Written by: Blair Kelly

Do you use the line “I’m a fee-only, fiduciary, independent advisor” on your website to explain how you’re different?

News flash! If you answered yes to this question, you need to prioritize creating a new UVP (unique value proposition) ASAP.With the passing of Regulation Best Interest (Reg BI), consumers’ minimum expectations are going to change, which means the differentiation factor you use in your marketing will need to changeas well.What will be expected of every single financial advisor as a basic operating practice will no longer be something you can tout as a true differentiator.In fact, with large numbers of advisors beginning to offer fee-based or fee-only advice in the last few years, we at Twenty Over Ten have already been advising our clients to go beyond the “I’m a fiduciary” spiel in their marketing as well.Yes, it is very important. No, it is not enough.Of course, not everyone agrees on all the details of Regulation Best Interest or how it will impact the industry, but most consumers aren’t paying attention to all the nuances and fine print of the law. They are busy living their lives.What HAS stuck with consumers through all the news coverage over the past few years is the importance of financial professionals operating as true fiduciaries. All consumers will simply expect this now.It’s a minimum expectation, not a differentiator. Yes, list it on your website. But go farther —what else makes you different?https://youtu.be/Ypv6nOJBz0c4 Ways to Truly Differentiate Your Firm on Your Website

So we’ve established that you must have a true differentiator right on the homepage of your website. This is the niche audience you target — the group of people whose problems you help solve and who you understand how to serve better than anyone else.But does that mean you should no longer mention that you operate a fee-only, or fee-based or independent practice? Should you not even mention that you are a fiduciary?The short answer is — no, you shouldn’t leave it out. Even though operating as a fee-only fiduciary advisor is becoming more and more common, this language should still be included on your website. It’s important to ensure that your prospects and clients understand what this means and realize that when they work with you, everything that your firm does has their best interest at heart. So, how can you highlight the fact that you are a fee-only, fiduciary advisor but still focus on a more granular niche? Here are four ideas to get you inspired:1. LEVERAGE AN FAQ PAGE

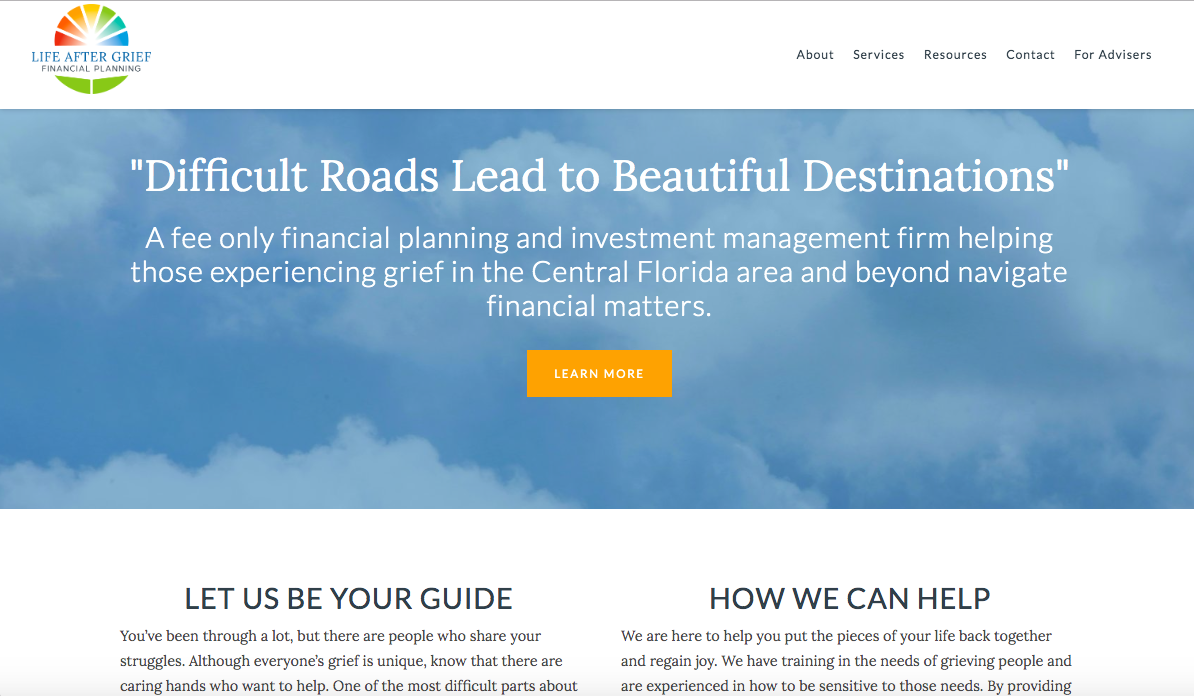

Life After Grief Financial Planning based out of Orlando, Florida does a great job of highlighting their UVP directly on their homepage. After all, your homepage is the most visited page on your advisor website, so that is where you absolutely need to nail your messaging.Immediately we understand that Christopher Dale, CFP® works specifically with those who have suffered loss, helping them navigate financial decisions after the loss. However, as we continue to click through their website the FAQ page is where he begins to explain more about being fee-only and what that means for his clients. FAQ pages are a great way to present dense information — especially if you utilize a design element like an accordion, which allows site visitors to “click” on a question to reveal the answer like in the example below.

However, as we continue to click through their website the FAQ page is where he begins to explain more about being fee-only and what that means for his clients. FAQ pages are a great way to present dense information — especially if you utilize a design element like an accordion, which allows site visitors to “click” on a question to reveal the answer like in the example below.

