Written by: David Lebovitz

"Cryptocurrencies have come roaring back, as concerns around elevated levels of government debt, currency debasement, and inflation have all conspired to push the price of these assets back towards all-time highs."

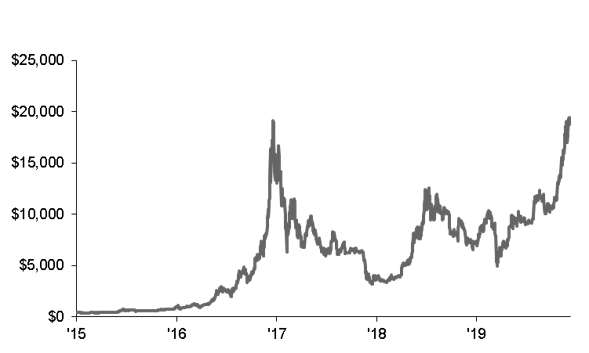

After a significant rally into the end of 2017, Bitcoin and other cryptocurrencies went into hibernation for a number of years. In 2020, however, cryptocurrencies have come roaring back, as concerns around elevated levels of government debt, currency debasement, and inflation have all conspired to push the price of these assets back towards all-time highs. But does cryptocurrency deserve a place in a portfolio? And what kind of role can it play?

To start, it is important to recognize the difference between digital currencies and cryptocurrencies – cryptocurrency is a type of digital currency, but not all digital currencies are cryptocurrencies. Digital currency is simply a currency that only exists virtually – there is no physical paper or coin backing it. Cryptocurrency, however, takes the concept of digital currency one step further, employing blockchain technology and a decentralized ledger, which effectively means that no single authority controls the network.

Part of what has made cryptocurrency so attractive in recent years has been this lack of centralization and oversight, as these currencies are regulated by the community that uses them, rather than a governing body like a central bank. At the same time, individuals continue to embrace cryptocurrencies like Bitcoin due to a fear that reckless government spending and elevated levels of debt will eventually render traditional fiat currencies worthless. While this is possible in a world of debt monetization, it does not necessarily seem probable; as such, we continue to view cryptocurrencies as speculative investments.

However, this does not mean that cryptocurrencies should be excluded from properly diversified portfolios. Rather, it requires a recognition that we are still learning about how these assets behave relative to traditional stocks and bonds. For investors who are comfortable taking on a bit more risk, an investment in cryptocurrency might be appropriate; that said, for those who view it as a panacea in a world of uncertainty and historically low interest rates, a bit of caution may be warranted.

Bitcoin is back!

Bitcoin per USD

Related: What Is Cryptocurrency?