Roth Conversions Can Dramatically Lower (Raise) Lifetime Taxes (Spending)

Roth conversions let you transfer assets from regular IRAs, 401(k)s, and 403(b)s to their Roth counterparts. Such conversions are, of course, taxable. But Roth assets grow tax free and aren’t taxed on withdrawal. Plus, Roth withdrawals trigger neither Social Security benefit nor Medicare Part B IRMAA taxation. Roth conversions also limit tax uncertainty, reduce future tax-triggering Required Minimum Distributions (RMDs), and facilitate higher lifetime spending, including larger bequests of Roth accounts with significant, albeit relationship-specific tax benefits to heirs.

Optimal Conversions - Highly Complex Due to Multiple Abruptly Moving Parts

Converting more this year means higher current, but lower future taxes. Current conversions also impact gains from future conversions. Thus, an optimal conversion strategy requires simultaneously deciding how much to convert this year and in all future years.

Moreover, conversions can change taxes abruptly by flipping you across tax brackets. These include the federal income tax’s seven brackets, state income tax brackets (Hawaii has twelve), Medicare’s six IRMAA tax brackets (based on modified adjusted gross income (MAGI) lagged two years), and two brackets beyond which either 50 percent or 85 percent of Social Security benefits are taxable (under federal and, in ten states, state income taxes. Also, the more you convert, the lower your future RMDs permitting a larger share of your future asset holdings to accrue income tax free. There are also brackets under the federal income tax for the High Earners Medicare Tax and Medicare net investment income tax.

In short, federal income taxes are only part of the optimal Roth conversion story and converting only when federal income tax brackets are low — the typical practice — is rarely best and may cost you money.

Remarkably, very large, short-term conversions can generate the largest lifetime tax savings and, therefore, highest lifetime spending despite potentially landing you in the top federal bracket. The reason? Doing so dramatically lowers your future taxes. Stated differently, Go Big or Go Home may be your best strategy.

Optimal Roth Conversions — One Size Fits None

Your age, spouse’s age (if married), longevity, wages, retirement dates, Social Security collection strategy, and levels of regular and retirement assets — all can make major differences to your best conversion moves. So do future tax policy, your Roth withdrawal (as opposed to conversion) strategy, and the state income taxes you’ll face in retirement. Finally, large, short-term conversions may be infeasible/undesirable if they’d produce major cash-flow problems.

Internal Consistency is Essential

Reducing lifetime taxes via Roth conversions permits higher lifetime spending with the pattern of increased annual spending depending on cash-flow constraints. But a household’s path of spending affects its path of asset accumulation, taxable asset income, and, therefore, taxes. Thus, Roth conversions impact taxes, which impact spending, which impact taxes, which impact spending, and on and on.

In math lingo of math nerds, optimal Roth conversions is a simultaneous equations problem with non differentiable, discontinuous, and non-convex constraints. In the lingo of English majors, determining precisely how much to convert and when to do so is a crazy complex chicken and egg problem, i.e., “I need to know A before I know B, C, and D, but I need to know B, C, and D before I know A. And the same goes if I switch letters.”

Any given conversion plan may not be the best, but it has to be internally consistent to understand the tax savings it delivers. Finding consistent financial plans, given our complex and highly non-linear tax systems, requires a special mathematical technique called iterative dynamic programming. My company, Economic Security Planning (ESP), received a patent for inventing this methodology. It plays a central role in the company’s economics-based financial planning tool, MaxiFi Planner. MaxiFi can generate internally consistent financial plans, including Roth conversion plans, within a second!

