I’ve been fortunate enough to help tens of thousands of financial advisors get more clients, and here are some things I wish advisors knew about marketing…

Niche Marketing

1. Having a niche makes your marketing more effective.

Let’s say you’re a dentist and you’re searching for a financial advisor. You see two financial advisors on LinkedIn with the following headlines:

A: “Financial Advisor At XYZ Wealth Management.”

B: “Financial Advisor Helping Dentists Retire With Confidence.”

You are more likely to respond to the advisor with the niche-specific headline. Here’s another example…

This is an ad running on Facebook targeting - you guessed it - attorneys. Attorneys are more likely to respond to this ad than ads from generalist financial advisors. In fact, this ad ran successfully for more than a year. If you know anything about online advertising, you know that type of longevity is rare. Besides…

2. Casting a wide net might feel good, but it hurts your conversions.

Choosing a niche can be scary because it might feel like you’re alienating people who otherwise might work with you. This fear was expressed by an advisor who sent me the following email:

“Hey James, I’ve been listening to your podcast religiously for the past week (since I discovered you…) and recommended that a colleague read and listen to your content.

I totally agree with your take on having a specific niche market. As a former pediatric physical therapist, I want to work with pediatric healthcare professionals. Do you think I should narrow that down to only pediatricians? I don’t want to be so specific that I alienate all of the other healthcare professions.”

My response?

I told him that his fear is a common one. Yet, the degree to which being specific increases conversions is almost always greater than the alienation which occurs.

If you have a group of pediatricians and you work specifically with pediatricians, you may convert 10 of them into clients. On the other hand, if you’re a generalist and you have a group of 100 random people, you may only convert 5.

3. According to CEG Worldwide research, 70% of top financial advisors (defined as those earning at least $1 million per year) focus on a niche.

I know you’ve heard “choose a niche” a million times. Just do it.

4. According to Schwab’s 2020 RIA Benchmarking Study, firms with a documented ideal client persona gained 28% more new clients and 45% more new client assets than those without a documented ideal client persona.

Seriously. Do it.

5. You cannot be exclusive unless you exclude people.

If you want to become a better marketer, I urge you to harness the power of exclusivity. Because while I’m a big believer in attraction marketing, I’m an even bigger believer in repulsion marketing.

I’ve found if you can repel the wrong people from your life, the right people become even more attracted to you. When you only work with a specific group of people, those people take pride in knowing that those outside the niche cannot work with you. That feeling cannot exist without exclusivity, and exclusivity cannot exist without exclusion.

6. My favorite niches are occupation niches.

One reason why I love occupation niches is because they’re easy to find. Once upon a time, I had a financial advisor from Cleveland, Ohio tell me there weren’t enough teachers (his desired niche) in his area. So, I went to LinkedIn, typed in “teacher” and refined my search to Cleveland and the greater Cleveland area.

Guess what I found?

30,000 results.

This means I validated his niche marketing idea in a few minutes. Occupational niches are also my favorite niches because you can easily find podcasts, YouTube channels, blogs, and more about specific occupations. They can be perfect collaboration opportunities for smart financial advisors.

Continuing with the teacher niche, a quick Google search for “best teacher podcasts” tells me that there are currently dozens of podcasts geared toward teachers. All you have to do is send a message to the podcast hosts explaining why you would make a good guest. The worst that can happen is they say no, while the best thing that can happen is you get in front of an audience of people in your niche.

7. If you don’t know where to find people in your niche, it’s probably not a good niche for you.

This should be obvious, but I’ve heard from advisors who say they’ve chosen a niche and then ask me where to find these people. They should already know that answer.

Email Marketing

8. Email marketing is the best appointment-setting strategy for financial advisors, bar none.

Depending on the study you read, email marketing has a return on investment ranging from 3,600% to 4,400%.

Where else can you get those numbers? If you’re not harnessing the incredible power of email marketing, you’re leaving money on the table.

9. According to McKinsey & Co., email is 40X more effective than Facebook and Twitter combined.

Here’s a funny story…

One day, an inebriated ice fisherman drilled a hole in the ice. He peered into the hole and a loud voice from above boomed, “There are no fish down there.”

