In 2019, 44,000 advisors left broker-dealers while fewer than 40,000 joined the industry last year. Even though a large number of financial advisors are still registered with FINRA (Financial Industry Regulatory Authority), the organization is losing traction in the BD channel.

Why is this happening? There is an increasing popularity in the fee-only model, especially as huge financial companies buy out RIAs, there is a shift for independence. Most advisors strongly value the relationship with their clients, and when going independent, you can charge less in fees, therefore keeping more money with the client, which in turn, can really benefit you and them in the long run, keeping them happier and the relationship stronger.

Is your firm thinking of going their separate way? If so, there are some things to consider such as the typical launch timeline plus costs for a new website and social media strategy.

Launch Timeline

When it comes to going independent, there are some questions that you should be asking yourself about what you want to accomplish and how you are going to get there.

Ask yourself, “Do I really want to have my own advisory firm?” At this point, you probably know the answer to this one, but think about the pros and cons of why you want to break away from broker-dealers and start your own firm.

Start By Creating A Business Plan

For independent planners, make sure you are including:

- The goals of the business

- Specific strategies on how to achieve these goals

- The current state of the financial markets

- The demographics of clients and prospects

- How to differentiate your firm from the competition

- A flexible marketing plan

- All probable costs (these should be clearly defined)

- A realistic estimate of the amount of time it will take to accomplish the plan’s objectives

The timeline of this can vary per firm, as you will see below that Kyle Moore, CFP® of Quarry Hill Advisors built his client list out in just 2.5 years to over 50 families, but it really can vary for each firm.

We are breaking out some of the above points below:

FIGURE OUT YOUR BUSINESS GOALS

What do you want to achieve with your plan? What are your goals? Break out your objectives so that you can begin working on them. Start by giving yourself 90 days for the first step, and see where you are during that time period. Write out a physical list so that you can check them off as you achieve them.

FIGURE OUT YOUR BUSINESS MODEL

What type of services are you going to provide for your clients? Are you going to serve a particular niche? Serving a particular audience is a great way to get more out of your marketing dollar, so figure out your type of client and start figuring out how to target this niche when creating a business model.

How are you going to stand out from your competition? That’s another thing you need to figure out when building out your business plan. The financial industry is becoming more saturated, so how are you going to differentiate yourself?

BUILD YOUR CLIENTS

As we are all continuing to work virtually, it’s so important to build a strong advisor site so that you can create the type of content that will draw in the audience that you want to attract. Building your leads and turning them into clients can take some time, but with hard work and diligence, it can be done. When building your clients, who do you want to primarily focus on? Narrow down a specific niche so that you can really cater your marketing and content creation towards that specific audience.

Find out how Kyle Moore, CFP® started his own advisory firm and grew his firm to over 50 families that he serves in 2.5 years using a two-pronged marketing approach.

While it will take a lot of work to build your firm out and can take several years to grow it to where you went, everybody has to start somewhere. Once you figure out your business model and the niche you want to serve, you can begin to create an advisor website to start driving leads.

Budgeting Items

When launching your website, there are many crucial items to keep in mind for budgeting purposes.

Budget Line Item #1: Creating and Maintaining a Strong Website – $1,500 to $3,600

Many advisors were already headed down the “virtual” path, and the COVID-19 pandemic was expedited this process even more. So many potential leads are meeting you for the first time online through your social media platforms, visiting your website or simply Googling you.

57% of internet users say they won’t recommend a business with a poorly designed website on mobile.

Based on the quote above, that goes to show that an updated, well-design and compliant website is necessary. When choosing a hosting provider, there are many different ones to choose from, so here is a useful comparison of some of the industry’s top advisor website providers to keep in mind.

Okay, so you’ve made the decision to create a new website, so what should you be asking the sales representative? It’s very beneficial to get answers to the questions below so that you know fully what to expect and so that your website is mobile-friendly, has strong UX is compliant and displays exactly what your firm has to offer.

When it comes to building a website, choosing a strong provider is key. When working with Twenty Over Ten, users get a unique experience that you can’t get anywhere else. When working with Twenty Over Ten, the build process is incredibly easy, just follow the steps below.

STEP 1: CHOOSE A FRAMEWORK

The framework choices are:

STEP 2: UPLOAD YOUR LOGO

Your logo is one of hte most important parts of your firm’s brand, as this is what people most remember.

