Written by: iCapital

What if you could gain market exposure, but limit your losses if the market goes down? Or make an investment with the potential to generate higher coupon payments?

Structured investments can be designed for almost any market outlook or financial objective and can be used to:

What is a Structured Investment?

It starts with an asset such as a:

That’s called the underlier. The structured investment is a package that links to the underlier and shapes its performance to meet specific investor needs. There are two most common types:

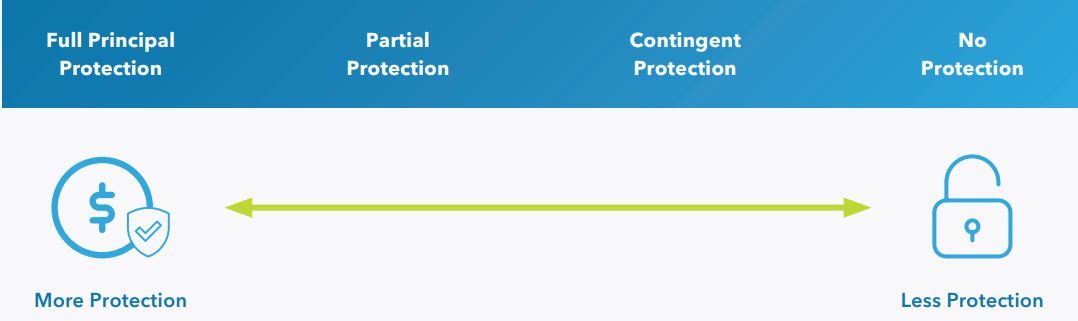

Depending on the type of structured investment, a level of principal protection can be selected that aligns with an investor’s goals and objectives.

The power of structured investments is in the flexibility of their design, offering solutions across the risk-return spectrum.

Choosing an Investment

Investing in structured investments begins with a review of objectives. Is the investor’s primary objective growth or income? What market exposure is sought?

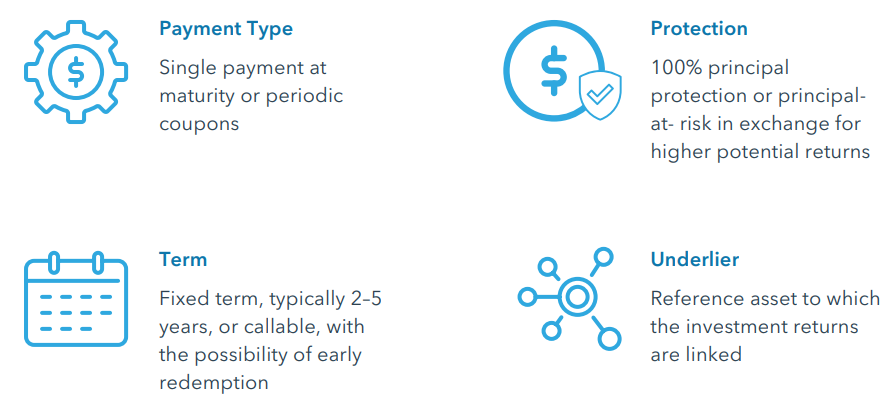

With an objective in mind, an investment based on its four basic parameters:

Structured investments are buy-and-hold products and investors must be willing to hold their investment until maturity. Investors should always read and understand the offering document before investing—in it they will find clearly defined terms, fees, and risks, including issuer credit risk, any limits on upside participation, potential for loss, and limited liquidity.

How They Work

Let’s walk through two hypothetical examples:

Why Now?

Structured investments can help address specific portfolio needs for a more tailored portfolio approach and are:

Strategic: They can provide strategies to manage today’s investing challenges, such as ongoing market volatility.

Flexible: Some offer full or partial principal protection at maturity, while others offer greater upside, but come with greater risk.

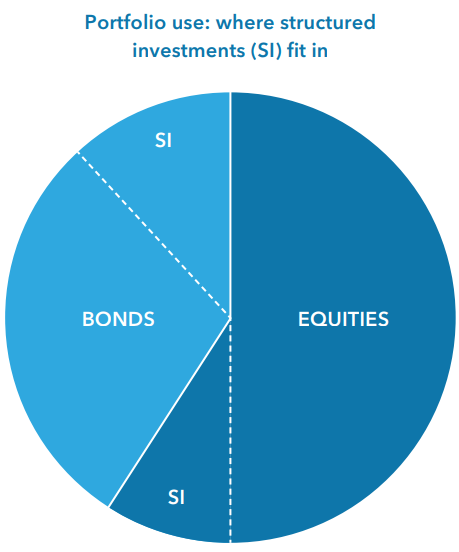

Diverse: They can be a core portfolio component as an alternative or complement to equity or fixed income holdings, for example.

Advancements in innovative technology and analytical tools have increased education and transparency. This has provided a clearer understanding of how these investments can be used within a diversified portfolio and created a stronger structured investment market than ever before.

Related: How Private Equity Buyout Managers Create Value

The material herein has been provided for informational purposes only by iCapital, Inc. (“iCapital”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is not intended as and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. For full disclosures, please see Getting Started with Structured Investments.