Written by: David M. Lebovitz

As we have highlighted in our Long-Term Capital Market Assumptions over the past few years, alternative investments continue their transition from optional to essential. However, when it comes to investing in alternatives – and particularly private market alternatives – the approach should be different from the one traditionally taken in the public markets. Alternative asset allocation must be based on an outcome-oriented approach. Put differently, investors first need to identify the problem they hope to solve, and then determine the most appropriate asset for achieving the desired outcome.

There are three roles that alternative investments can play in a diversified portfolio – they can provide income, diversification, or enhance returns. Importantly, these are not mutually exclusive; some alternatives – like core real assets – can provide a combination of both income and diversification. In general, we find that investors look to real estate, infrastructure, and direct lending for diversification and income, whereas hedge funds typically provide either diversification or return enhancement. Furthermore, private equity and more opportunistic credit strategies focused on distressed assets and special situations have traditionally been used to enhance returns. The bottom-line; different types of alternative investments will play very different roles in the context of a diversified portfolio.

Despite this high-level framework, investing in alternative assets is difficult and complex. In an effort to help provide more clarity, we have created Principles of Alternatives Investing. In this document we highlight the benefits of adding alternatives to a portfolio, growth in the asset class, the benefits that different types of alternatives can provide, as well as the importance of manager selection.

In a year that has seen elevated volatility, geopolitical uncertainty, a hawkish shift in monetary policy, and stock/bond correlations turn positive, investors have been reminded that returns are generally not as easy to come by as was the case in 2021. Furthermore, although valuations now look more favorable for both stocks and bonds, the outlook for long-run returns is still challenging. This, coupled with an ever-growing menu of alternative investment options, suggests that having a roadmap for navigating the alternative investment universe will be a key determinant of long-run success.

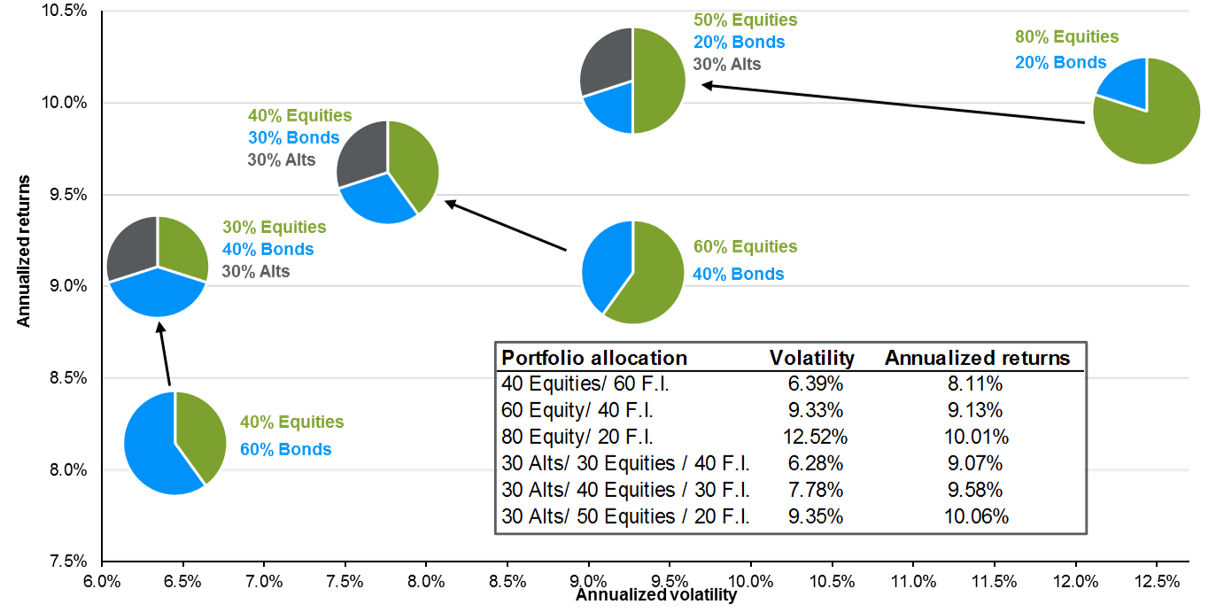

Alternative investments can improve portfolio risk and return

Annualized volatility and returns, 1989 - 2021

Source: Bloomberg, Burgiss, HRFI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year.

Data is based on availability as of May 31, 2022.

Related: Is There a Role for Private Real Estate in My Portfolio?