Written by: Matthew D. Bass

When it comes to the cost of capital, “higher-for-longer” has been the dominant theme in markets for at least a year now. And it’s likely to remain so—even if central banks deliver a handful of expected interest-rate cuts in the months ahead.

Stubbornly high borrowing costs and sticky inflation will put pressure on cash-flow stability and on some asset valuations. They are also starting to bring the medium-term rate and return outlook into sharper focus. That should increase transaction volume across private markets. Meanwhile, the global economy, driven in part by solid US growth, has held up extremely well.

What’s more, persistent stress among small and mid-sized banks who must comply with changing regulations and funding needs should broaden the investment opportunity set for private lenders and enhance return potential. We consider this good news for experienced lenders with the ability to source, underwrite and manage credit risk throughout the economic cycle.

In other words, there’s a bright side to a higher-for-longer rate environment. And as bank lending declines and public markets shrink, the private market universe continues to expand. We expect to see attractive opportunities across the risk-return spectrum.

A Rapidly Growing Opportunity Set

The sustained growth of private credit has been remarkable. Before 2008, it effectively didn’t exist as a distinct asset class. By 2023, total assets weighed in at about $1.6 trillion—roughly the size of the US high-yield bond market. Those assets are expected to hit $2.3 trillion by 2027, according to Preqin, a data provider.

That’s a pretty big pool for investors to fish in—and it only applies to corporate credit. Adding other forms of private credit, including commercial real estate, infrastructure, and consumer-oriented specialty finance—makes the opportunity set even larger.

Even so, it’s important that investors to pick their spots carefully. High rates will be a burden for some borrowers and may pose additional risks for lenders.

The Apex of Active Investing

Navigating a market beset by these cross currents requires an active approach—and we believe private markets offer a particularly effective form of active investing. Lenders can structure loans to suit current market conditions and specific borrower characteristics. Today, this includes lending against reset asset values at conservative loan-to-value ratios and the ability to negotiate protective covenants.

What’s more, private credit transactions are directly originated, negotiated and structured. And they involve regular communication among lenders, borrowers and, in the case of direct lending, private equity sponsors. This makes it easier to engage with borrowers and proactively address potential problems.

Leaning In

Consider commercial real estate debt. The commercial real estate sector faces its share of challenges and bad press. But with market stress and regulatory changes pushing banks to reduce commercial property loans, the the balance of power has shifted to private lenders who can pick strong borrowers with superior collateral and negotiate deals with high return potential and strong downside protection. And with ample equity cushions to absorb losses, there’s no need for credit investors to lose sleep trying to time the market.

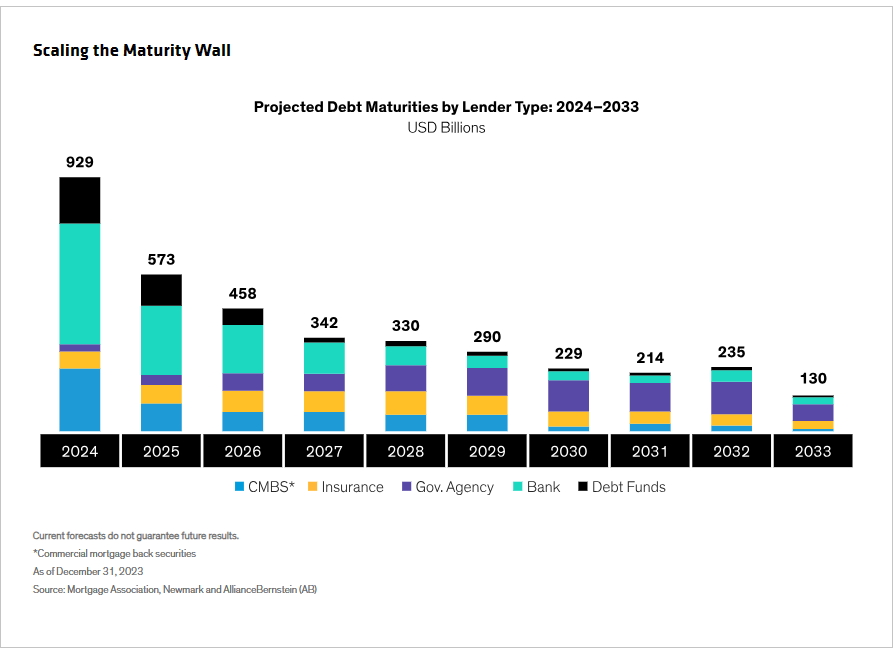

Higher rates will create hurdles in the months ahead, and loan modification activity will likely get more challenging. But with investors sitting on ample amounts of dry powder and capitalization rates increasing, we expect transactions to pick up as bid-ask spreads narrow. A wave of maturing loans this year is also likely to generate demand for capital at a time when terms are likely to favor lenders (Display).

Strong Return Potential in Direct Lending

High rates cooled deal activity in direct lending last year, which typically accounts for about half of the global corporate private debt market. But with average yields above 12% in 2023, the strategy also generated strong returns for investors.

Spreads on new deals have narrowed in early 2024. But we expect the base rate used to price direct corporate loans to finish 2024 around 4.5%—well above the sub-1% levels that prevailed for years after the global financial crisis. That will keep new-issue yields in private credit above historical levels, which should add up to high return potential for investors.

Some borrowers will struggle with high rates. That will put a premium on a manager’s ability to build resilient portfolios rooted in strong upfront underwriting, appropriate structuring and active portfolio management across existing positions. But relative stability in rates and narrowing bid-ask spreads should help increase overall deal volume.

The Energy Transition Continues

Private lenders remain at the forefront of financing the clean energy transition, and lending against solar and battery storage infrastructure is particularly attractive, in our view.

Of course, the path of the energy transition around the world hasn’t been a straight one, and we don’t expect that to change. The capital intensive, complex nature of these projects and the volatility created in recent years by high borrowing costs demand a selective approach that prioritizes organic cash flow and the control that comes with strong covenants.

We see a lot to like at the top of the capital structure. This includes loans secured by hard assets and the financing of ground leases, which give investors first claim on project cash flows. In the US, the Inflation Reduction Act promotes clean energy build-out through expanded federal tax credits, which provides new investment opportunities, particularly with banks pulling back from such financing in anticipation of stricter global capital requirements.

Bank Retreat Puts Focus on Consumers

Those stricter global banking regulations, along with income statement and balance-sheet pressures, are also causing small and medium-sized banks to cut back on consumer lending. In the US, more than $1 trillion in household deposits have left the banking system since 2022.

Private investors are increasingly filling the void, either by partnering with banks and providing fresh capital to originate new loans or buying banks’ “back book” of performing and nonperforming consumer and commercial loans at a discount (Display).

These asset-backed strategies—sometimes referred to as specialty finance—involve lending against pools of cash-flowing assets or loans across consumer, residential mortgage and transportation end markets. They represent an important growth area in private credit but remain underrepresented in private asset allocations.

Consumers—in the form of a growing global middle class with the means and motivation to travel—are also driving opportunities in new asset classes and strategies. This includes aircraft leasing, which also benefits from aircraft supply constraints.

For all of these strategies, higher-for-longer interest rates will create some hurdles. But the overall economic outlook is promising. Yields look set to stay well above their levels before the pandemic, while the market for private credit continues to grow at a fast clip. In our view, that’s good news for lenders and investors alike.

Related: Fixed-Income Outlook: Seeing the Forest Beyond the Trees