A new report by BMO Capital Markets suggests that the price of gold is no longer being driven by real interest rates. What replaced them? I unveil the answer below.

The American consumer did it again. Thanks in large part to a strong holiday shopping season, U.S. gross domestic product (GDP) expanded at a faster-than-anticipated 3.3% in the fourth quarter of 2023. The results make the strongest case yet that the Federal Reserve has pulled off a soft landing, but they also raise questions about the timing of the central bank’s next move… and where investors should allocate their capital.

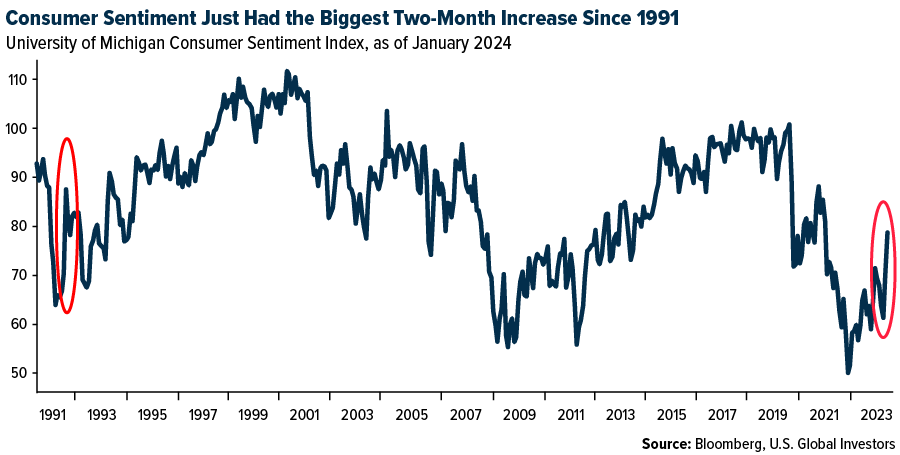

It certainly feels as if the economy has turned a new leaf, and the data appears to bear that out. At the end of last year, Fed Chair Jerome Powell’s dovish pivot ignited hopes that the days of sky-high interest rates were numbered. This was bolstered by the Federal Reserve Bank of New York’s Survey of Consumer Expectations, which shows that Americans’ inflation expectations have dropped to a two-year low. And the University of Michigan found that consumer sentiment jumped this month to its highest level since July 2021. In December and January, the good vibes saw a cumulative 29% increase, representing the biggest two-month gain since 1991.

Businesses are riding the wave of positivity as well. The preliminary Composite PMI for January indicates the sharpest rate of U.S. output growth in seven months, reflecting a buoyant business environment. Manufacturers, in particular, are increasingly confident about future output, a sentiment not seen since May 2022.

Amid these developments, the betting market is adjusting its expectations for a rate cut. According to the CME FedWatch Tool, there’s now an 88% likelihood that the central bank will lower rates to between 4.75% and 5.25% in May of this year, not March, as earlier forecast.

Why Firms Favor Gold In A Strong, High Interest Rate Economy

Interestingly, despite the rosier economic outlook, several firms are recommending gold. This may seem counterintuitive, especially with rates still above 5% and the stock market at an all-time high. Analysts at JPMorgan say the metal will benefit this year from rate cuts and the return of investment demand. XIB Asset Management, the Canadian hedge fund that soared over 200% in the first two years of the pandemic, is now betting that gold and uranium will outperform on lower rates.

“Gold and other commodity-driven equities have traditionally performed well during the next stages of the credit cycle,” one of XIB’s founders, Sean McNulty, said in an email to clients, as reported by Bloomberg.

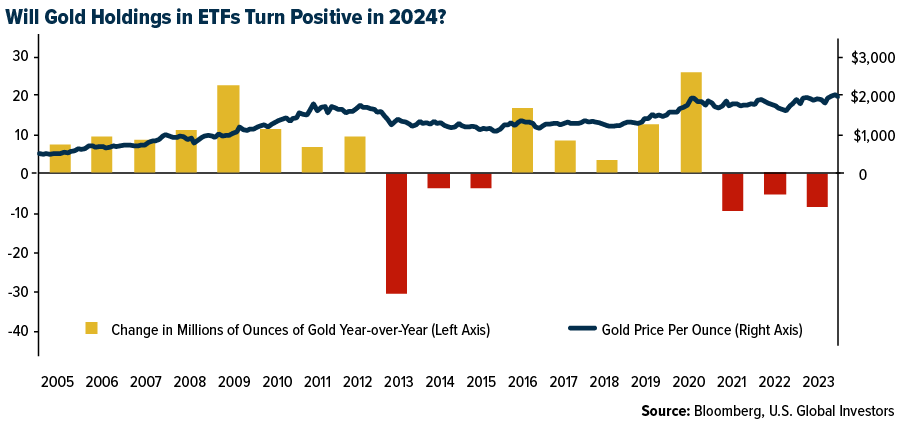

UBS recommends buying gold on dips below $2,000 per ounce. The Swiss institution projects the yellow metal to rise as high as $2,250 per ounce by year-end on looser monetary policy, which would put pressure on the U.S. dollar and real rates, thereby boosting demand, particularly from gold-backed ETFs. After three straight years of ETF outflows, UBS predicts a shift to inflows, potentially sparking a sustained rise in gold prices.

