Written by: Dave Alison

There is an incredible amount of uncertainty surrounding the Federal disaster relief efforts available to small businesses today. At the onset of the pandemic, the government was forced to move quickly to provide capital through different loan options such as the Economic Injury Disaster Loan (EIDL) and Paycheck Protection Program (PPP) loans.

Now, almost one-year since the COVID-19 outbreak hit the U.S., the Small Business Administration (SBA) is still accepting EIDL applications and has reopened the Paycheck Protection Program loan program. This “Second Draw” will allow more companies to receive forgivable loans for the first time and some hard-hit businesses to apply for a second loan.

The most frequent question we have received from our advisors is, “Which loan is right for us or should we do both?”

While there is not a one-size fits all solution, here are a few questions you should ask.

The first question to consider is business qualification:

Who Qualifies?

EIDL: To qualify, you must be:

- A small business, cooperative, ESOP or tribal business with 500 or fewer employees;

- An individual who operates as a sole proprietorship, with or without employees, or as an independent contractor; or

- A private non-profit or small agricultural cooperative

- Your business must be directly affected by COVID-19

Second round of PPP: First-time qualified borrowers and also borrowers that previously received a PPP loan may be eligible. PPP loans are limited to businesses that:

- Employ no more than 300 employees or meet an alternative size standard;

- Have used the entire amount of their first PPP loans or will use such amounts; and

- Had gross receipts during Q1, Q2, or Q3 2020 that were at least 25% less than the gross receipts from the same quarter in 2019 (applicants may use Q4 2020 if they apply after January 1, 2021). If a business was not in operation for a portion of 2019, then the comparable quarters may be different.

Must Be in Business By:

- EIDL: January 31, 2020

- PPP: February 15, 2020

Businesses should also be aware that the second round of PPP loans did not remove or change the necessity requirement. This means that you must be able to certify that the “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant” as of the date on which you submit a PPP loan application.

Assuming you meet those broad requirements, the next step is to determine which program is best suited for your needs.

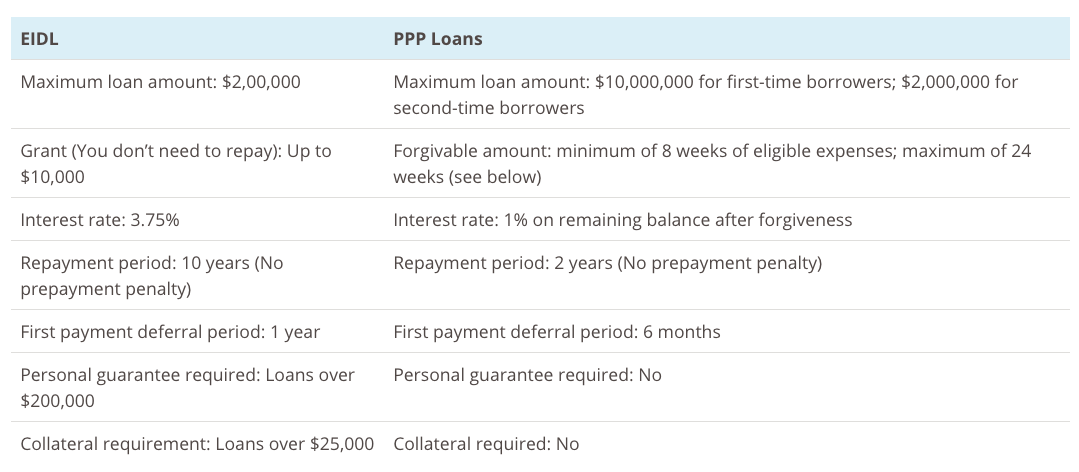

Here Is a Comparative Checklist of Both the EIDL and PPP Loans:

The key to coordination between these two relief efforts are that you cannot “double dip” in benefits. This does not mean you cannot apply and receive both benefits, but it does mean that you cannot apply the same benefit dollar to the same expense.

For example, you could not use the $10,000 grant from the EIDL to pay the same payroll expense being considered in the forgivable amount of the PPP loan.

In terms of the emergency grant of up to $10,000 under EIDL, these grants do not have to be repaid as long as funds are used for:

- Providing paid sick leave to employees unable to work due to the direct effect of the COVID–19;

- Maintaining payroll to retain employees during business disruptions or substantial slowdowns;

- Meeting increased costs to obtain materials unavailable from the applicant’s original source due to interrupted supply chains;

- Making rent or mortgage payments; and

- Repaying obligations that cannot be met due to revenue losses.

If you get a PPP loan, you can request forgiveness of the principal portion of the loan for the 8-to-24-week period after you get the loan that covers:

- Payroll costs

- Interest on a mortgage

- Rent

- Utilities

- Operations

- Property damage costs

- Supplier costs

- Worker protection

No more than 25% of the forgiven amounts may be for non-payroll costs. Your loan forgiveness will be reduced if you decrease your full-time employee headcount. It will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annually in 2019.

