Ten-year Treasuries yield a scant 1.32% and the S&P 500's dividend yield of 1.30% is hardly anything to get excited about.

Some of the other traditional sources of income aren't what they used to be in the yield department and when it comes to bonds, the lower the starting yield is on a bond when an investor gets involved, the more upside is limited going forward.

Perilous times in the bond market have advisors examining alternative forms of income and rightfully so, but there's some good news, too. Dividend stocks are back in style and after being foiled by the coronavirus pandemic in 2020, payout growth is roaring back. That's a boon for advisors and conservative clients alike because dividend stocks aren't exotic, they don't require much explaining and the audience for this asset is vast.

And let's not forget a point that's entirely relevant in the current climate. Dividend growth is historically tops inflation. In every inflationary environment over the past six decades, payout growth proved adept at topping rising consumer prices.

Good Times for Shareholder Rewards

As advisors well know, stocks are performing quite well this year and much of that ebullience centers around catalysts such as fiscal stimulus, strong consumer spending and increasing coronavirus vaccinations. However, those aren't permanent catalysts and each is recently showing signs of wear and tear. Dividends may be able to pick some of the slack for equities.

“What seems increasingly likely—perhaps regardless of these catalysts—is an acceleration in payouts to shareholders in the form of dividends and share buybacks,” says WisdomTree analyst Matt Wagner. “Earnings have rebounded to well above their pre-pandemic highs. Since the end of 2019, forward earnings on the S&P 500 are up 18%.”

Speaking of the pandemic, it was a primary reason why dividend growth stalled last year. The global health crisis exposed an array of financially flimsy companies and when balance sheet strength suddenly became a priority, plenty of companies had no choice but to cut or suspend payouts. The 2020 shareholder rewards situation was further damaged by the Federal Reserve forcing banks to hold off on buybacks and dividend hikes while requiring those companies to set aside capital for bad loans.

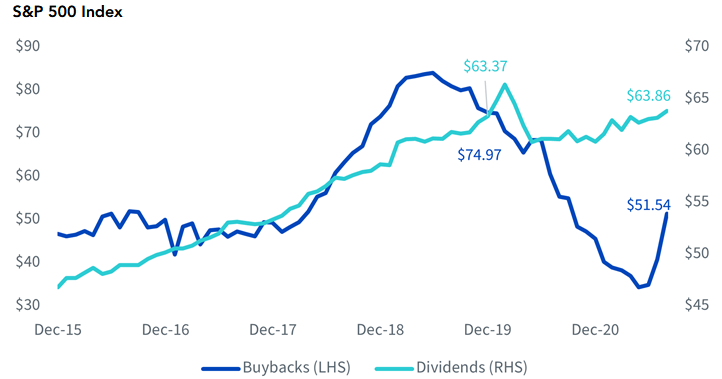

Fortunately, the coronavirus-induced recession was brief by historical standards and loan defaults weren't nearly as bad as expected, allowing banks to repatriate that cash back onto their balance sheets and use some of it for shareholder rewards. Point is, as the chart below confirms, there's still plenty of runway for shareholder rewards to get back to pre-pandemic levels.

Courtesy: WisdomTree

“Share buybacks and dividends are on the mend this year following cuts in 2020, but there is still significant ground to be made up on payouts,” adds Wagner. “Trailing 12-month share buybacks (net of share issuance) are down by nearly a third since the end of 2019. Forward estimated dividends are roughly unchanged over the same period.”

More to Come for Shareholder Rewards

Excluding banks, S&P 500 companies had $2.02 trillion in cash on hand at the end of last month. Many of the most cash-rich American companies reside in the technology and healthcare sectors, which, not surprisingly, have been impressive dividend growers in recent years.

As Wagner notes, there's another encouraging sign in the form of an S&P 500 payout ratio that's currently low by historical standards.

“Companies have a lot of room to make up if the latest trailing 12-month payout ratio (combining earnings and buybacks) of 65% is to revert to the mean of the recent 85% historical trend,” he said.

Preparing for elevated shareholder rewards is relevant today and income-starved clients may just thank advisors for getting them out of low-yielding assets like Treasuries.

Advisorpedia Related Articles:

Beneficient Bringing Beneficial Liquidity to Alternative Assets

SPACs Aren't Going Anywhere, but Craze Is Cooling

With Income at a Premium, Get Conversant in Closed-End Funds

WealthForge Altigo Platform Pioneering Efficiency in Alternative Investing