He walked several yards away and drilled another hole. He peered down his new hole and the voice boomed again, “There are no fish down there.”

He then walked twenty more yards, where he drilled yet another hole.

Again, the voice proclaimed, “There are no fish there, either.”

The fisherman looked up at the sky and asked, “God, is that you?”

“No, you idiot,” the voice said, “it’s the rink manager.”

Moral of the story? If you’re trying to accomplish a goal, make sure you’re in the right place to accomplish it.

10. According to Optinmonster, 58% of people check their email first thing in the morning.

Guess which message is likely to get consumed? Email.

11. Stock market commentary emails suck.

This is what financial advisors look like when they send stock market commentary emails and then complain that their clients worry about short-term volatility…

Stock market commentary emails are also ephemeral. I prefer marketing assets that can be used again and again. Evergreen marketing assets (such as entertainment, stories, lessons, etc.) rarely go out of style.

12. The most effective emails build rapport with your email list.

I’ve sent and tested millions of emails and this is one of my biggest discoveries. Even with the advent of robo-advisors, many people still want a relationship with a human financial advisor. So, advisors see better results when they relate to prospective clients on a human level.

One of the most successful emails I’ve ever seen was an email about Grey’s Anatomy (yes, the television show) sent to an email list of nurses. The email discussed all the mistakes he spotted in the show (“an IV doesn’t go there,” “that’s not how you perform CPR,” etc.). The email proved not only that the advisor specialized in working with nurses, but that he watched the same television show, too.

I see this effect in my emails, too. When I talk about popular books such as Think And Grow Rich or movies like The Avengers, financial advisors respond back with their input and we bond over liking the same things.

13. Plain text emails typically work better than fancy ones.

Test it for yourself if you don’t believe me.

14. Daily emails work best.

In my experience, daily emails have higher conversion rates than monthly, biweekly, or weekly emails. If you don’t believe me, test it for yourself.

And I don’t mean you have to sit down and write a new email every day, either. An awesome feature of email marketing is that you can use an autoresponder sequence to send out emails in a predetermined order and sequence. With an autoresponder sequence, your prospective clients should go through the same sequence whether they subscribe today or three weeks from now.

Another reason daily emails work best is because they allow you to follow up several times in a row. Most sales studies have found that most conversions happen after the fifth touchpoint. My anecdotal evidence confirms this as well, which is why I recommend that financial advisors have at least five emails in their autoresponder sequences.

Prospecting

15. “Making more calls” is not the answer.

One of the dumbest things I catch people telling struggling financial advisors is to “make more calls.”

(Substitute calls for whatever you want - mailings, messages, emails, etc.)

This is terrible advice because if a financial advisor is struggling, it’s a symptom of a broken process, and trying to expand a broken process is a recipe for disaster.

Imagine biting into a spoiled sandwich and feeling sick. Eating the rest of the sandwich is not the answer. The answer is to go back and fix the process, aka get a new sandwich.

For example, if you’re saying the wrong things or targeting the wrong prospects, “more calls” isn’t the answer. You have to fix the root cause because…

16. The key to successful prospecting is increasing volume AND effectiveness.

Continuing with the “make more calls” example, I want you to imagine that a financial advisor has a website that has never converted a single prospect into a booked appointment. The conversion rate is a big, fat 0%.

Should the advisor send more traffic to the site?

No!

Yet, that’s precisely what happens when advisors fall into the “make more calls” trap or when advisors are taught that prospecting is merely a numbers game. Because without a solid foundation, increasing your volume won’t make one iota of difference.

17. Video messages work well.

If you want to increase your message conversions, send a video using a service like Loom or BombBomb. You can get even higher conversions by having your recipients’ LinkedIn profiles or websites as the background so they know the video was made specifically for them.

Another way you can use video messages is by recording a personalized birthday video for your LinkedIn connections. I’ve done this in the past and it works well. I’m not lazily copying and pasting “Happy Birthday.” I sent my connections a video where I personally wished them a happy birthday wearing a big, goofy hat with candles on top.

Here’s the hat…

18. The idea of a “natural market” is a crock.

I’m about to dispel one of the biggest “myths” new financial advisors struggle with.

