as of Aug. 16, 2024.

8. Morgan Stanley, as of Sep. 4, 2024.

9. Goldman Sachs, as of Aug. 26, 2024.

10. Bloomberg, iCapital Investment Strategy, as of Sep. 6, 2024.