Written by: Kunal Shah and Joshua Freeman

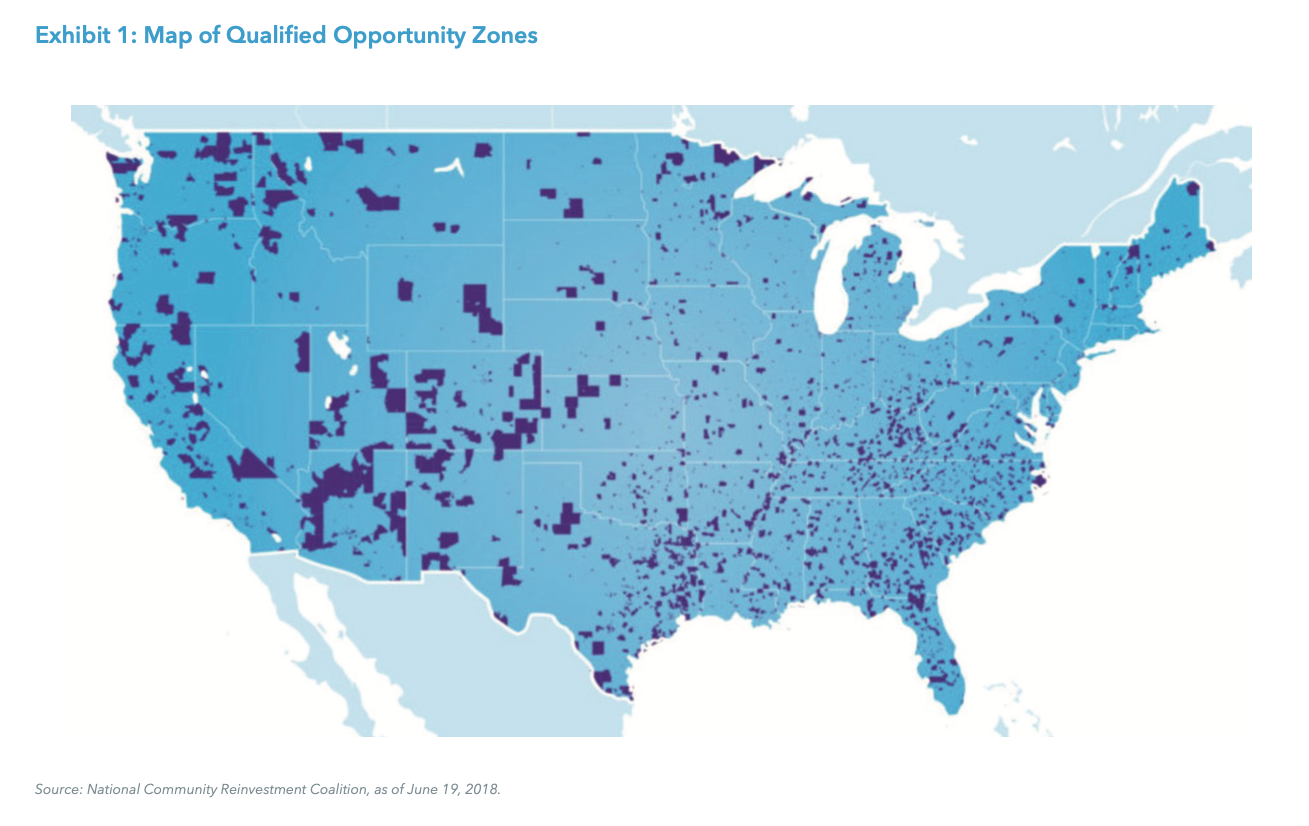

The Qualified Opportunity Zones (QOZ) program was created by the U.S. Congress as part of the Tax Cuts and Jobs Act of 2017. The program’s overall mission is to stimulate economic activity in underdeveloped parts of the country by providing tax benefits that encourage long- term capital investment into these designated low-income urban, suburban, and rural areas. This is expected, in turn, to transform communities and boost the local economy. State governors designated over 8,700 census tracts across the country as QOZs, as shown in Exhibit 1. Although many of these zones are indeed underdeveloped, there are also attractive areas that are already gentrifying or located near central business districts.

Investors who develop real estate or fund businesses in these QOZs are eligible for tax incentives — which has led to the advent of private investment vehicles known as Qualified Opportunity Funds (QOF or QOZ funds). These funds provide several tax benefits to their investors, as detailed below. The key tax incentive is the complete elimination of tax on any capital gains generated by the QOZ fund if the fund is held for at least 10 years — this is the primary and most substantial draw of the QOZ program.

