I was asked “when should I slow down or stop the marketing?”

Answer: “Your marketing never stops. Never.”

The rationale behind the question was the adviser has a good and large business – there are enough clients right now. So it wasn’t a stupid question by any stretch. But here is the thing: Even if a professional thinks they have enough clients and business is going great, ongoing marketing is needed. That is because clients have an unfortunate habit of leaving, or dying, or no longer needing advice….there is continual attrition in even the best client bases.

But you knew that.

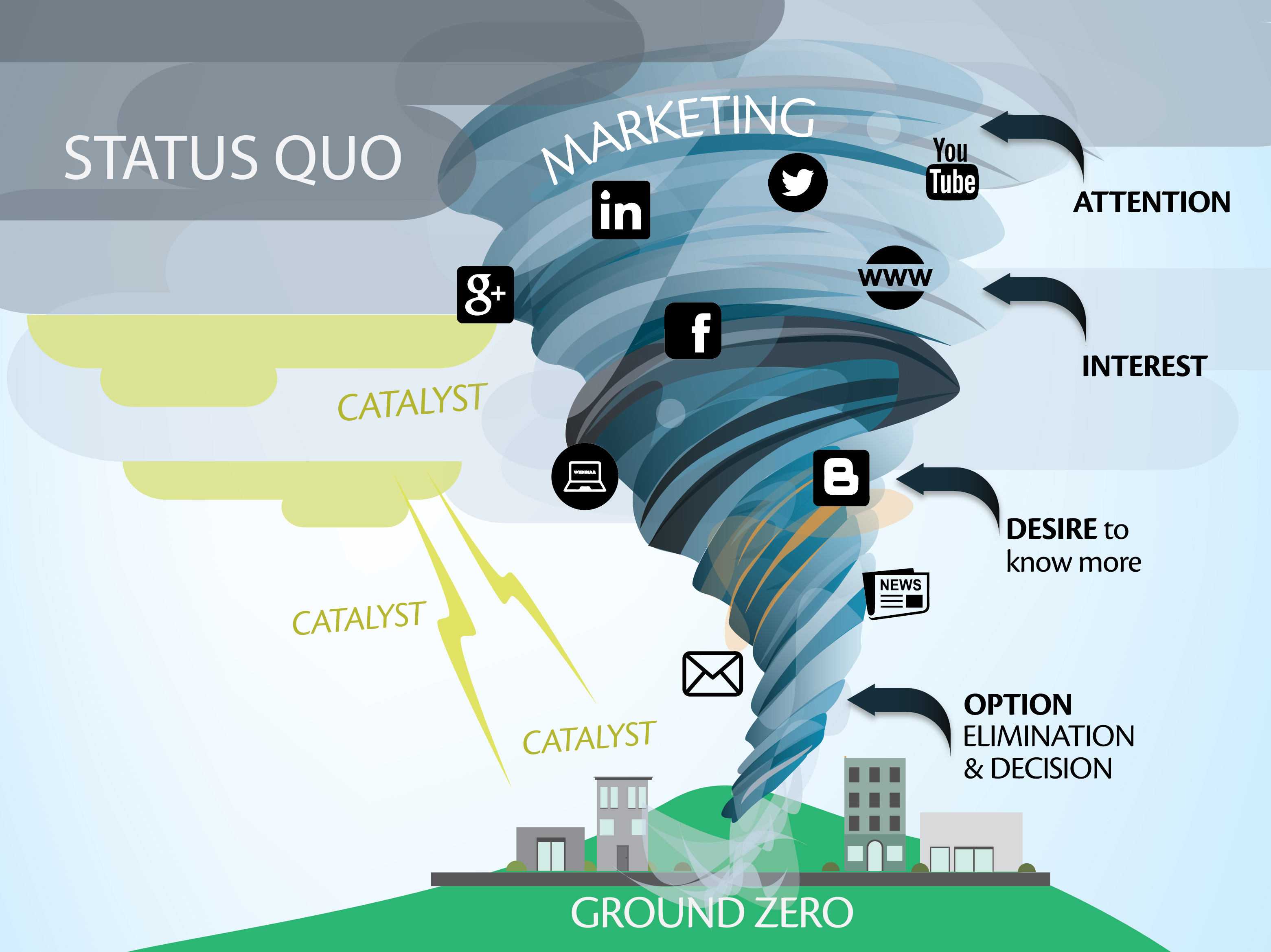

The more important reason for why marketing should never stop for professionals – especially those in financial services – is that if we are not constantly marketing and educating clients then we are relying on the catalyst events in people’s lives to trigger action on their part. And we know that it is usually too late to help with great advice once lightning has struck.

For financial advice in particular to be truly effective it needs to be provided before the lightning strike of sudden and unexpected disaster. It also needs to “pull” consumers towards advice, rather than try and push advice onto them when they are not receptive. Ergo! Constant marketing is required which creates momentum for consumers and leads them to advice logically and patiently…

We know that most consumers are travelling along happily enough in life, basically maintaining the status quo. They are busy working and paying mortgages and raising families….they are too busy living today to plan how life could be better tomorrow. Today is more pressing.

Until that lightning strike.

Effective marketing of financial advice has to disturb that status quo. Delivering useful information and content that educates creates the whirlwind that generates attention and interest is the beginning of the process that bypasses the need for a lightning strike to trigger action. It is the education and delivery of useful tools and information that is the critical difference between marketing effectively in today’s world as opposed to 10 years ago.

Using social media, websites, email and blogs are undoubtedly the easiest and most cost effective ways to do that when combined with good content, and can create the momentum that pulls consumers into the advice process – before there is a catalyst event in their lives hopefully.

Of course, the marketing of an advice business can be stopped anytime the adviser likes. There is a pretty strong probability that the growth of the practice will stop soon afterwards too. If an adviser is intentionally going out of business or retiring I guess there is no harm in stopping the marketing too. If however there is a desire to grow the book of business, or the value of the business, then the bad news is that marketing never stops.

Related: How To Deliver The "Right Advice" In The "Right" Way