MaxiFi’s Roth Conversion Optimizer

MaxiFi’s Roth Optimizer finds the optimal Roth conversion plan — the annual conversion amounts — that collectively minimize your lifetime taxes and maximize your lifetime spending, to an acceptable level of precision. Before running the Optimizer, MaxiFi asks how much you’re willing to reduce your short-term spending in order to lower your lifetime taxes and raise your future and, thus, lifetime spending. MaxiFi’s Roth Optimizer generally takes a few minutes to search over all possible internally consistent conversion plans, excluding those causing unacceptable cash-flow problems. While the details of how the Optimizer works are proprietary, its easy to check each year’s tax calculations based on MaxiFi’s detailed outputs. Confirming the accuracy of annual tax calculations confirms the accuracy of the Optimizer’s lifetime tax calculation since lifetime taxes equals the present value of all future annual taxes.

Why MaxiFi Is Needed to Get Roth Conversions Right

The financial industry does conventional, not economics-based financial planning. Conventional planning elicits households’ retirement spending goals and then searches for investment strategies, often quite risky ones, to try to meet those goals. In contrast, economics-based planning determines how much a household can safely spend, on a sustainable basis, given its resources and the prevailing return on safe long-term inflation-indexed U.S. Treasuries, called TIPS. I.e., economics focuses on what households can afford to spend on a sustainable basis, not what they would like to spend.

Having set a retirement spending path, conventional planning assumes that any extra future resources, including tax savings from Roth conversions, will be saved. But if Roth conversions lower your taxes, you’ll want to spend more, not just accumulate more assets. In not adjusting spending, conventional planning fails to form internally consistent conversion plans. It also ignores cash flow constraints in assuming that spending goals will be met, with no cash flow problems, by high returns on what may be an overly investment strategy. And it has no means for finding the conversion plan that maximizes lifetime spending subject to the household enjoying as stable a living standard as possible and desirable.

A Case Study — John Considers Roth Conversions

John Adams (made-up name) is a close friend who I assist with financial planning. John is 65, retired, single, lives in Tennessee, and rents an apartment for $3K a month. John has $1.25 million in regular assets and $1.25 million in a regular IRA. In addition, John has a $45K nominal pension that will kick in at 70. That’s also when he’ll take Social Security, which will pay $57,582, valued in today’s dollars, per year. John’s investing in TIPS yielding 2% real.