Read this email I got from a new advisor…

"I have recently entered the financial services field. I have over 250 people in my natural market with the majority of them being in the $100K income level.

However, since I’m only 25 and the major portion of my natural market is under 30 years old, I can’t imagine gathering huge assets from them. Should I approach them with insurance instead of investments?"

My answer?

The idea of a “natural market” is a complete crock. I want you to imagine you’re a doctor and you just opened a practice. Would you look for a “natural market?”

No! 🙄

You’d look for sick people. Let’s try another one…

Imagine you went into the roofing business. Would you approach your “natural market” and expect to do business with you.

Again… no!

You’d look for people who need new roofs.

Why in the world would this concept be any different for financial advisors?

That’s why in Your First Year as a Financial Advisor, I explain how trying to do business with family and friends (the “natural market” ) is one of the WORST things you can do as a financial advisor.

Don’t get me wrong - the idea of a “natural market” makes sense on paper. After all, these are people who already know, like, and trust you, right? And they probably need money management, insurance, etc.

Yep. Pretty attractive idea. But it can set you up for long-term failure.

19. Consistency is the key to prospecting success.

Pick something you can do every day, and do it. A mediocre prospector who works every day will beat a superstar prospector who doesn’t work.

20. Focus on your inputs more than your outputs.

The bottom line is that you can’t directly control how many clients you get, but you can control your behavior. You have complete control over your marketing strategies and your activities.

21. You don’t have to be an extrovert to be an effective prospector.

Harvard Business School did a study that found that introverted leaders are typically more effective than extroverted leaders.

This is because a quieter, calmer leader is more likely to:

-

Listen carefully…

-

Stay focused, and…

-

Not be afraid to work for long stretches of time without interruption.

These are all characteristics that make up successful financial advisors. That’s why I wish the financial services industry would ditch this myth that you need to be some gregarious extrovert in order to succeed. Because it’s just not true.

Introversion and extroversion both exist on a spectrum. You’re never either/or: you’re a combination of both. Personally, I’m pretty evenly split between the two. I like my alone time, but have no problem mixing it up with other people.

But introverts - on average, none of this is absolute - tend to make better financial advisors because they’re better listeners.

Any financial advisor who listens carefully to prospective clients and truly understands them is more likely to get those prospective clients to say “yes” to working with them.

Good listeners build trust, and trust is necessary to earn cooperation from people. It’s that simple.

22. Embrace outbound marketing strategies while building your inbound marketing machine.

Outbound marketing is when you initiate a conversation. It includes things like cold calling, messaging, direct mail, and so on. It involves pushing OUT into the marketplace and making your voice heard.

Inbound marketing is when prospective clients find you. It includes things like blogs, podcasts, opt-in emails, and more. It involves pulling people IN to hear your message.

Sadly, many financial advisors approach these two marketing schools as either/or. For example, one financial advisor may tell his colleagues to “just pick up the phone and dial!” (outbound marketing) while another advisor may brag that he has built his business primarily via referrals (inbound marketing).

My marketing philosophy is built around the idea that you should do both. Because the person who does nothing but outbound marketing can benefit from adding inbound marketing strategies, and vice-versa.

23. Wealthy investors, defined as those with a net worth of over $1 million, are less likely to consider a friend’s recommendation when searching for an advisor.

This finding comes from research published in Financial Advisor Magazine (specifically, an article titled “How Consumer Choices Differ”). It states that wealthy investors rely on trusted professionals such as CPAs and attorneys.

Another interesting tidbit about wealthy investors is that they are less likely to MAKE a referral. So, if you’re targeting these people, you should focus on building strategic alliances with other professionals.

24. Business owners care about your first impression.

Another finding from the research mentioned above is that 23.1% of business owners cited the impression the advisor made during the first meeting as the decisive factor in their selection process. Only 11.5% of business owners reported being influenced by family members or friends.

This means if you want to work with business owners, you should put extra effort into making a great first impression.

Also, only 15.4% of business owners said they have never made a referral, compared to 30.8% of employees and 34% of retirees.

