Your Intuitive Supplement for Online Business

It is important for financial advisors to stay in regular communication with their clients in normal times but even more so in challenging times when we are forced to work remotely.

A new normal: Financial Advisors and/or clients will not want to meet in person as often when the social distancing restrictions loosen up. Everyone has gotten used to working at home and being more physically distant.

Consider…

If you’ve only met your clients a few times, how effective will you be transitioning from “face” to online meetings?

Will you be as confident in your intuitive radar, picking up a client’s emotions when interacting online?

Do you actually know enough about the client’s financial behavior and have predictive insights into their likely reactions to market movements to be able to speak to them via video links as effectively as you might have previously done in face meetings?

What do you really know about your client’s financial behavior and communication style, particularly in high pressure circumstances? What about your own style?

Not in person, not the same

From working with clients remotely since 2001, the problem I see is that, while online meeting systems like Zoom and Skype may give you a visual on the client, they will not fully tell you the truth about their feelings and reactions – wittingly or unwittingly.

Advisors often tell us their intuition in client meetings is stronger than a robust behavioral assessment tool. Nevertheless, we have always maintained that at any time, combining intuition and measurable financial behavior data is the winning formula. That approach helps ensure the “brain speak” is never wobbly and the financial behavior reporting provides consistent, reliable natural guard rails.

So, when the direct physical line to the client is cut off – it makes the use of an independently validated behavioral tool all the more important to make up for the lost opportunities to leverage intuition.

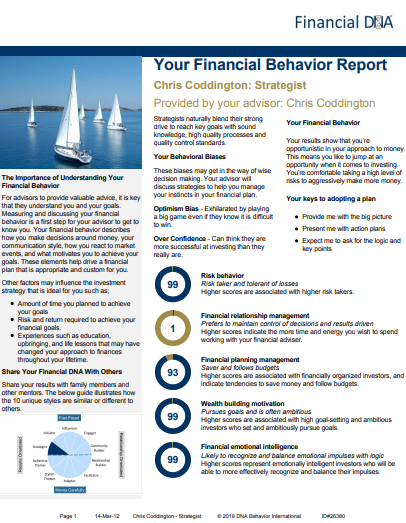

Your cheat sheet: Validated insights Here is an example of a DNA Behavior report that gives you a deep dive into both financial behavior, communication style and market reaction. Bonus: It’s delivered, in real-time, to any device you use.

Even if an advisor is confident and focused in in-person meetings, don’t assume that confidence is there on conferencing platforms and other forms of remote communication. We all react and behave differently to various forms of communication, both consciously and unconsciously. You just have to see some of the Zoom gaffes and parodies being passed around online to see this.

Just as important: Your client won’t necessarily be able to read you well or they might not present themselves to you in quite the same way when not face to face. This leads to difficulty in interpretation.

Are what clients saying corresponding to what they actually want or need? And are you relaying what you intend? Do you have the validated insights to know the difference both for you and for your client(s)?

Remote + your secret insights weapon

Conferencing platforms, social media and other means of communication are great levelers. So how do you bridge the gap and translate accurate, quality “face” conversations into this era of distancing and remote communication, using various forms of technology?

Well, you’ve got to Get Below the Surface (link to Part Two of the article), and that’s what we’ll talk about Next. Keep reading (link to Part Two of the article).

Related: Coronavirus Fear is Not a Winning Investment Strategy