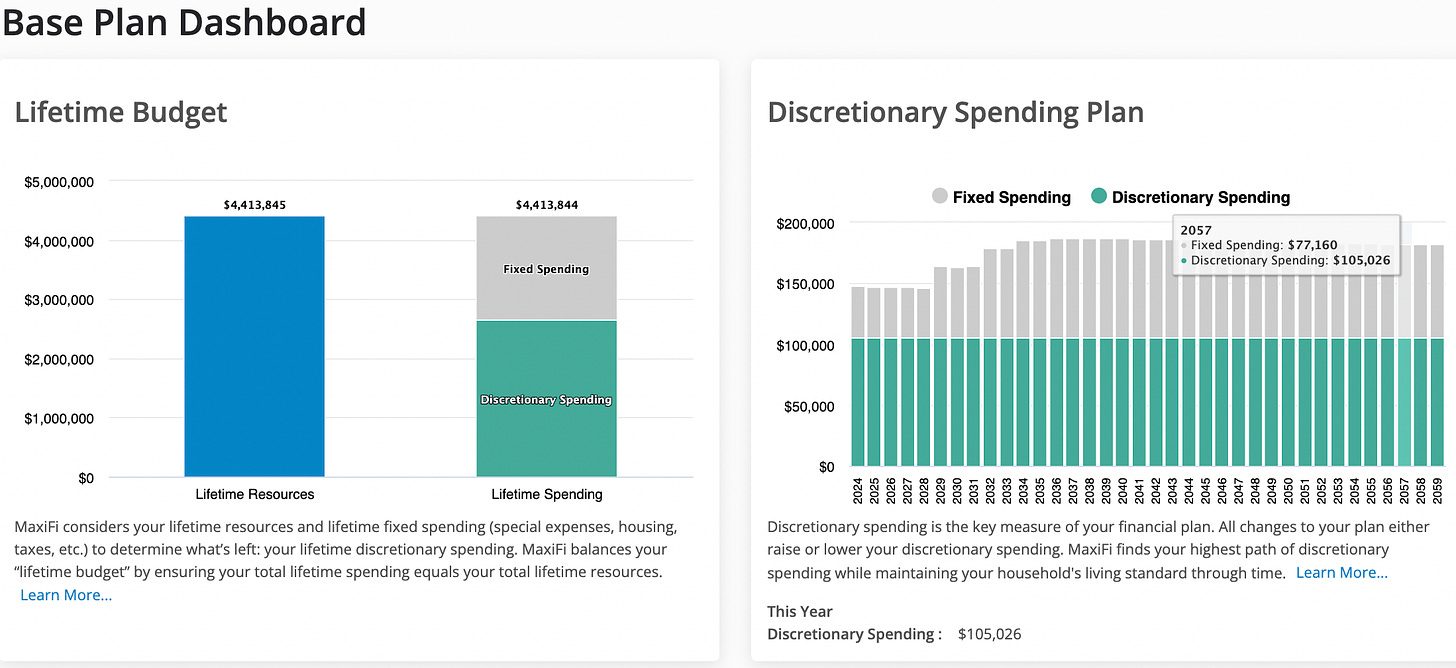

The charts below shows John’s base plan from running MaxiFi with no Roth conversions. On the left, you see that John’s lifetime fixed spending on housing and taxes plus his lifetime discretionary spending equals (within a dollar) his lifetime resources — all measured in present value. On the right you see that John’s able to spend $105,026 per year in today’s dollars — right through age 100, John’s maximum age of life. That’s the green bars indicating John’s annual discretionary spending. The grey bars show John’s annual fixed spending. The grey bars rise as he ages due to his paying taxes on his Social Security and pension benefits as well as his IRA withdrawals, which he intends to start at age 75.

Running MaxiFi’s Roth Conversion Optimizer

Next I told MaxiFi to run the Roth optimizer. But I restricted the optimizer to only consider conversion plans that entailed no reduction in John’s discretionary spending. I.e., I told it to throw out conversion options that involved his spending less in the short run in order to spend more later.

