Written by: Victoria Hasler | Hargreaves Lansdow

Gold is often considered a ‘safe haven’ in uncertain times, but how much gold should you hold?

When you look back on 2024, what will you remember?

Elections? Budgets? The continued rise of the ‘Magnificent 7’?

I’ll certainly remember those things, but I’ll also remember the relentless march of gold.

Over the course of 2024, gold rose 28.89%* in sterling terms, outpacing both shares (UK and global) and UK government bonds (gilts). And in the second half of the year, it felt like I was reading a headline about the gold price hitting a new high almost every month.

But investing isn’t about the past, it’s about the future.

And the real question is whether this trend will continue.

So, should you hold gold for 2025?

Sadly, neither I, nor anybody I know, can predict what the price of gold will do in 2025 (if you know someone who can, I’d love to meet them).

What I can offer you is some reasons why the yellow metal might remain at the forefront of investors’ minds, and thoughts on how it could fit in your portfolio.

What could be next for the shiny stuff in 2025?

The factors that have been driving the gold price higher show few signs of relenting.

While this doesn’t mean the price will climb at the rate it has been doing, or do so without some blips along the way, it’s reasonable to expect that these factors could continue to offer some support for the commodity.

Gold remains popular with retail investors, who, according to the World Gold Council, now hold 45,000 tonnes of the metal in gold bars and coins. That’s around 22% of all the gold mined throughout history.

In fact, retail ownership of gold is likely to be far higher than this. That’s because physical gold is only one way to own gold these days. You can also own it through exchange traded funds (ETFs) or even digitally through digitally tokenised gold.

Added to that, central banks, particularly those in developing countries, are continuing to buy a lot of gold, driving the price higher.

For as long as most of us can remember, the US dollar has been the world’s reserve currency. This means that central banks, particularly those in countries with less stable currencies, have kept a large part of their reserves in dollars.

But with governments around the world freezing Russian assets after their invasion of Ukraine, many emerging market central banks have been starting to diversify their reserves into something a little more tangible. Something they can physically hold onto themselves and not fear that anyone can freeze.

In other words, they’ve been buying gold.

These forces combined have led to gold hitting new highs more times this year than I can count.

But why should investors consider gold for their portfolios?

This article isn’t advice. All investments can rise and fall in value, so you could get back less than you invest. Past performance isn’t a guide to the future. If you’re not sure if an investment’s right for you, ask for financial advice.

The benefits of investing in gold

Gold has historically always been seen as a portfolio diversifier. This is because it tends to perform well during more turbulent times.

Recent analysis from the World Gold Council gave us some interesting takeaways.

Over the last 30 years, and taking returns in US dollars, gold seemed to be positively correlated to US equity markets when they were going up a lot (i.e. the price of gold increased as equity prices increased).

It also found gold was negatively correlated to US equity markets when they were going down a lot (i.e. the price of gold increased as equity prices fell).

And in times of moderate rises or falls in shares, gold was pretty much uncorrelated.

This makes for an attractive payoff because it means that holding gold can help shelter your portfolio in difficult times, without costing you when shares are racing ahead.

So, if you think the world will continue to be volatile, perhaps because of political tensions or the impact of new policies by the Trump administration, then buying some gold as a hedge might appeal.

However, we’re big fans of diversification and if you’re looking to hold some gold, it should only form a small part of a well-diversified portfolio. That’s because investing in gold isn’t for everyone. It’s a specialist market area so investors should be prepared to take a long-term view and accept the associated volatility

If you do think it has a place in your portfolio, then here are a couple of investment ideas to get you started.

Investing in funds and exchange traded products isn’t right for everyone. Investors should only invest if the investment’s objectives are aligned with their own, and there’s a specific need for the type of investment being made. Investors should understand the specific risks of an investment before they invest, and make sure any new investment forms part of a diversified portfolio.

For more information on these funds and their risks, including charges and the key investor information, visit the funds and exchange traded funds (ETFs) section of our website.

iShares Physical Gold ETC

An ETC, or exchange traded commodity, is traded on a stock exchange, like a stock, but tracks the price of a commodity or a commodity index.

The iShares Physical Gold ETC tracks the gold spot price. This is the current price in the marketplace at which gold can be bought or sold for immediate delivery. It could be a good way to benefit from any potential moves in the gold price, without having to own the physical commodity.

This fund has the option to use derivatives though, which adds risk if used.

And as this is an offshore fund, you’re not normally entitled to compensation through the UK Financial Services Compensation Scheme. Charges are also taken from capital, not income, as this ETC doesn’t produce any income.

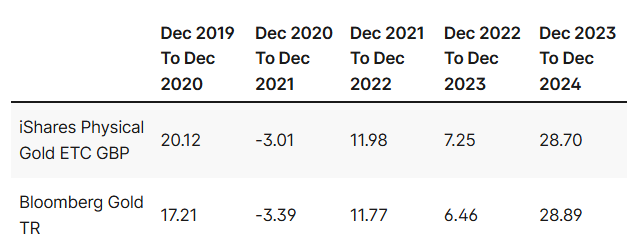

Past performance isn't a guide to future returns.

Source: Lipper IM, to 31/12/2024

Troy Trojan

If you’d rather own a fund with a mix of assets and let the manager do the hard work of deciding what to buy for you, then you could consider the Troy Trojan fund.

The managers, Sebastian Lyon and Charlotte Yonge, aim to grow investors' money steadily over the long run, while limiting losses when markets fall.

The fund is focused around four 'pillars'.

The first contains large, established companies Lyon and Yonge think can grow sustainably over the long run, and endure tough economic conditions.

The second pillar is made from bonds, including US index-linked bonds, which could shelter investors if inflation rises. Some of the fund is also invested in UK gilts.

The third pillar consists of gold-related investments, including physical gold, which has often acted as a ‘safe haven’ during times of uncertainty. The fund tends to have around 10% invested in the yellow metal over time.

The final pillar is ‘cash’. This provides important shelter when markets stumble, but also a chance to invest in other assets quickly when opportunities arise.

The manager has the flexibility to invest in smaller companies, which, if used, adds risk.

The fund is concentrated which means each investment can contribute significantly to overall returns, but it can increase risk.

Past performance isn't a guide to future returns.

Source: Lipper IM, to 31/12/2024