How It Works

From a chronological perspective, firstly, QOFs allow investors to defer their existing or current capital gains taxes on appreciated assets until 2026 by selling and rolling their gains into a Qualified Opportunity Fund within 180 days of them being realized. Both return of principal and gains can be rolled into a QOF, however, only the “gain” portion is eligible for tax exemption on any future appreciation.

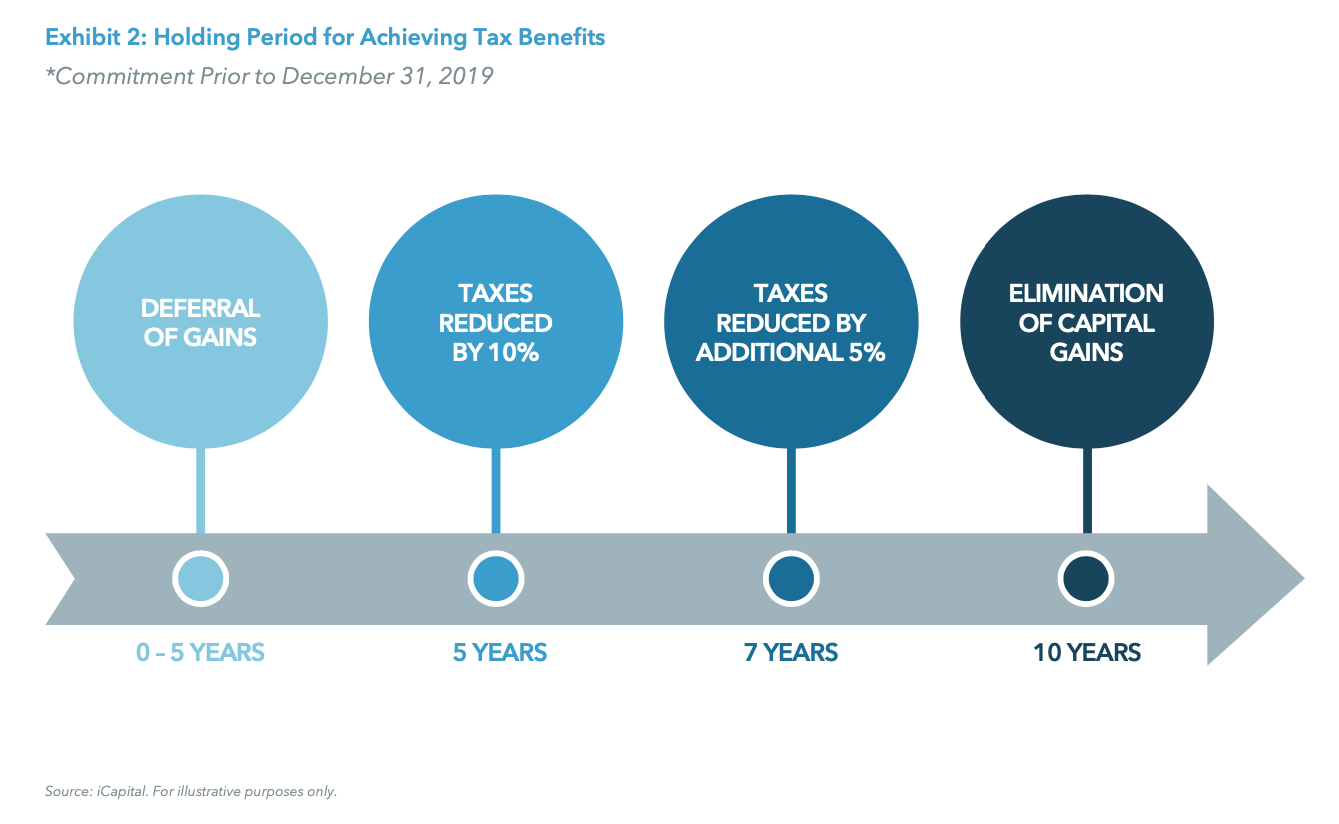

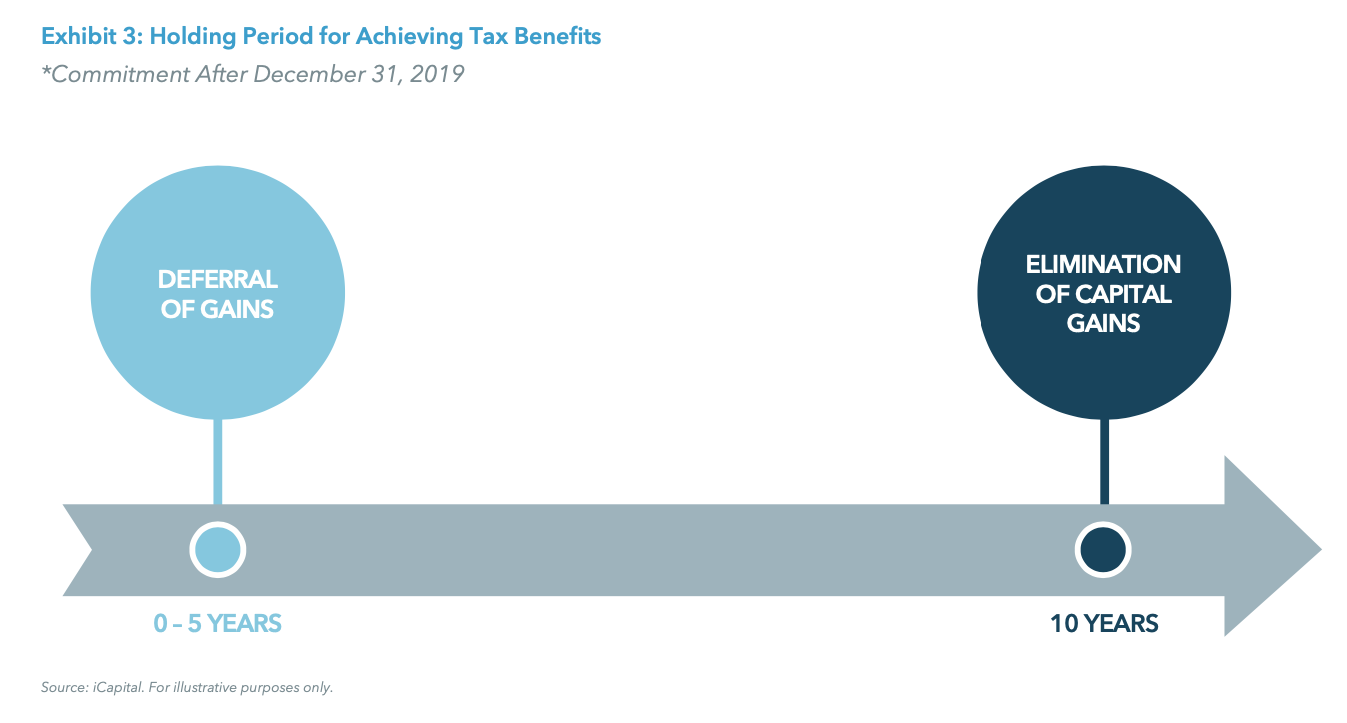

There is then a sliding scale of tax benefits that can be realized, which is primarily based upon the date an investor committed to the QOZ fund and length of time that an investment is kept in a QOZ fund prior to being withdrawn.

QOZ investors that committed prior to December 31, 2019 are eligible for a reduction in capital gains tax. Once an investment in a QOF is held for five years, an investor benefits from a 10% reduction in capital gains tax on their initial investment amount. After their investment is held for seven years, this reduction increases by an additional 5%, to an overall 15% reduction in capital gains tax. However, this reduction is only available to QOZ investors who committed prior to December 31, 2019, as deferred gains are taxable either when the QOZ investment is sold or exchanged, or, if earlier, December 31, 2026.

While investors committed after December 31, 2019 would not receive the 10-15% tax reduction, they would still be able to defer taxes on capital gains until 2026 and would be eligible for the full tax benefit if the investment is held for 10 years. At that point, any capital gains that have been generated by the investment in the QOZ fund is exempt from taxation.

As a hypothetical example, let’s say an investor owned $1.1 million of XYZ stock, of which $100,000 represents the original cost basis and the remaining $1 million is unrealized capital gains. The investor sold their XYZ position on June 1, 2019 and realizes $1 million in capital gains, which they invested into a QOF within 180 days of the sale — in this example, on June 30, 2019:

- After five years — on June 30, 2024 — the investor’s basis in the QOF increases from $0 to $100,000 (thereby reducing their capital gain by 10%).