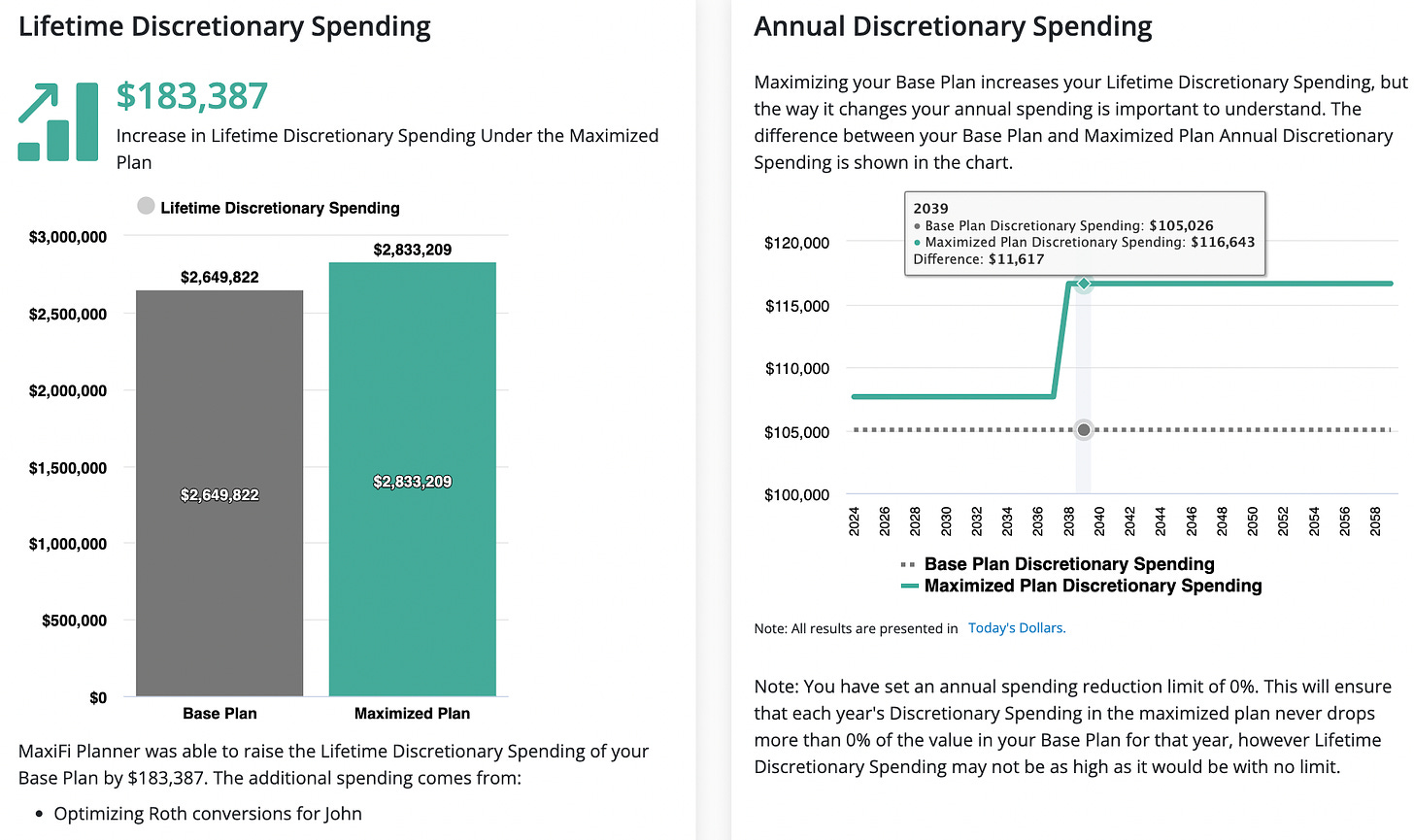

As indicated, MaxiFi’s Roth conversion optimizer found $183,387 in lifetime tax savings permitting John to spend $2,623 more per year through age 70 and $11,617 percent more per year thereafter. These tax savings are a huge. They represent 1.6 years of discretionary spending under his no-conversions base plan!

MaxiFi’s Conversion Message — Go Big!

MaxiFi tells John to convert $1,095,426 (simple sum, not a present value) of his $1,250,000 IRA holdings over the next five years according to the schedule shown below. With this conversion plan, John saves $$139,902 in federal taxes (Tennessee has no income tax) and $43,484 in IRMAA taxes.