2. CATER TO A NICHE

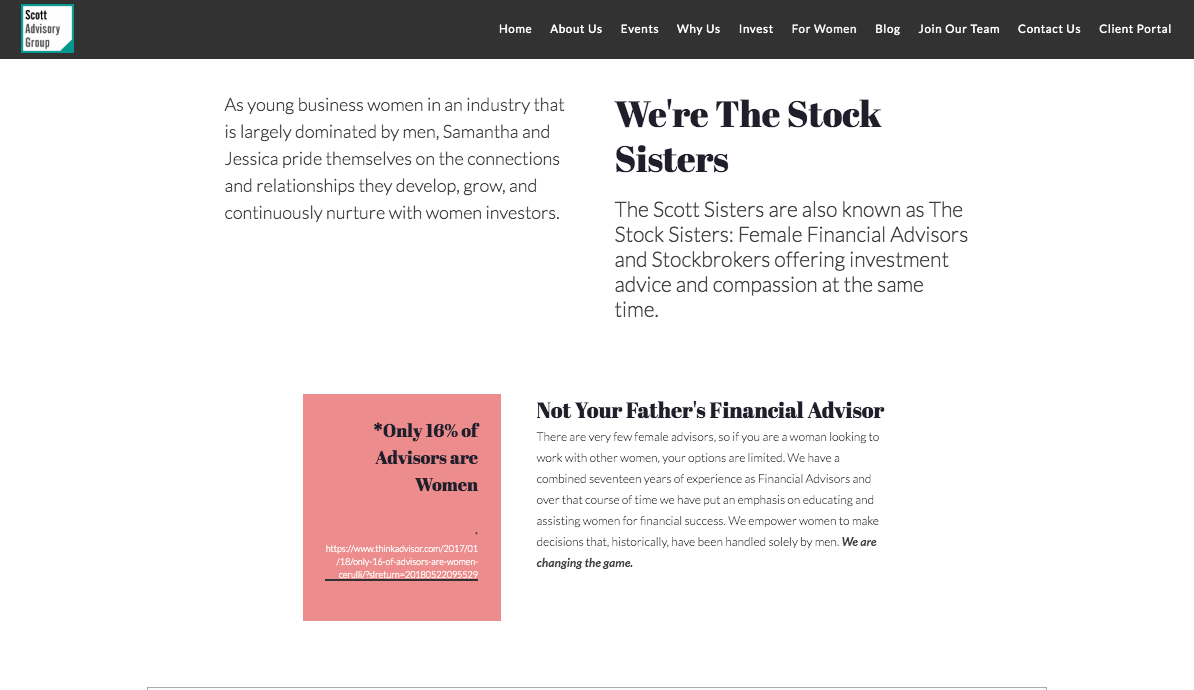

Developing a niche market for your firm is nothing new but it’s something that historically we’ve seen many advisors shy away from because they don’t want to “pigeon hole” themselves. I often hear “I don’t want to declare a niche on my website because I don’t want to exclude any potential clients who may not fit that niche.”This is just plain stupid.Identifying and marketing directly to a niche market is one of the key components of establishing and growing your business. What sounds better “I work with everyone!” or “I work with busy and motivated professionals who want to delegate time-consuming and complicated financial decisions?” Establishing a niche creates more valuefor your marketing dollar while also generating more quality leads. At Twenty Over Ten, we work with advisors who serve many different niches, such as:

3. FOCUS LOCALLY

Okay, so maybe you really really can’t identify a niche for your firm. The next best option —focus on your local area! We get it, it can be hard for advisors to compete for local business, especially since every community has many advisory firms.However, your entire online presence – website, blog, social media profiles – are all great ways to drive awareness and generate more traffic to your website, and ultimately, more inquiries about the services you provide. In this way, you can grow your reach and one by one oust your competitors.Take David Walsh for example, an investment advisor representative with Voya Financial Advisors. David is St. Louis born and bred and cares about his local community. And that sentiment shines brightly throughout his website. Even though his website’s homepage focus may be on the communities of St. Louis, he still takes the time to highlight his firm’s fiduciary, independent qualities on the other pages of his website.

Even though his website’s homepage focus may be on the communities of St. Louis, he still takes the time to highlight his firm’s fiduciary, independent qualities on the other pages of his website.  Related: Advisors: Blogging is No Longer a Luxury but a Necessity

Related: Advisors: Blogging is No Longer a Luxury but a Necessity4. BRAG A BIT

There’s no doubt about it — self-promotion can be hard. The last thing you want to do is come across as arrogant because after all, people prefer humility, right?However, you should be proud of your team’s accomplishments, and our own research has shown that financial advisory firms that have a “featured in” or “as seen on” section get a higher number of qualified leads than those that do not. So don’t be afraid to brag a little.Showcasing your firm for its accomplishments whether it’s recent media mention, an award, etc. is a good way to market your firm and prove your credibility and expertise. Not only can this help to attract new clients it also communicates a larger message for your overall brand.Take Zega Financial for example. Their CEO & Co-Founder, Jay Pestrichelli, has a great relationship with the media and has done many on-camera and print interviews. In addition to putting these clips on their website, they can also share them on their social media platforms, in email newsletters, etc. These are all really great ways to drive traffic and interact with a different audience base than who you may typically interact with.To gain an even greater exposure be sure to give credit to the station or interviewer by tagging them when you share. Doing so gives you the opportunity to connect with an even larger audience.

In addition to putting these clips on their website, they can also share them on their social media platforms, in email newsletters, etc. These are all really great ways to drive traffic and interact with a different audience base than who you may typically interact with.To gain an even greater exposure be sure to give credit to the station or interviewer by tagging them when you share. Doing so gives you the opportunity to connect with an even larger audience.