Written by: Przemyslaw Radomski, CFA

As of Wednesday (Dec. 30) morning, gold is range trading and remains more or less flat as it seeks momentum. As we wait for the precious metals to act on a catalyst, let’s also take a look at the Euro’s relation to the U.S. Dollar and how both impact gold.

Over the last 24 hours, the precious metals market did more or less nothing, despite the new daily decline in the USD Index. The latter is now testing its monthly and yearly lows, while the PMs are not. PMs – as a group – are not reacting to what should make them rally, and this is yet another bearish sign for the precious metals market.

Figure 1 - USD Index (Sept – Dec 2020)

The USDX is at its monthly and yearly lows and at the same time…

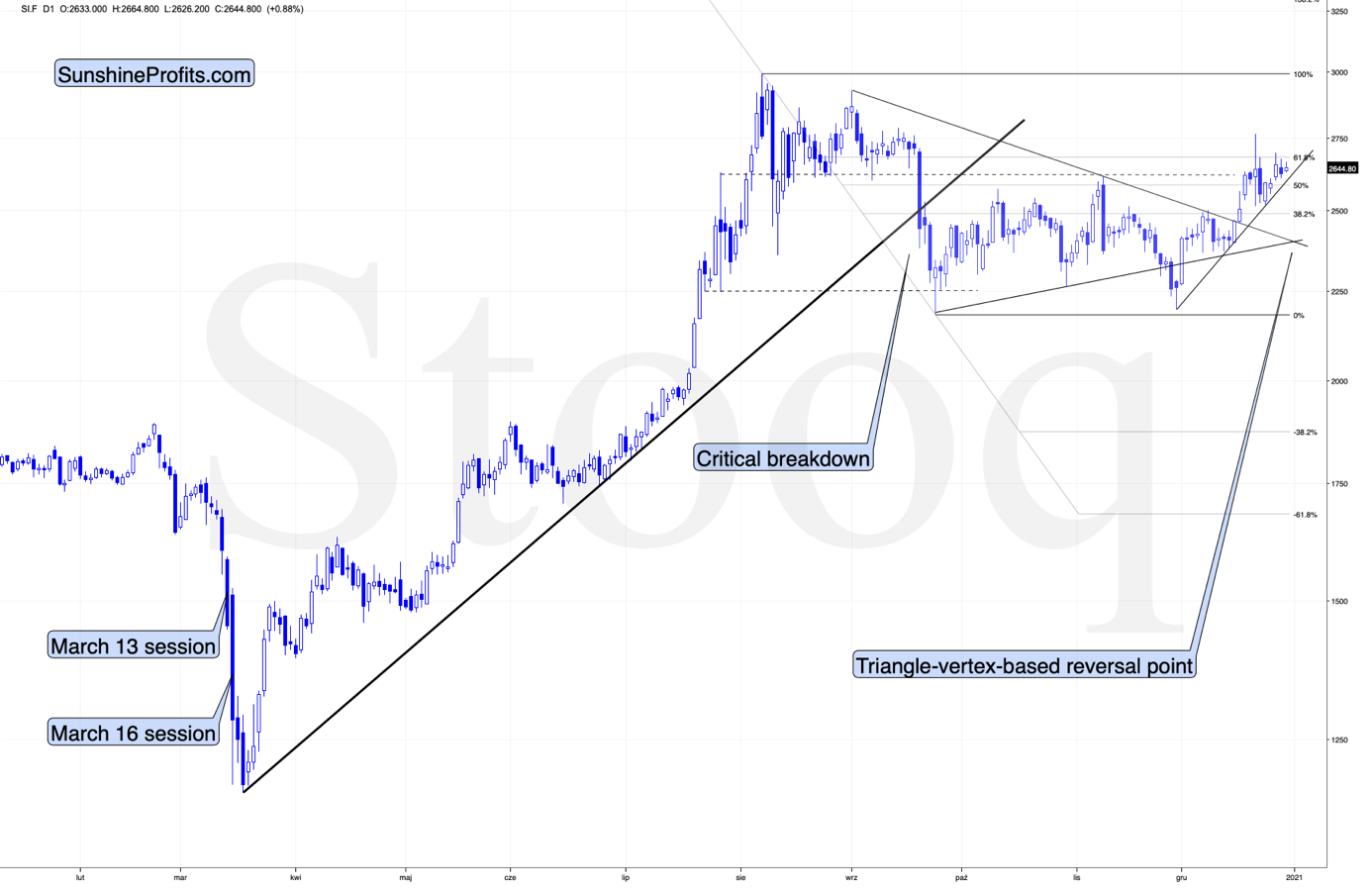

Figure 2 - COMEX Gold Futures (Jan – Dec 2020)

Gold is about $30 below its monthly high, and about $200 below the yearly low.

After a temporary breakout, gold is back below its 2011 high. The breakout above the latter was clearly invalidated.

