Written by: Samantha Russell

The challenge of writing compelling emails often comes down to a balance of two things; quality and quantity. As an advisor, you need to be engaging your email list with consistent, personalized and relevant content. Creating emails that meet these criteria, though, can take a lot of time. This is where email automation steps in, providing financial advisors with a tool to schedule and create emails quickly.

Automation solves a lot of the challenges of email, namely quantity and a bit of quality. But, what you lose with automation is personalization — one of the biggest advantages to any advisor messaging.

In this blog post, we’ll cover the methods advisors can use to personalize their emails. From specific tools to examples, the information below will provide ways advisors can personalize their emails and enhance their communication.

How To Personalize Your Emails

Personalization goes beyond including the recipient’s name in your subject and salutation. Personalization involves the entire email process, including:

Send Time: Finding an optimized send time is important for overall conversion. You don’t want your emails to be buried in your recipient’s inbox.

Sender: The sender should be personal, not a brand name. You want to connect with the reader.

Recipient: Including your recipient’s name is a classic form of personalization. But it can go beyond that. Consider the other information you have about your recipients when crafting your final message.

Subject Line: The subject line is the opening sentence of your message. It needs to catch your reader’s attention. Personalization helps in this regard.

Content: The other factors on this list will get your recipient to engage with your emails, but the actual content is what will keep clients subscribed. Make sure it’s relevant.

Segments and Lists: A key feature of any email campaign is creating effective email segments and lists. These allow you to craft emails directed toward specific subscribers based on a set of criteria, like lead score, geographic location, profession, etc.

The items on this list require information to be effective. So before you start personalizing emails, it’s important to set up methods for gathering data from your email list. So be sure to take advantage of a CRM.

8 Ways Financial Advisors Can Personalize Emails

1. Send Emails Using a Name, Not a Brand

Readers want to receive messages from other people. It’s far more personal than a brand. But more than that, it implies that the sender is providing the information to you directly. It fortifies the one-on-one relationship between advisor and client.

For example, much of the FMG content that advisors receive comes directly from Samantha Russel, Chief Evangelist at FMG Suite:

![]()

2. Add a Photo To Your Signature

Sending emails under a personal name is a great start. But emails are often enhanced with imagery. Take advantage of this by including a picture in your email signature. A professional photo of yourself, or one you may use on social media, can enhance the quality of your message by giving readers a face to go with the name.

3. Add Emojis To The Subject Line

Emojis can be perceived in different ways. Some readers may view them as unprofessional. However, emojis are a powerful tool for email, increasing unique open rates by as much as 56%. So, even if your firm prefers not to use emojis, consider testing them out.

Emojipedia is a great resource here. Not only does it provide context on an emoji, ensuring its use in an appropriate manner. But it also allows desktop users to copy emojis into their subject lines without having to use a mobile device or other application.

Unsure of what emojis to use? Mailchimp has a list of the most popular emojis for subject lines:

4. Use The Reader’s Name When Appropriate

The classic personalization rule is to add your reader’s name to the subject or opening lines. It’s a common and reliable strategy. However, as Neil Patel suggests, it can also be overdone. Furthermore, SuperOffice data shows it doesn’t make a big difference in actual performance:

That’s not to say you should not use your reader’s name. It will all depend on your industry. For financial advisors, the service you provide is very personal. So, feel free to include the recipient’s name for now. This way you’ll still receive the benefits of referring to your reader, without over-doing it.

5. Optimize for Popular Email Providers

The email provider your recipients use can have an impact on the way your emails appear. As Backlinko suggests, it’s always a great idea to adjust for this factor. The number one email provider in the U.S. is Google Mail, at 53% of all email accounts and over 130 million daily users. So optimizing for Google Mail should be a top priority.

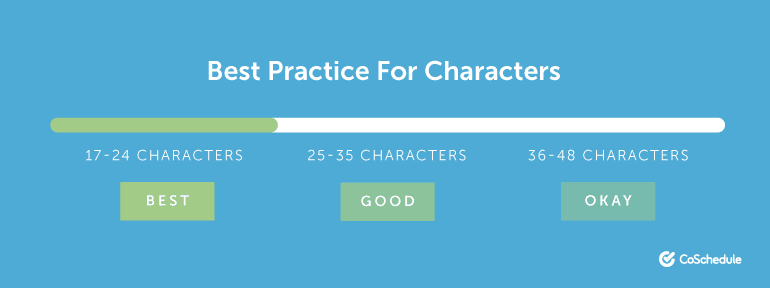

One of the best ways to do this is to keep your subject lines short and effective. CoSchedule can help out here with great resources like the Email Subject Line Tester, and a recommended subject line length:

6. Include a Video

Videos are huge across every form of marketing. But for emails, videos have been shown to increase click-through rates by up to 300%! If you’re already using video, then take advantage of your efforts and include them in your email messages. Furthermore, make sure to emphasize that your email contains a video by adding [Video] to your subject line or referencing it another way. This will further increase the chances of readers clicking and interacting with your message.

As an example, we follow all of our webinars with a video replay, leading advisors directly to a recording:

7. Provide Relevant Articles and Comments on Current Events

Your content needs to be related to subjects your reader cares about to be relevant, but it also needs to be timely. Don’t be afraid to craft custom emails that address current events in the financial industry. These can be incredibly powerful. After all, your clients are looking to you as the authority on financial subjects. Providing your opinion informs readers while solidifying the value of your emails in their inboxes.

8. Consider Other Forms of Communication

Personalizing doesn’t end with this list. Always keep in mind your audience and their preferred methods of communication, especially when writing the body of your email and drafting your content. What sort of words will resonate with your readers? What are their other interests and how can you relate them to your services?

Making these connections will make your message that much more valuable. After all, according to YCharts, email is one of the most important forms of communication for advisors:

Related: How Often Should Financial Advisors Send Emails? (4 Questions To Determine Frequency)