Now That You Have an Understanding of the Loans, Here Are Some Further Considerations:

1. How Quickly Do You Need the Loan?

The EIDL loan can provide up to $10,000 within three days of application. PPP Lenders will begin to accept applications from January 13, 2021 until March 31, 2021 for small businesses, sole proprietors, independent contractors and self-employed individuals, and it is expected the loans may be available within two weeks after the application process.

2. How Will You Use the Money?

EIDLs are working capital loans that may be used to pay fixed debts, payroll, accounts payable, and other bills that could have been paid had the disaster not occurred. The loans are not intended to replace lost sales or profits or for expansion. Funds cannot be used to pay down long-term debt.

PPP Loan proceeds may be used for:

- Payroll costs;

- Costs related to the continuation of group health care benefits during periods of paid sick, medical, or family leave, and insurance premiums;

- Employee salaries, commissions, or similar compensations;

- Payments of interest on any mortgage obligation (but not to pay principal or to prepay a mortgage) rent (including rent under a lease agreement);

- Utilities;

- Costs related to business software or cloud computing services for business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, HR and billing functions, tracking of suppliers, inventory, records, and expenses, etc.;

- Property damage costs (e.g., vandalism, looting, etc.) due to public disturbances that occurred in 2020;

- Supplier costs of goods that are essential to operations;

- Personal protection equipment or property improvements that allow businesses to comply with requirements or guidance issued by the CDC, HHS, OSHA, or any state or local government.

3. How Much Could Be Forgiven?

Under the EIDL, the grant portion up to $10,000 does not need to be repaid. Even if your application for EIDL is turned down, you can still keep the grant.

Under the PPP, any amount used to pay for qualified expenses in the proceeding 8–24-week period after accepting the money will be forgiven.

Since your PPP loan amount is calculated as 2.5x your 2019 monthly average payroll expense (wages capped at $100,000 per person, no 1099 contractor payments included, healthcare and retirement benefits paid by employer count), you could potentially receive a larger benefit under PPP and EIDL if your average 2019 payroll expense is greater than $4,000.

If you have enough eligible expenses to consume the entire $10,000 grant as well as your full PPP loan amount, it may make sense to apply for both programs.

If you own more than one business, you may be eligible to apply for each business. You are not able to individually apply for multiple loans under the same program though.

Here Is an Example:

Bob is an owner of Wealth Management, Inc., an S-Corp which has eligible average monthly payroll expense (including his own W-2 wages) of $18,000 in 2019. Based on this information, he was eligible for a $45,000 first-round PPP loan. Assuming that over the next 8-weeks he incurs $45,000 of eligible expenses, all $45k will be forgiven. If in fact he had $55,000 of eligible expenses, he could also have used the EIDL grant of up to $10,000.

In addition to Wealth Management, Inc. S-Corp, Bob receives 1099 income from his corporate RIA for his advisory fees which he doesn’t process through his S-Corp. Bob has no other staff and reports this income on the Schedule C of his tax return. Under this scenario, Bob was also eligible to apply for the first-round PPP based on his self-employment income. If he also contributes to a SEP IRA or has employer healthcare costs, those would also be included in his benefit. In this example, let’s say Bob has $150,000 in net self-employment income and contributes $27,950 to a SEP IRA. In this case Bob’s payroll expense would be $150,000 of self-employment income and $27,950 of retirement contributions for a total of $177,950. We then exclude compensation over $100,000 ($50,000) to arrive at a total eligible payroll expense of $127,950. The monthly average would be $10,662.50 ($127,950 / 12 months). At a 2.5 multiplier, Bob would be eligible for a PPP loan amount of $26,656.25.

In order to qualify for a Second Draw of PPP loans, if Bob took the full $26,656.25 loan amount that he was eligible for and had gross sales of $500,000 in Q2 2019 and experienced a 30% loss in gross sales in Q2 of 2020 ($300,000), then he could apply for a second round of PPP funding.

Alternatively, if Bob was eligible for a PPP loan amount of $26,656.25, but only took $20,000, he could apply to receive the $6,656.25 he previously opted not to take if he also had at least a 25% loss in gross revenue from 2019 to 2020.If Bob never took the PPP loan, he would still be under the same requirements to show that he experienced a 30% loss in gross receipts in Q1, Q2, or Q3 of 2020 compared to the year prior.

Of course, the rules are constantly being updated and the Treasury and SBA is continuing to provide guidance to the lending institutions, but at this time the final decision is going to come down to your lending institution.

We highly recommend you use this information as a guide but work with your lender to identify the best loan solution for you and your business.

For more valuable resources, click here to listen to the related podcast or access the step-by-step guide top advisors are following to help their clients succeed amid the current disruption. It’s a win-win.

Contact us for more resources that you can implement today to help grow your business during these uncertain times.

*This blog post was originally published on April 6, 2020 and was updated on January 22, 2021 to reflect the second round of PPP loans.

Related: 5 Planning Points from the New Relief Package Advisors Should Cover with Clients