Written by: Kunal Shah | iCapital

Despite their enduring popularity, some investors continue to view large private equity buyout funds as unexciting next to smaller, “nimbler” funds. But the data suggests that this is an outmoded perception, and that large buyouts could be an attractive defensive allocation in the current uncertain market environment.

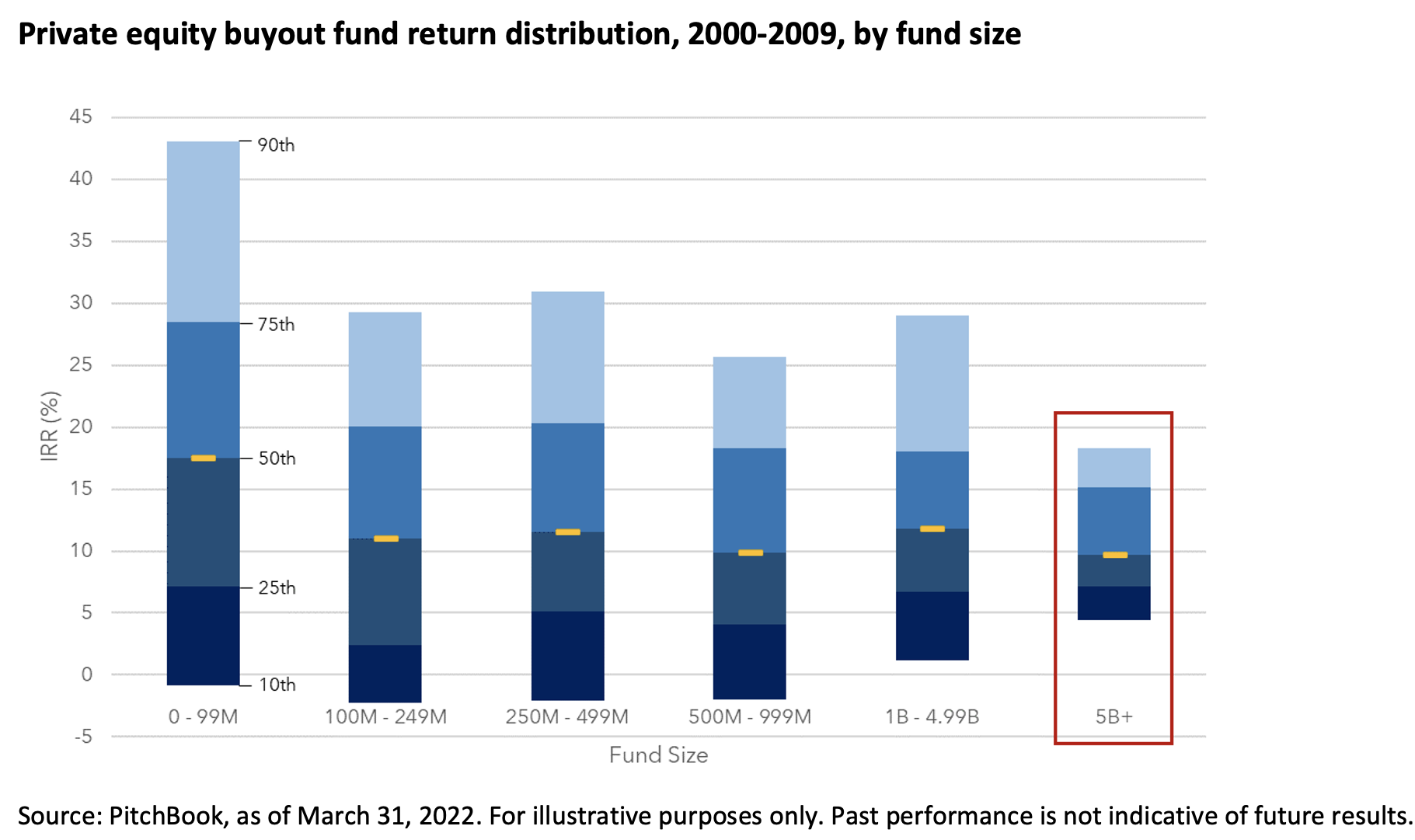

Fund selection is of elevated importance in private equity, given the wide performance dispersion.[1] So analyzing the distribution of returns is vital to get a true picture of the risk and upside of a particular fund category or cohort.

Looking at the internal rate of return (IRR) of funds launched from 2000 to 2009 at the 10th, 25th, 50th, 75th, and 90th percentile level may certainly explain why large funds are seen as uninspiring options.

Funds of $5 billion or larger produced the most modest returns at the 50th, 75th, and 90th percentile level. The flipside is that the “floor” on returns from these funds was the highest of any size cohort, which makes intuitive sense, with larger companies typically better able to withstand economic shocks than their smaller peers. As a result, large funds were considered unexciting but safe investments.

