Written by: Meera Pandit

The macro landscape has shifted dramatically over the last three years, and in 2024 uncertainty lingers as to whether the economy will experience resilience or recession. However, despite the constantly evolving macro backdrop, investors are consistently seeking the same outcomes in portfolios: alpha, income, and diversification. Although the traditional 60/40 portfolio staged an impressive comeback in 2023, investors may find opportunities to supplement those outcomes in alternative assets.

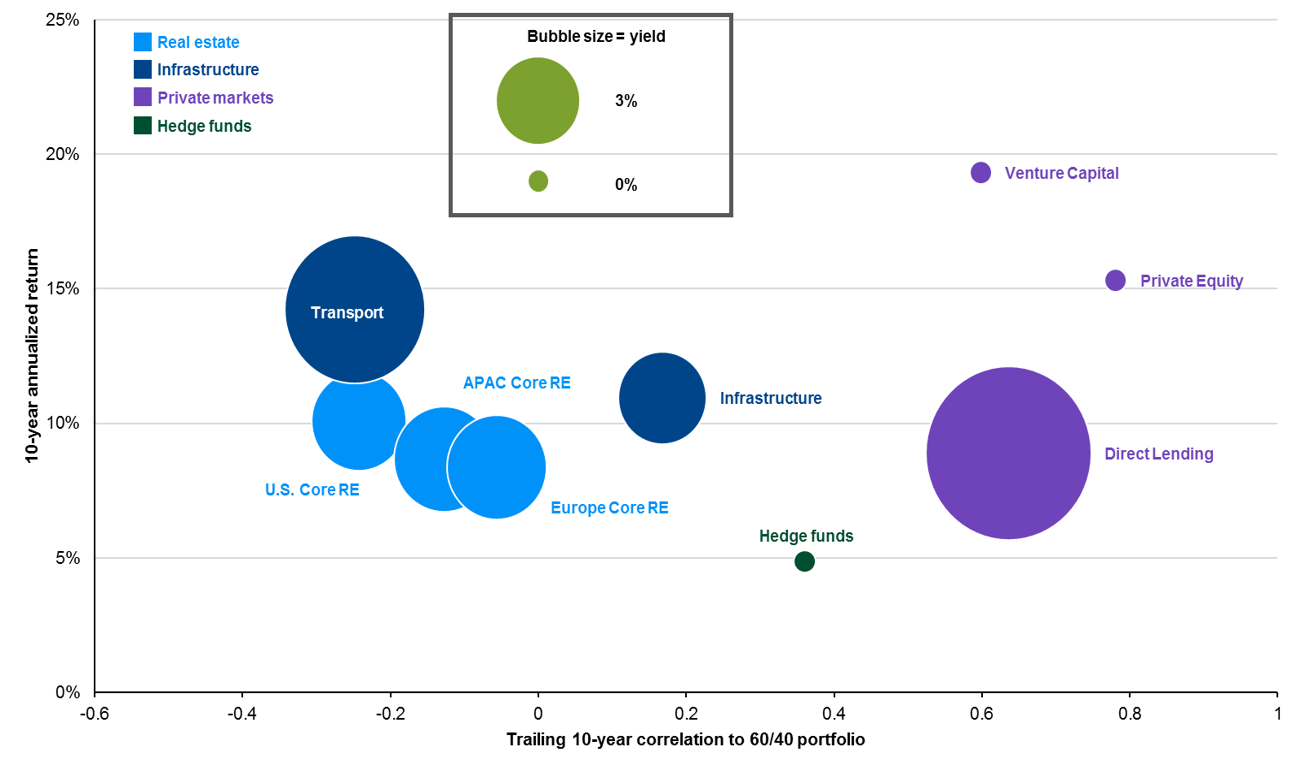

As highlighted in the chart below from page 12 of our 4Q23 Guide to Alternatives, alternatives can provide alpha, income, and diversification, but not necessarily all in one asset. Areas like real estate and real assets (transport, infrastructure) can provide income and diversification, while areas like private equity and venture capital are less income-oriented and do have strong correlations to public equities but emphasize return enhancement and alpha generation.

In the year ahead, investors should not expect a repeat of 2023’s 20% returns on public equities. Multiple expansion drove the recent rally, earnings expectations are too lofty, and volatility was unusually low. Therefore, private markets may be an additional source of returns. Resilient economic growth and profits have supported private equity multiples, and although transaction volumes have been light, the deals that are being completed tend to be smaller and higher quality (GTA pages 42, 43, 44). In addition, history shows that performance from vintage years (the year when a private equity fund first deploys capital) that are economically uncertain tend to produce higher median returns (GTA 45).

Investors should also hopefully not encounter a repeat of 2023’s significant bond market volatility as the Fed holds rates steady or considers rate cuts. Still, after three challenging years for fixed income, investors are seeking additional sources of diversification. Real assets like real estate and infrastructure have exhibited low or negative correlations to stocks, bonds, and a traditional 60/40 portfolio (GTA 6, 12). In addition, infrastructure has been able to deliver stable income through varying interest rate environments (GTA 30).

2023 brought unexpected upside in equities and unpleasant volatility in bonds. While the dynamics in 2024 are likely to differ, come what may, alternative assets offer outcomes that clients reliably seek in portfolios.

Correlations, returns, and yields

10-year correlations and 10-year annualized total returns, quarterly, 2013 - 2022

Source: Burgiss, Cliffwater, Gilberto-Levy, HFRI, MSCI, NCREIF, FactSet, J.P. Morgan Asset Management. Correlations are based on quarterly returns over the past 10 years through 2022. A 60/40 portfolio is comprised of 60% stocks and 40% bonds. Stocks are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. 10-year annualized returns are calculated from 2013 – 2022. Indices and data used for alternative asset class returns and yields are as described on pages 8,9, and 11 of the Guide to Alternatives. Yields are based on latest available data as described on page 8 of the Guide to Alternatives.