Figure 3 - COMEX Silver Futures (Jan – Dec 2020)

Silver is not even close to its 2011 high, and while it’s relatively strong compared to gold and miners on a short-term basis, it’s not at its December high right now. It’s also a few dollars below its yearly high.

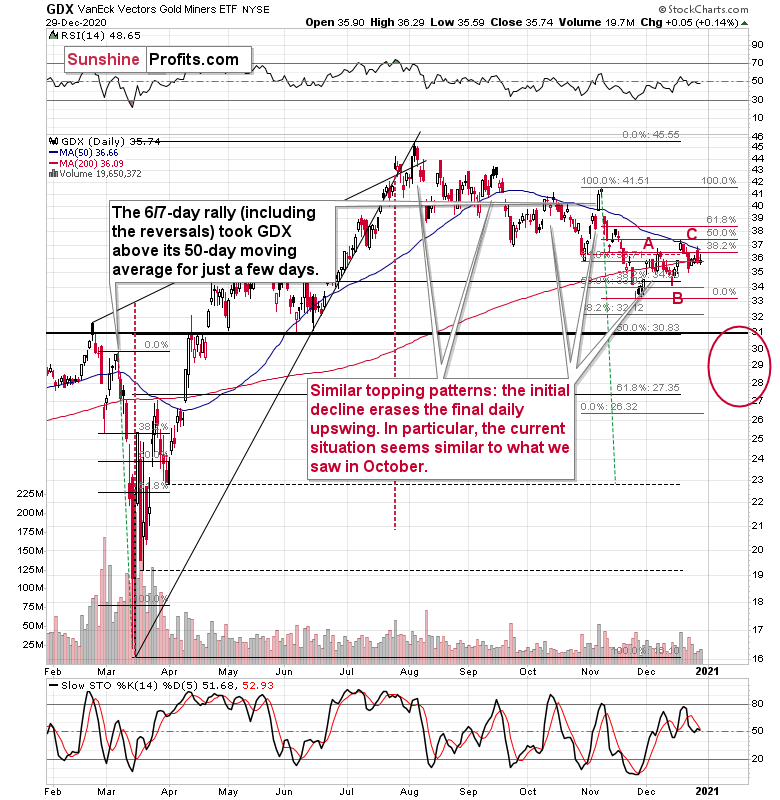

Figure 4 - GDX VanEck Vectors Gold Miners ETF (Feb – Dec 2020)

Miners remained relatively quiet on Tuesday (Dec. 29).

We see that the GDX ETF moved lower once again despite the intraday attempt to rally. During Monday’s (Dec. 28) session, miners once again moved back to their 50-day moving average and… Once again verified it as resistance. The implications are bearish.

Let’s get back to silver once again. On its chart, you can see a triangle-vertex-based reversal at the end of the year. Before the price moves close to the reversal, it’s relatively unclear what kind of implications a given reversal is likely to have. Well, including today’s (Dec. 30) session, there remain only two sessions until the end of the year, so we’re likely to see the reversal shortly.

Based on the likelihood that the next big move is going to be to the downside, it would fit the overall picture more if the upcoming reversal was a top, not a bottom. A bottom would imply a rally in the following days or weeks, and the relative performance (as described above) along with other factors continues to favor a bigger decline.

This means that we might not see a meaningful decline for a few more days, and we might even see one final move higher before the top is formed. This could be something that takes place in silver only, or something that we see in gold and miners as well. Still, I don’t expect it to be really significant in case of the latter. They are underperforming the metals, after all.

Before summarizing, let’s discuss the USD Index’s main part – the EUR/USD currency pair in greater detail. After all, this pair often moves in tandem with gold.

EUR/USD Decouples from Fundamentals

John Maynard Keynes once said, “Markets can remain irrational longer than you can remain solvent.”

And right now, EUR/USD is putting his theory to the test.

Because the euro accounts for nearly 58% of the movement in the USD Index, its rise (and likely fall) will determine if/when the war is won.

But brimming with confidence and unwilling to wave the white flag, the EUR/USD has been green for five straight days and has rallied during nine of the last 12 trading days. And while sentiment and momentum are warriors that don’t die easy, the euro is losing fundamental soldiers left and right.

Please see the chart below:

Figure 5 - European Central Bank (ECB) Balance Sheet

Another weekly update shows the European Central Bank’s (ECB) money printer continues to work overtime. And as I mentioned on Monday (Dec. 28), the ECB’s total assets now equal 69% of Eurozone GDP – nearly double the U.S. Federal Reserve’s (FED) 35%.

And why is this necessary?

Because the Eurozone economy is in free-fall.

Remember, currencies trade on a relative basis. Thus, a less-bad U.S. economy is good news for the U.S. dollar.