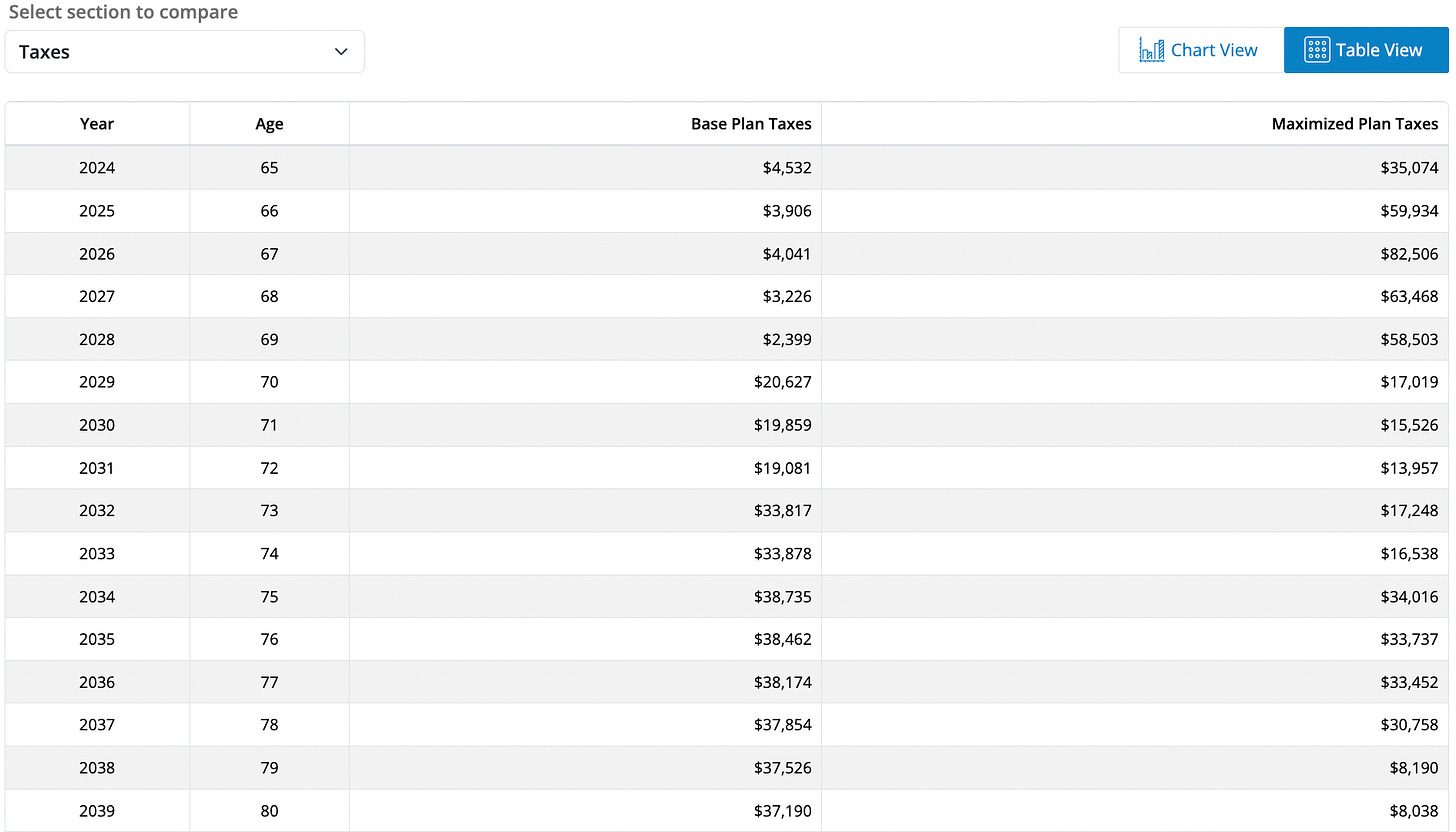

The last chart compares John’s annual taxes, through age 80, in his base plan and optimal conversion plan. Before age 70, John pays dramatically more annual taxes. But from age 79 on, he pays dramatically lower taxes. A similar story holds with respect to IRMAA taxes. At 69, John pays $7,550 in Part B premiums under the conversion plan — far higher than the $2,360 he pays at that age under the base plan. But from age 77 on, his IRMAA taxes are lower. After age 80, they are dramatically lower. For example, at age 81, they are $3,364 in the conversion plan and $8,746 in the base plan.

Checking Results and Alternative Assumptions

MaxiFi’s reports provide all the details needed to verify the accuracy of its annual federal and state income taxes, FICA taxes, retirement and all other Social Security benefits, and IRMAA taxes. In particular, MaxiFi’s Year at a Glance report lets you drill down to see the elements entering into taxable federal income.

You can also run MaxiFi’s Roth Conversion Optimizer under alternative assumptions about future tax policy, old-age medical and other off-the-top spending, retirement, relocation decisions, housings, …, you name it.

