Goldman Sachs says it’s time to go long commodities.

In a new report, the investment bank makes the case that natural resources are poised to increase in value next year on a potential end to the current monetary tightening cycle, shrinking recession fears, hedging against geopolitical risks and demand for “green energy” metals such as copper and aluminum, among other drivers.

Goldman forecasts that the S&P GSCI Index—which tracks 24 different commodity futures contracts, with an oversize oil weighting—could end 2024 with a 12-month return of 21%.

That would be a welcome reversal from commodities’ mostly dismal performance this year, despite intermittent strength from gold and crude oil. If 2023 ended today (November 14), the S&P GSCI would have recorded a paltry return of 0.87% after bouncing around in the negative zone for most of the year.

Is The Fed Done?

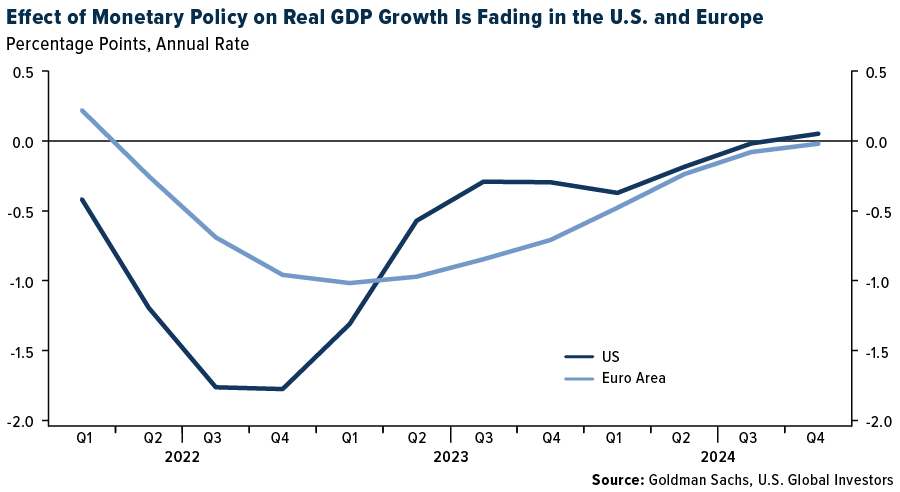

Among the more compelling points Goldman analysts make is the diminishing effect of monetary policy on real gross domestic product (GDP) growth in the U.S. and Europe.

The Federal Reserve has hiked rates at an unprecedented pace this cycle to slow the U.S. economy and tamp down consumer prices, and this week’s consumer price index (CPI) report by the Bureau of Labor Statistics (BLS) suggests that these efforts may be working. Inflation rose at an annual rate of 3.2% in October, down from 3.7% in September and significantly down from the cycle high of 9.0%, set in June 2022.

Continued disinflation implies that the Fed and European Central Bank (ECB) are done hiking rates, in Goldman’s view, which they believe will support demand for commodities.

The Resource Demands Of Electric Vehicles And Clean Energy

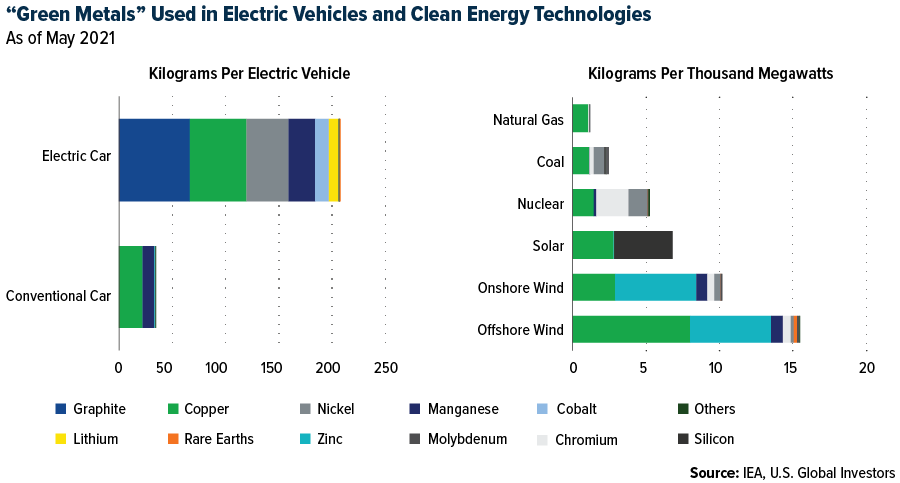

Clean energy production is another contributor to potentially higher commodity prices in 2024. An average-size electric vehicle (EV), for example, requires six to seven times more metals and minerals than a conventional car of similar size does. Whereas an EV uses around 200 kilograms (440 pounds), a gas-powered car uses 30 kilograms (about 66 pounds).

Likewise, constructing an offshore wind plant requires 13 times more minerals than building a similarly sized gas-fired power plant. This underscores the significant resource intensity associated with clean energy projects.

It’s not just quantity that matters, though, but also the variety of materials needed. Household-name metals such as cobalt, lithium and nickel often appear in headlines, but lesser-known minerals like graphite play an equally crucial role. In terms of battery composition, graphite accounts for roughly half of a lithium-ion battery’s weight. Lithium, on the other hand, makes up only about 8% to 10%.

Strategically Positioned For Demand Growth

Our Global Resources Fund (PSPFX) is strategically positioned to capitalize on these trends. With an approach encompassing energy and basic materials, PSPFX targets companies globally engaged in the exploration, production and processing of essential resources. Its objective aligns with the current market dynamics—seeking long-term capital growth while offering a hedge against inflation and monetary instability. Moreover, PSPFX has strategically focused on “green” metals and minerals, anticipating accelerated appreciation as the global energy transition unfolds.

We believe that the fund’s top holdings, including investments in Filo Mining and Ivanhoe Mines, align with the growing demand for copper and gold, essential in the green metal sector. The fund’s global reach diversifies its investment risk and capitalizes on regional market strengths.

As 2024 approaches, we believe PSPFX’s alignment with the positive outlook for commodities, as detailed in the Goldman Sachs report, makes it an attractive investment option.