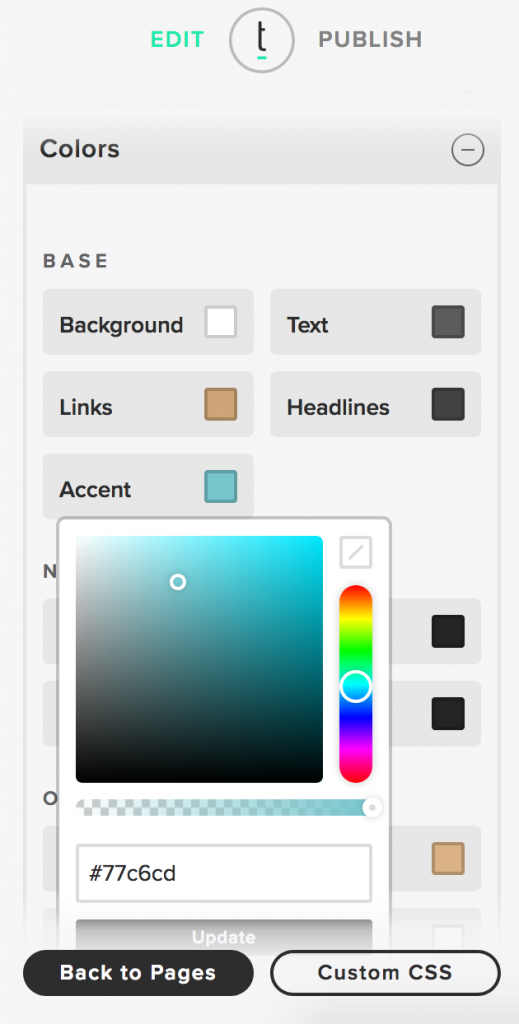

STEP 3: CHOOSE YOUR COLOR PALETTE

Choosing a color palette that will showcase your brand is key and incredibly easy in the Twenty Over Ten platform. You need to ensure that you are staying “on-brand” and once you pick the colors, let your team know which ones can be used in the logo, emails templates, any parts of the website, etc.

STEP 4: ADD YOUR CONTENT

Adding strong content as key, as it’s a huge part of your inbound marketing strategy. During this process, Twenty Over Ten can help you if you want help, or you may already have it written out. Regardless, our platform makes it very simple to add in, and people will definitely know what your firm does upon visiting your site.

STEP 5: CONNECT YOUR DNS (DOMAIN NAME SYSTEM)

Once you have your logo, color scheme, content and images all in place and you’re liking how your website looks, then it’s time to connect your Domain Name System (DNS)! Once you connect this, then it shows your website live! Check with your domain provider to see if there are any settings that need to be edited before doing this.

While we obviously suggest Twenty Over Ten, there are other website providers out there that you can use, such as:

- FMG Suite

- Advisor Websites

- Emerald

Budget Line Item #2: CRM – $35-$325/month

Even though Customer Relationship Management (CRM) doesn’t necessarily fall into the “marketing” category, it’s a crucial part of running your business. The reason a good CRM tool is so important is that it allows your firm to manage and analyze its interactions with past, current and future clients in order to understand how to better serve your users.

Pricing can vary greatly when it comes to a CRM, so probably anywhere from $35 to $325, and this all depends on the number of seats that you intend to use, what type of functions your tool will have and other factors. Some of the top CRM tools that we recommend are:

In 2017, Twenty Over Ten integrated with Redtail Technologies to improve communications, so now users can really use a platform to combine sales and marketing efforts. Redtail CRM is a cost-effective CRM tool that is designed specifically for financial advisors to help boost productivity.

Twenty Over Ten also integrated with Wealthbox, a web-based CRM tool for financial service firms. It is known for its modern product design that results in a simple yet powerful UX for RIAs of any size.

Some other CRMs that we do not have one-click integration with, but are great to use nonetheless are:

Having strong customer relationships at your firm is so important in order to ensure your clients and prospects are happy so that you can continue to grow while also giving your current clients the attention that they need. Keep in mind that a happy customer will be more likely to refer your business to others, so remember that when budgeting for your firm’s CRM tool.

