Written by: Tony Davidow, CIMA® | Franklin Templeton

As we have mentioned in multiple white papers, a confluence of events has helped fuel the adoption of private markets: the market environment, product evolution and access to institutional-quality managers. The first generation of private market funds evolved to feeder funds and now registered funds. Product evolution has now provided access to private markets to a broader group of investors, at lower minimums, and more flexible features.

These new fund structures are registered with the US Securities and Exchange Commission—hence the moniker “registered funds”—and are hybrid structures that capture attributes of the first generation of private market funds (“drawdown” funds) and mutual funds. Like a mutual fund, these funds are continuously offered, have low minimums, 1099 tax reporting, and are broadly available to investors (accredited investors and below the accredited investor threshold). Like the drawdown structure, these funds invest in illiquid securities (private markets).

Registered funds are also referred to as “evergreen,” “perpetual,” or “semi-liquid,” and include interval, tender-offer, non-traded real estate investment trusts (REITs) and private business development companies (BDCs). Registered funds have experienced significant growth in both assets under management and the number of funds.

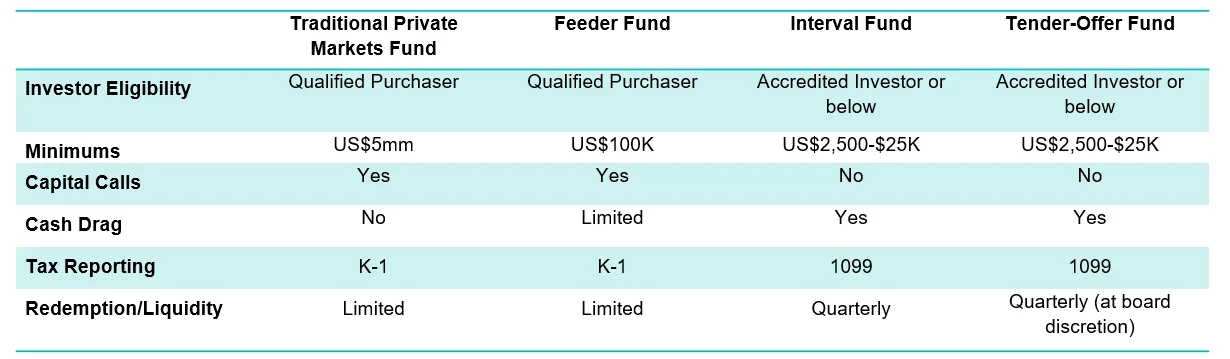

Note, there are tradeoffs with the various structures (see Exhibit 1).

Exhibit 1: Structural Tradeoffs

Investor Eligibility – Traditional private market funds and feeder funds are only available to Qualified Purchaser (US$5mm or more in investable assets), while interval funds and tender-offer funds are generally available to accredited investors and below.

Minimums – Traditional private market funds have high minimums (US$5mm), feeder funds have lower minimums (US$100K), and interval and tender-offer funds have low minimums (US$2,500-$25K).

Capital Calls – Traditional private market funds and feeder funds are subject to capital calls as opportunities are sourced, and capital is deployed. Interval and tender-offer funds do not have capital calls as money is invested upfront.

Cash Drag – Traditional private market funds do not have cash drag as capital is called from investors as it is needed and invested over time. Cash drag is the negative impact of holding liquid investments to meet redemptions. Feeder funds may have some cash drag. Interval and tender-offer funds may experience some cash drag as they keep a portion of their assets liquid to meet redemptions. Note, many fund managers have been able to mitigate the cash drag by managing their liquidity sleeve.

Tax Reporting – Traditional private market funds and feeder funds deliver K-1 tax reporting, which is often late and may be restated. Interval and tender-offer funds deliver 1099 tax reporting which is preferable to K-1 reporting.

Redemption – Traditional private market and feeder funds have limited liquidity and should be viewed as long-term investments (7-10 years). There may be some liquidity available in the secondary market. Interval and tender-offer funds offer favorable liquidity. Interval funds are required to make periodic repurchase offers, at net asset value, of no less than 5% and up to 25% of shares outstanding. For tender-offer funds, the board of trustees of the fund determines whether honoring redemption requests would harm other investors. The tender offers are at the discretion of the board of trustees and therefore cannot be guaranteed.