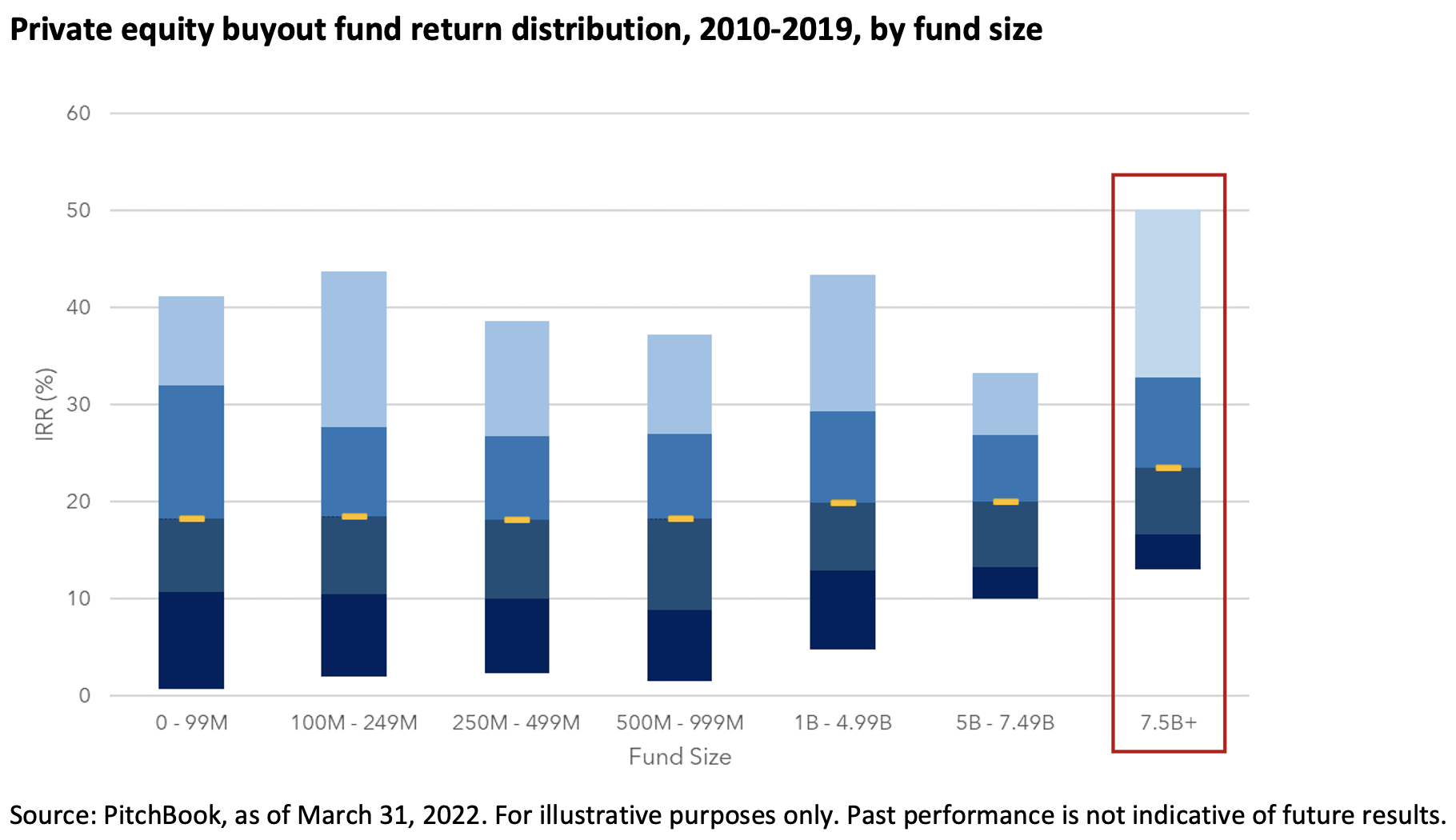

However, the data for 2010 to 2019 demonstrates a notable shift in large buyout fund performance.

Large funds[2] were the best performing cohort in the 2010 to 2019 vintages, returning the highest IRR at every percentile level. Large fund operators were able to pair the higher floor of the previous decade with greater upside.

Whether or not you believe large fund outperformance can continue—and there are good reasons to think that the improvements may be as much structural as they are a result of business and economic cycles—it matters just as much what has not changed as what has. Across both decades, large funds have consistently had a tighter range of returns than other fund size cohorts, with better performance at the lower quartile and decile level—a higher floor.

With market volatility and recession risks elevated and the outlook uncertain, it may be a good time to integrate large buyout funds into a portfolio as part of a slightly more defensive approach. Advisors may want to particularly target funds with exposure to sectors with inelastic demand, such as health care, sports and entertainment, and technology.

Specialized funds, typically using tender offer or interval fund structures, can offer exposure to private equity for qualified individual investors. According to alternatives research firm AI Insight, growing demand has drawn an increasing supply of established, large, high-caliber managers into the space, driven innovation in terms of structure and technology, and helped compress previously elevated fees. This makes these products a progressively more compelling option for high-net-worth investors seeking access to the upside and diversification of alternative investments—which are increasingly becoming essential components of a well-balanced portfolio.

Kunal Shah is a Managing Director and Head of Private Equity Solutions, Co-head of Research at iCapital.

Related: Multifamily Real Estate as a Hedge Against Inflation

[1] Source: Cambridge Associates, “Private Investing for Private Investors: Life Can Be Better After 40(%),” February 2019.

[2] We define large funds on a sliding scale to reflect inflation and the growth of the broader private equity market. From 2000 to 2009, large funds includes those raising $5 billion or more. In vintages 2010 to 2019, large funds are defined as those raising $7.5 billion or more.