Budget Line Item #3: Hosting and Attending Webinars – $14.99 to $499/Month

Before the COVID-19 pandemic, a big chunk of marketing should be going to hosting or attending events for networking purposes, but as the world has continued to social distance, this has completely changed. However, it’s still important to be networking where you can, and marketing yourself and showing that you are a thought-leader in the industry. How should you do this?

Enter: Webinars

Webinars are a fantastic way to showcase your firm as an expert in the field, meet other people virtually, get contact information for lead generation and show new products. In fact, when you host webinars, up to 40% of webinar attendees become qualified leads. Depending on the tools and technology that you use for webinars, the price can vary, just like a CRM tool.

At Twenty Over Ten, we have had great success with Zoom, but as you can see above, there are several different tools that you can use varying in price based on the number of participants and organizers.

Some other FREE tools that you should use when hosting your webinars are:

Budget Line Item #4: Social Media – $49 to $599/Month

Think that you don’t need to be on social media or that you simply don’t have time? Think again. Did you know that over half of consumers use social media to research products? With that being said, having a strong presence online is crucial for growing your business. Like CRM tools, social media tools have a very wide range in prices depending on the number of users and social profiles.

At Twenty Over Ten, we suggest to our advisors that they are on “The Big Three” platforms, which are Facebook, Twitter and LinkedIn. When it comes to staying in budget, setting up social media profiles is obviously free of charge, but if you are going to be posting frequently and trying to engage and keep up with multiple platforms, then there are some tools that you should invest in to make your process much easier and more streamlined.

LEAD PILOT

Lead Pilot is an AI-powered, full-service solution that combines personalization with automation to help financial advisors with their inbound marketing efforts. Through this platform, users have access to:

- Automated Drip Campaigns

- Email Marketing

- Social Media

- Lead Scoring & Profiles

- Branded Landing Pages

- Analytics

With the social media tool, you can easily share your content with your audience on social media, helping you to connect with new followers while engaging with current ones. With the Lead Pilot social marketing tool, you can:

- Schedule your content down to the minute to ensure you stay top of mind at all times.

- Automatic archiving satisfies all regulatory requirements for every social media post.

- From infographics, videos and more hand-select content to share from the Lead Pilot library or create your own.

If you are not quite ready to get Lead Pilot or don’t have it yet, then there are several other social media scheduling and archiving tools below that you can use.

HOOTSUITE

Hootsuite makes finding, scheduling, managing, and reporting on social media content easier

With Hootsuite, you can:

- Link Existing or New Social Media Accounts

- Compose posts and choose with platforms to use

- Add Links and Photos

- Schedule dates and times for posts to go live

Additionally, Hootsuite has a feature that allows a post to go live in combination with the optimum reach points and pre-scheduled posts during the selected day.

SMARSH

Smarsh was created to help advisors archive, store, and monitor its data in order to comply with the tight regulations. It has updated its technology to meet the needs of clients across an extensive range of industries.

This useful tool has:

- Intuitive tools to help identify relevant information

- On-demand access with “search ready” data

- Multiple formats and options to produce, package and deliver specific data

- Comprehensive and customizable reporting

HEARSAY

Hearsay makes it easy for advisors to nurture clients with personalized content, then connect one-on-one at moments that matter. It uses a simple, mobile-first approach and turns social media into an effective sales tool.

With this tool you can:

- Automate publishing with social media campaigns

- An Action List tool helps advisors keep track of “to-do” tasks

- Create and send out emails with email marketing tools

What Much Should Advisors Be Spending on Marketing?

Keep in mind that if you are focused on growth, then you should typically be spending about 4-10% of your revenue on marketing, however, the average advisor is spending about 1-2% of their revenue on marketing. As a firm that is preparing to go independent, then you will probably be a growth-focused firm, so it will be important to go beyond simply marketing yourself, but also focusing on personalization and automation.

When you sit down to map out your marketing budget, think about where your firm needs the most help and where you can leverage other tools and content to drive more leads and conversions to your site. It’s all about getting the most out of where you put your marketing dollars. The sample marketing budget below shows that if you are making $250,000 in revenue and you want to spend 5% on marketing initiatives, then that is where your expenses should be allocated.

Final Thoughts

Making the decision to go independent is exciting, but it is not a choice that comes without challenges. If you plan accordingly, however, and choose the best tools that work for you and your business and stay in budget then it will pay off significantly in the long run.