Take, for example, the likely retention of TCJA — the 2017 Tax Cut and Jobs Act, now scheduled to expire in 2025. Retention of TCJA will mean lower federal tax rates, a higher standard deduction, and other features, which, on balance, spell lower future taxes for most households. Does TCJA retention eliminate John’s gains from Roth conversions? No. But his maximum gains, while still huge, are smaller — $147,837 rather than $183,387. Interesting, the new total optimal conversions $1,072,143 are quite close to the $1,095,426 under current law (TCJA expires). Yet, conversions now extend over six, rather than five years with lower conversions per year.

What about the interaction of Roth conversions and Social Security? Suppose John planned to take Social Security immediately. How would that change his lifetime tax savings from optimal conversions, assuming retention of TCJA? They’d drop to $99,515. That’s still a massive gain — almost a full year’s discretionary spending.

Another way to view this finding is that the gain from optimizing Roth conversions is compounded by optimizing Social Security. Waiting until age 70 to collect benefits produces a $106,901 increase in lifetime spending. Maximizing Roth conversions as well adds another $147,837 for a total gain of $254,738. Hence, optimizing conversions when doing so doesn’t raise Social Security benefit taxation increases conversion gains by almost 40 percent. Indeed, it permits the gains from optimal Roth conversion to exceed those from Social Security optimization.

How Important is Getting the Timing of Roth Conversions Right?

Very important. Consider, again, the TCJA-retention case whose maximum conversion savings equals $147,837. This value is $40,761 smaller if the same $1,072,143 in conversions is spread evenly over just the next three years rather than allocated properly over the next six years. Clearly, the future is uncertain. So, Roth conversion plan needs to be updated annually. But does uncertainty combined with the importance of proper conversion timing argue for holding off conversions until the future is the past? No. On the contrary, the gains from conversion depend on the number of future years one a) enjoy tax-free asset accumulation unperturbed by RMDs and b) receive distributions that don’t trigger additional federal income, state income, IRMAA, or Social Security benefit taxation. To see this, consider how much the $147,837 declines if John’s maximum age of life is 95, not 100. Now the gains are $108,256.

Run MaxiFi’s Roth Conversion Optimizer Yourself

MaxiFi Premium, which includes its Roth conversion optimizer, costs just $149. I saved John 1,231 times $109 by running MaxiFi’s fully integrated MaxiFi Roth Conversion Optimizer! Plus, running MaxiFi is a kick. What other program can you run on a laptop or a mobile phone that can raise your lifetime spending by tens to hundreds thousands of dollars?

Worried about running financial software? Please don’t. We have terrific customer support. Just click the green Help icon, located at the bottom right of every screen, for context sensitive help or to connect, via email, with customer support. We also offer an Expert Review service with our head of customer support, Dan Royer, a Co-Piloting service, with PhD economist and CFP, Jay Abolofia, and a Larry Plans for You service with yours truly. Just go here and sign up.

Have Your Advisor Run MaxiFi’s Roth Conversion Optimizer

If you’re using a financial advisor, ask them to show you the difference between their conventional analysis and MaxiFi’s economics-based financial planning. If they aren’t willing to plan your finances in accord with standard economic science, developed by Irving Fisher, John von Neumann, Oscar Morgenstern, Franco Modigliani, Harry Markowitz, William Sharpe, James Tobin Paul Samuelson, and Robert Merton — all giants in economics, click here for a list of financial planners who use MaxiFi Planner every day with their clients.

Final Thoughts: Getting Roth Conversions Right Can Be As Important as Optimizing Social Security

Frankly, I’m amazed as the potential tax savings available from Roth conversions. Before we developed the MaxiFi’s Roth Conversion Optimizer, I manually ran small-scale conversion strategies for a range of different households — myself, relatives, friends, and MaxiFi clients. The results were disappointing. The reason is now clear. I hadn’t considered large enough conversions. Nor could I or anyone else get the timing of conversions correct using a hunt and peck strategy. As MaxiFi’s Roth Conversion Optimizer shows, Roth conversion can be a very big deal — indeed, potentially as important as optimizing your Social Security collection decisions. Hence, you owe it to yourself to run MaxiFi’s Roth Conversion Optimizer or have your advisor do so for you.