Please see below:

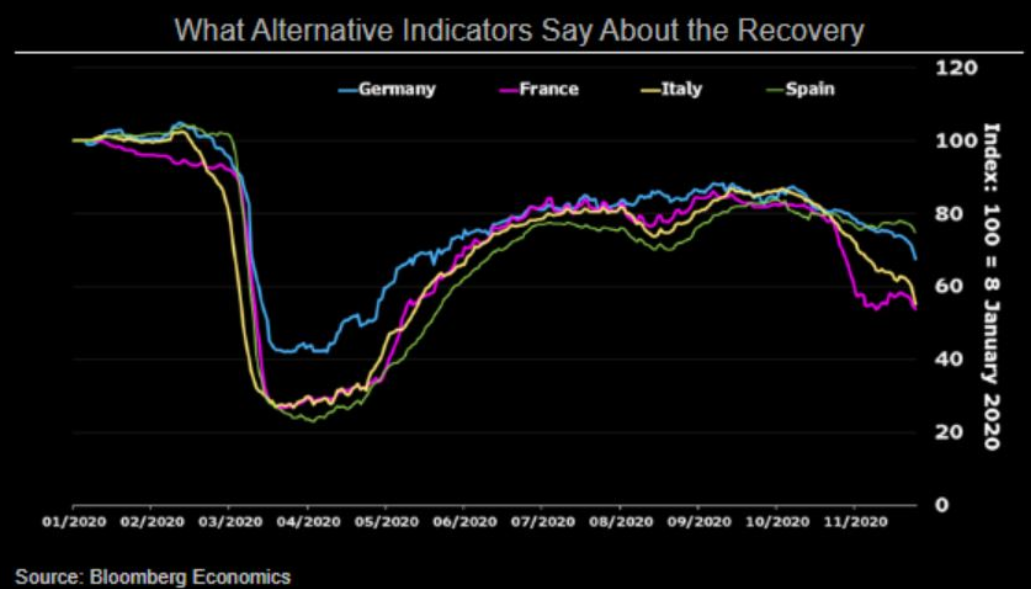

Figure 6 - 2020 Economic Indicators for Germany, France, Italy, Spain

Across Europe’s largest economies – Germany , France, Italy and Spain – economic activity is rolling over (To explain the chart, alternative economic indicators are high-frequency data like credit card spending, indoor dining traffic, travel activity and location information.)

And underpinning the irrationality, the deceleration is happening as the euro is strengthening.

Makes sense?

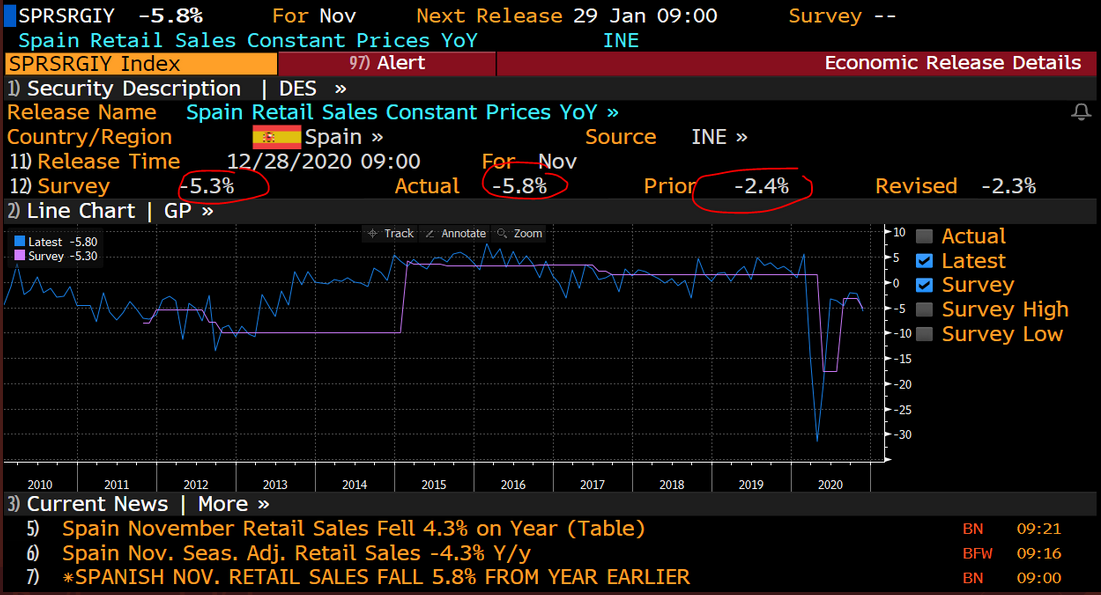

Well, considering Spain’s retail sales dipped further into negative territory on Monday (Dec. 28) – coming in at – 5.8% vs. – 5.3% expected – the data speaks for itself.

Figure 7 - Spain Retail Sales Constant Prices (Source: Bloomberg/Daniel Lacalle)

The bottom line is: the euro bulls are fighting a war they’re unlikely to win. And as the fundamental data worsens, it’s analogous to a platoon losing more and more soldiers. Eventually, the infantry runs out of reserves and it’s time to wave the white flag.

And then what happens?

Well, then history tries to explain how it all went wrong.

Related: As USDX is Poised to Pop, What Happens to Gold?

DISCLOSURE: The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.