Written by: David M. Lebovitz

Although interest rates have risen over the course of 2022, this has only partially quenched investors’ thirst for income. At the same time, recession fears are rising, and we recognize that a contraction in economic activity seems increasingly likely. Looking ahead, there are a plethora of questions around the trajectory of inflation, monetary policy, and growth, and investors are looking for a silver bullet.

While there are no silver bullets when it comes to investing, exposure to private real estate can help address some of these challenges. To start, inflation is rising at its fastest pace in nearly 40 years, leaving many investors worried that if inflation is not contained, it will erode both future returns as well as existing wealth. Looking back to 1978, the best performance environment for real estate was when inflation was above its median of 2.9%; real estate performed slightly better when inflation was rising, rather than falling, but the return on average was greater than 10% in both environments. When protecting against inflation is a priority, real estate can provide a solution.

At the same time, although rates are rising as the Federal Reserve (Fed) looks to combat inflation, they remain low by historical standards. It seems likely that when the next recession materializes, short-term interest rates will return to the zero-bound, once again leaving investors starved for income. While looking to high yield and emerging market debt markets can help portfolios generate higher yields, these asset classes are positively correlated with equities. Put differently, if the stock market rolls over, high yield will not provide protection. On the other hand, real estate – and core real assets more broadly – can provide investors with credit-like yields but low-to-no correlation to the equity market.

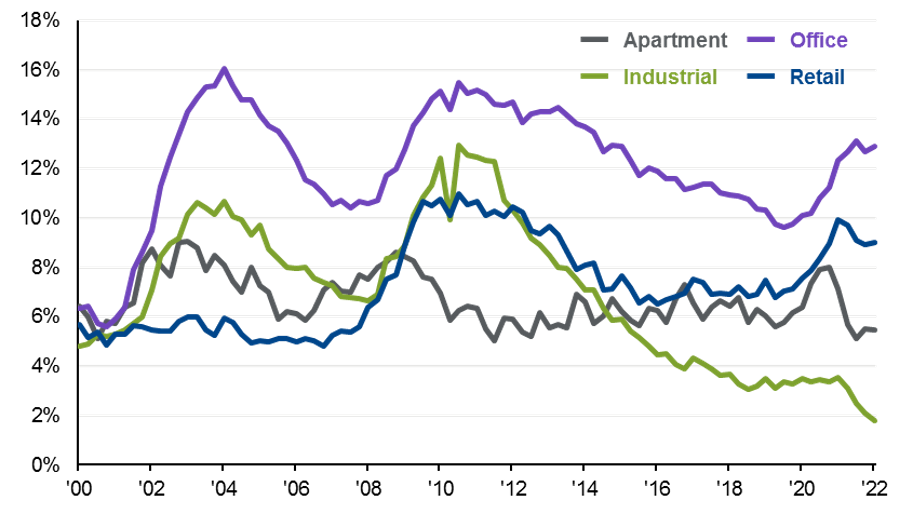

That said, some investors are of the view that real estate assets will decline in value if the economy goes into recession. While we would expect that certain assets might see their values come under pressure, it is important to remember that private assets are not marked-to-market on a daily basis. Furthermore, many of these assets have long-term contracts associated with them, reinforcing the idea that re-valuation may not be imminent during a period of economic stress. Finally, average valuations mask significant dispersion beneath the surface; suggesting that some of the more expensive markets like the industrial space may be more susceptible than those sectors where vacancy rates are higher.

At the end of the day, there are plenty of questions about the road ahead. What has not come into question is whether investors will need alternative sources of income and diversification. As such, it seems increasingly likely that private real estate will be part of the broader investment conversation in the years to come.

Average valuations mask dispersion beneath the surface

U.S. real estate vacancy rates by property type, %

Sources: NCREIF, J.P. Morgan Asset Management.

Data is based on availability as of July 12, 2022.

Related: Are We Already in a Recession?