- After seven years — on June 30, 2026 — the investor’s basis in the QOF increases from $100,000 to $150,000 (thereby reducing their capital gain by a further 5% to an overall 15% reduction).

- On December 31, 2026, the investor’s deferred gain is taxed. However, rather than applying to the full initial $1 million, the capital gains tax only applies to $850,000 (due to the $150,000 basis increase as described above).

- After 10 years — on June 30, 2029 — the investor is able to sell their interest in the QOF with no capital gains tax. Assuming that the investor sells their interest for $2.7 million (representing a ~10% IRR), the $1.7 million of appreciation is sheltered from any capital gains tax.

Now, let’s say that same investor sold their XYZ position on June 1, 2023 and realizes $1 million in capital gains, which they invested into a QOF within 180 days of the sale — in this example, on June 30, 2023:

- The investor would not be eligible for the 10-15% reduction in capital gains tax, given the investor would not be able to hold the investment for five or seven years prior to December 31, 2026.

- On December 31, 2026, the investor’s deferred gain is taxed at the full initial $1 million.

- After 10 years — on June 30, 2033 — the investor is able to sell their interest in the QOF with no capital gains taxes. Assuming that the investor sells their interest for $2.7 million (representing a ~10% IRR), the $1.7 million of appreciation is sheltered from any capital gains tax.

QOF Criteria

It is not enough for a fund to simply declare themselves to be a QOF. In order for a vehicle to be designated as a QOZ fund, there is a specific set of requirements that must be followed. Firstly, a fund must invest into either properties or businesses that are located within a QOZ, with 90%+ of their portfolio held in QOZ assets — a threshold that will be tested annually. Businesses qualify by deriving at least 50% of their gross income from the active conduct of a trade or business in a QOZ, or by having a substantial portion of their intangible property used in the active conduct of a trade or business in a QOZ. Further, any company that operated as a “sin or sun business” is excluded, such as liquor stores, gambling facilities, suntan facilities, country clubs, and golf courses.

As for properties, they must either be newly built or, if investing into an existing building, be subject to “substantial improvement” (with more capital invested into the property than its original basis, excluding land) within the first 30 months. A development or redevelopment- oriented approach is, therefore, the most suitable real estate strategy for a QOF, as it’s essential to meeting this former requirement.

Manager Considerations

Although the appeal of the QOZ program is evident, with dozens of managers raising pools of capital to target this space, we would caution investors to take a measured approach. QOZ managers must be assessed on their ability to generate appealing real estate returns, independent of any tax relief benefits that may come into play. When conducting due diligence on managers to partner with, investors should focus on managers with a proven track record in developing and redeveloping their targeted property type (whether multifamily, office, retail, or other) within their targeted geography (whether the Sun Belt states or the Tri-State area, for example). If a manager’s usual sweet spot is last-mile logistics in the Midwest, there is little guarantee that their skills will translate well into multi-family ground-up development in New York.

A deep development arm and track record are usually also indicators of a manager who has not only the ability to source and underwrite attractive properties, but also strong local networks when it comes to construction, design, leasing, and overcoming the myriad regulatory and legislative hurdles that come hand-in-hand with real estate development. QOZ managers who have pre-identified a handful of potential assets for their fund are also attractive, as this not only somewhat mitigates blind pool risk but also ensures that capital is put to work in a timely manner and within the constraints of the QOZ regulation.

Moreover, the time horizon of a QOZ fund is 10years, if the full spectrum of tax benefits is to be achieved, and so investors are choosing a long-term steward of their capital, who will be ultimately responsible for ensuring that the portfolio is appropriately sold at the right time and in a way that maximizes final returns. It remains more important than ever to undertake deep due diligence and underwriting — the tax breaks are a real advantage but are meaningless if layered on top of a poor investment that doesn’t generate significant gains to begin with.

Each investor must also balance exposure to real estate with any timing constraints surrounding the realization of their capital gains. Investors are taking a 10-year bet on a specific city’s or region’s long-term growth and economic prospects. Moreover, due to QOZ regulations requiring either ground-up development or significant redevelopment of assets, investors should be cognizant of the magnified risk-return profile compared to a core or core plus real estate fund investment.

Conclusion

Overall, QOZ funds represent an interesting opportunity — both for local communities who set to benefit from the revitalization that this program encourages, as well as for those investors who can partner with some of the top-tier real estate names for whom QOZ investing is a natural extension of their current strategy.

Related: Unlocking Potential with Fixed Indexed Annuities: Balancing Growth and Protection