In our previous articles, we unpacked the origins of the housing crisis in the U.S., identified cities where the problem is most pronounced, and explored which of those cities present the greatest opportunity for companies that understand how to capitalize on the market’s many challenges.

Now it’s time for the final piece of the puzzle: Laying out a strategy that seeks to offer maximum returns for investors, while simultaneously minimizing risk.

In the case of True Life Capital, several elements are crucial to the firm’s strategic “secret sauce.” In essence, the process can be boiled down to a three-step formula—one that is both repeatable and effective across various regions.1

That formula is:

-

“Acquire”

-

Entitle/Design

-

Sell

Step 1: “Acquire”

You might be wondering: Why the quotation marks? Put simply, it’s because True Life Capital focuses on controlling property rather than owning it. The firm does this through purchase-and-sale agreements (PSAs), which it uses to bring properties into its funds.

The objectives of this approach are numerous. The potential advantages of a control strategy include the requirement of less up-front capital; greater control over site plans; no need to manage leases, tenants, and taxes; the potential for more leverage in negotiations with owners; and a limitation of risk to encompass only project-specific capital and time.

The selection of properties in this step is also highly rigorous. PSAs are merely the beginning of the process. Potential properties must also pass due diligence and committee reviews before entering any of True Life Capital’s funds. Out of every 100 potential properties identified, only about 3 to 8 are selected for fund inclusion.

Step 2: Entitle/Design

The next stage of True Life Capital’s process involves its repurposing team, which secures the necessary jurisdictional approvals for transforming old infill real estate into residential development opportunities. It’s during this phase that the firm also designs a site plan—a process that can take up to 36 months and requires deep local expertise. This need for boots on the ground is the primary reason True Life Capital has offices in nine regions nationwide.

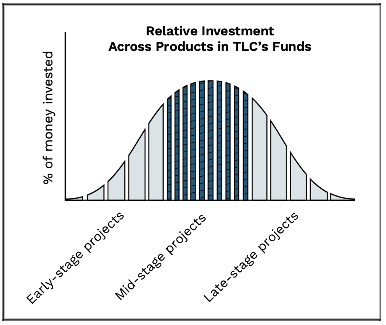

As for how the company manages investment across products in its funds, it’s important to know that the firm attempts to allocate the bulk of its money to mid-stage projects. This seeks to ensure funds are distributed in an effective way across numerous properties.

Step 3: Sell

Finally, the company sells the completed plans to the nation’s top home builders, and repeats the process. This last detail is important. True Life Capital’s process is not one that’s designed to work intermittently. It’s built to be repeatable, scalable, and applicable to any high-potential region in the country.

Final Thoughts

For proof of this process’s effectiveness, look no further than the numbers.2

To date, True Life Capital has completed 62 transactions, with more added to the pipeline every quarter. The firm has more than 40 active properties in its flagship strategies. And it has delivered more than 4,000 home sites to the market in its target regions.

Related: The True Life Companies: Helping Millennials Reach Home Ownership

True Life Capital is a division of The True Life Companies, LLC. Securities offered through Orchard Securities, LLC. Member FINRA/SIPC. Neither True Life Capital nor The True Life Companies, LLC is in any way affiliated with Orchard Securities, LLC.

1. Prior performance is not a guarantee of future results.

2. There are no assurances that any of the results described in the following process (including all facets of the “Acquire,” Entitle/Design, and Sell stages) can be achieved. Prior performance is not a guarantee of future results.