A New Driver Of Gold Prices?

As I mentioned at the top, BMO challenges this traditional view, suggesting that the relationship between gold and real interest rates has weakened. In a report titled “New Drivers for a New Gold Era,” BMO commodities analyst Colin Hamilton writes that the gold-real rate correlation, which I’ve written about many times, is now “broken.” According to him, this correlation fell apart amid the sharp real rate moves of 2022 and has not been re-established.

But if rates no longer matter, what’s the investment case? Hamilton argues that emerging economies’ push to diversify away from the U.S. dollar by increasing their gold holdings is now the most important driver of the metal going forward.

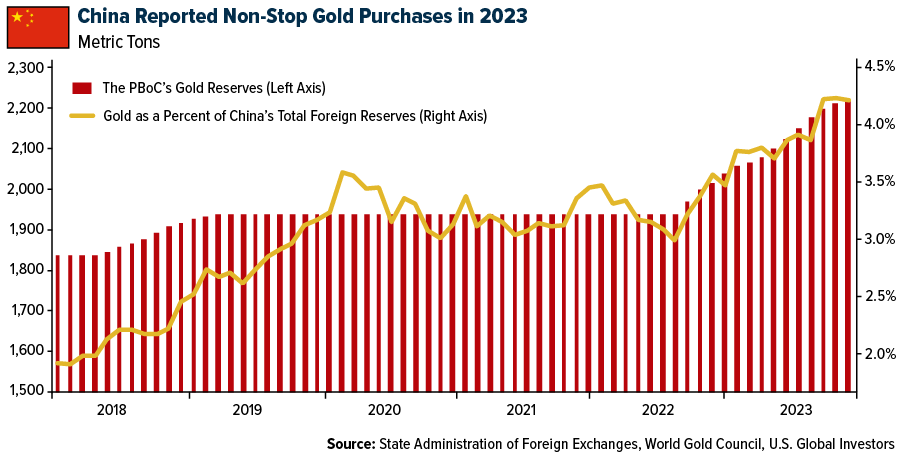

China is particularly key. The People’s Bank of China (PBoC) has become the world’s undisputed gold purchasing leader, buying the metal uninterrupted since November 2022. Last year, the bank announced a 225-metric ton increase to its gold reserves, which reached 2,235 tons by the end of December. The yellow metal now accounts for 4.3% of China’s official foreign exchange reserves, according to the World Gold Council (WGC).

As Bloomberg’s Mike McGlone recently put it, “A top reason [gold] has remained resilient is the deepest pockets on the planet—central banks—are accumulating at a breakneck pace.”

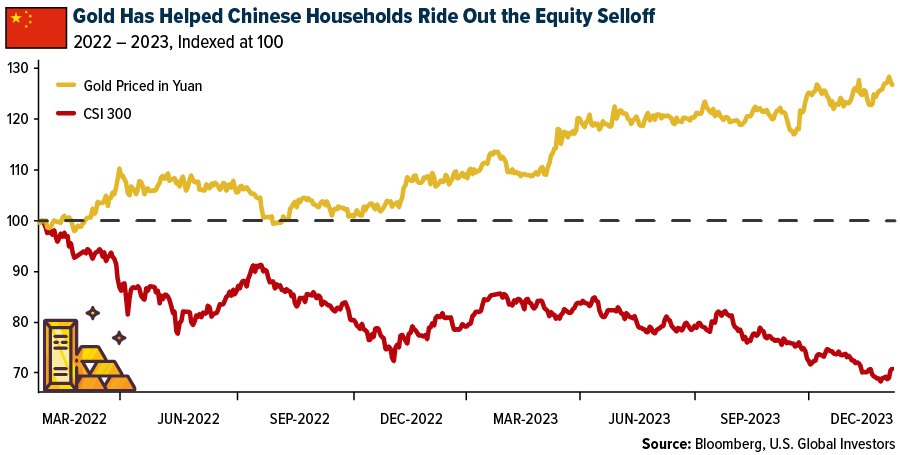

In addition, 2023 was an especially tough year for many Chinese investors, with stocks declining for the third straight year. The government is reportedly weighing a stock market rescue package backed by two trillion yuan, or roughly $278 billion, but it’s worth pointing out that similar purchases in 2015 did not immediately lift stocks.

Surveys show that Chinese households are not confident in the economy and are looking to save more and invest less in the stock market. According to Hamilton, the proportion of Chinese households holding higher levels of cash has correlated strongly to yuan-priced gold, which hit fresh highs in 2023 as the CSI 300 index of Chinese stocks sunk to a five-year low.

Given these dynamics, the major downside risk to gold prices this year could stem from a risk-on environment in China, such as an equity market rally. However, BMO and Hamilton both expect central bank buying and household investment to be a multi-year theme.

In this context, gold emerges not just as a safe haven in uncertain times, but as a strategic asset in a diversifying global economy.

Related: How The 2024 Election Could Propel Defense Stocks To New Heights