Written by: David Lebovitz

"As we touch on in our 2021 Long-Term Capital Market Assumptions, alternatives are going mainstream. Investors would be wise to make sure they are along for the ride." - David Lebovitz

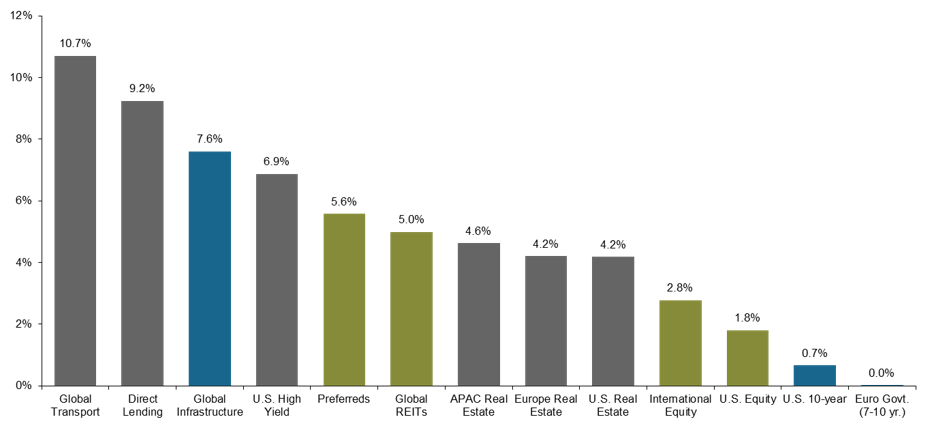

Although rates have moved higher during the past few weeks, investors are still struggling to generate income without increasing portfolio volatility. More and more, however, alternative investments are providing a solution. Core real assets and core private credit are two ways of generating income without taking on unnecessary amounts of risk, and within real assets, we see value in parts of the direct real estate market, as well as infrastructure and transportation assets.

Real estate has seen existing trends amplified by the COVID-induced downturn – this means headwinds for retail, tailwinds for industrial, and an office sector that remains in flux. For the most part, stress has been concentrated in the retail sector, but this is about more than social distancing. Tenant mix is a structural issue for retail properties, and we expect that those properties more oriented towards services and experiences will outperform. On the industrial side, continued growth in e-commerce as a share of retail sales looks set to push vacancy rates lower and prices higher, and in the office space, flexibility will be key.

Infrastructure comes in many different flavors, shapes and sizes, and each asset carries its own set of risks. Low risk infrastructure assets like regulated utilities and contracted power assets can provide steady streams of income as well as diversification. Furthermore, because many of these assets are essential services, they are relatively resilient during periods of economic stress. On the other hand, certain types of infrastructure assets like ports and trade terminals can deliver higher rates of return, but tend to be more volatile than their low-risk counterparts.

Ninety percent of traded goods touch water at some point during their lifecycle, and transportation strategies that focus on leasing assets to high quality counterparties are another way of generating attractive streams of income. In fact, despite a slowdown in shipping activity during the middle of this year, trade activity has bounced back nicely. Furthermore, the supply/demand imbalance that materialized in the aftermath of the Global Financial Crisis has been corrected, and with the orderbook relatively balanced, the risk of oversupply seems to have declined.

Finally, core private credit strategies can provide both diversification and income. There was no shortage of concern around direct lending towards the end of the prior cycle, as huge amounts of covenant-lite issuance and EBITDA adjustments had eroded the underlying quality of these assets. That said, with a new cycle upon us, the opportunity set is more attractive than was the case at the end of 2019.

The bottom line is that there are ways to generate income in the current environment, but it is not as simple as buying bonds. Investors will need to consider less liquid, private market strategies going forward, particularly as they become increasingly accessible. As we touch on in our 2021 Long-Term Capital Market Assumptions, alternatives are going mainstream; investors would be wise to make sure they are along for the ride.

Asset class yields

Percent

Source: BAML, Barclays, Bloomberg, Clarkson, Cliffwater, Drewry Maritime Consultants, Federal Reserve, FTSE, MSCI, NCREIF, FactSet, J.P. Morgan Asset Management. Yields are as of 06/30/2020, except Direct Lending, Global Infrastructure, and U.S, Europe, and APAC Real Estate which are as of 3/31/2020. Global Transport: Levered yields for transport assets calculated as the difference between charter rates (rental income), operating expenses, debt amortization and interest expenses, as a percentage of equity value. Yields for each of the sub-vessel types are calculated and respective weightings are applied to arrive at the current levered yields for Global Transportation; Preferreds: BAML Hybrid Preferred Securities; Direct Lending: Cliffwater Direct Lending Index; U.S. High Yield: Bloomberg US Aggregate Corporate High Yield; Global Infrastructure: MSCI Global Infrastructure Asset Index-Low Risk; U.S. Real Estate: NCREIF-ODCE Index; Global REITs: FTSE NAREIT Global REITs; International Equity: MSCI AC World ex-U.S.; U.S. 10-year: 10-year U.S. Treasury yield; U.S. Equity: MSCI USA, Europe core real estate: IPD Global Property Fund Index – Continental Europe. Asia Pacific (APAC) core real estate: IPD Global Property Fund Index – Asia-Pacific. Euro Govt. (7-10 yr.): Bloomberg Barclays Euro Aggregate Government – Treasury (7-10Y).

Data is based on availability as of October 31, 2020.