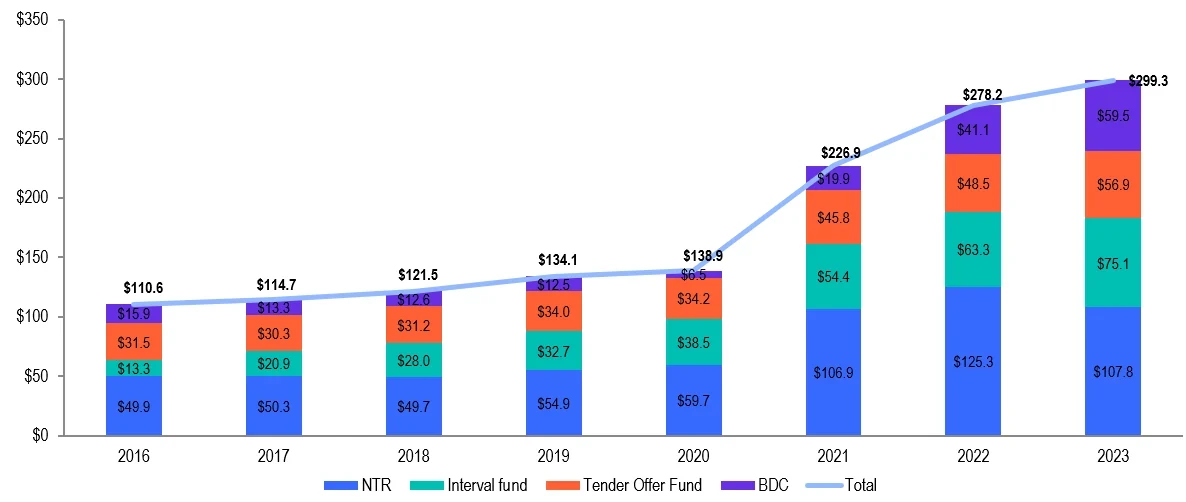

The growth of registered funds

Institutional managers entering the wealth channel for the first time have fueled the growth of registered funds. These managers recognize the size and opportunity in the wealth channel, and the new fund structures allow them to invest capital for the long term, without being forced to meet mass redemptions.

Exhibit 2: The Growth of Registered Funds

Source: Cerulli Associates. As of June 2024. All funds are presented on a net assets basis.

Historically, many institutional managers were leery of the wealth channel, due to concerns about “hot money.” There had been a perception that individual investors were prone to chasing returns, and they would not be patient investing in private markets, heading for the exits if they found better returns or felt uncomfortable about the markets.

The registered fund structure is available to a broader group of investors, at lower minimums, and more flexible features. We believe that the registered fund structure provides several advantages to high-net-worth investors.

- More accessible – with lower minimums and accreditation standards, more investors can access private markets.

- Greater liquidity – with quarterly liquidity provisions, investors can access their money if there are any unforeseen changes in circumstances.

- Tax reporting – with 1099 tax reporting, investors don’t have to wait for delayed K-1s that are often restated.

- Evergreen – these funds are generally available, so investors don’t need to make quick decisions about allocating within the subscription window.

- Fully invested – unlike the drawdown structure, where capital is drawn down over several years as opportunities are sourced, these funds are fully invested when capital is invested.

While the evolution of registered funds has helped to democratize access to the private markets, they haven’t replaced the first-generation drawdown structure, which still represents the lion’s share of the assets and funds. We believe there are advantages and tradeoffs with both types of structure, and in fact, they can serve as a complement to one another.

By combining registered funds and drawdown funds, an investor can benefit from gaining exposure to the underlying asset class more quickly via a registered fund and allowing the drawdown fund manager to source capital as they find opportunities. There is also a likely diversification advantage with exposures across industry, geography and vintage. Combining them can also be beneficial as the drawdown fund distributes capital, the proceeds can be invested in a registered fund to maintain the exposure to the asset class.

To learn more, please visit the AltsbyFT Knowledge Hub Knowledge Hub | Alternatives by FT