Finally, 30.8% of business owners consider themselves raving fans of their financial advisors, compared to only 19.6% of employees and 14% of retirees. So, if you work with business owners, you are more likely to get referrals without much effort.

Website Marketing

25. Ditch the photos of lighthouses, compasses, and couples jogging on the beach.

These are so common it’s become a running joke.

26. Ugly websites tend to get more conversions.

Here’s one of my favorite quotes:

“The ugly thing in a world of beauty stands out.” - Eugene Schwartz

Most financial advisors try to make their websites pretty. They want it to “match their brand” and stuff it full of big logos and slideshows. Or worse, they take the advice of a web designer whose only objective is to make your website look good.

The problem with this is that good looks are often in direct opposition to good marketing. Because, in my experience, ugly websites tend to have higher conversion rates than pretty ones.

My belief is that your website should make you money. I could care less about looks or designs because you are running a business, not a fashion show.

In my opinion, the purpose of a website is to maximize the chances of turning a web visitor into a lead and then into a client. Nothing more, nothing less.

27. Not all stock images are bad.

Self-proclaimed experts and marketing agencies love to hate on stock images, but let me tell you a secret…

I’ve conducted split-tests where stock images have been massive winners.

Big companies understand this well. The next time you see an online ad from Walmart, Amazon, Target, etc. pay attention to the type of image being used. Chances are it’s a stock image.

28. Include photos of you.

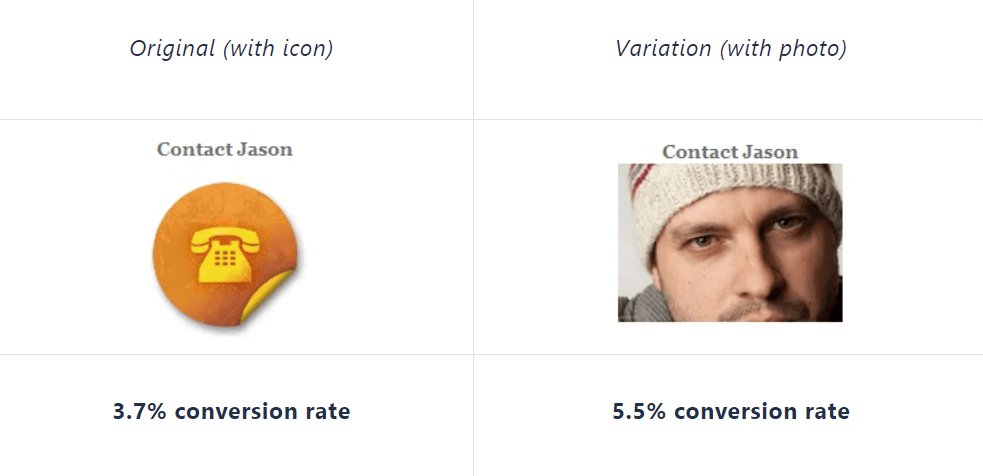

A/B testing company VWO ran a split test on one of its user’s blogs to see if replacing a generic contact icon with his photo would lead to more people contacting him. They found that using his face as the contact icon increased conversions by 48%.

29. If you have a niche, make it known on your homepage.

Put it front and center. So many financial advisor websites could be improved with this one thing.

30. Show, don’t tell.

People sometimes believe what they are told, but they never doubt what they conclude.

To illustrate this concept, I want to share a story I once read about Ted Turner, the billionaire media mogul. In the story, there was a brief account of the author riding in Turner’s truck as they got to know each other. Along the way, Turner unexpectedly stopped and, without saying a word, walked over to a soda can on the ground. He picked it up, threw it in his truck bed, and continued driving.

With that single anecdote, the author painted a picture of an environmentally friendly and conscientious man. Had he explicitly said those things about Turner, they would have gone unnoticed or met with skepticism. Yet, the author allowed me to form my own conclusions by showing me instead of telling me.

This is powerful stuff. Now, let’s apply it to financial advisors…

Several years ago, I offered a service where I would review financial advisor websites and give specific, actionable advice on how to make them better. I noticed most websites TOLD people what to think. They TOLD visitors about why the financial advisors were awesome, why people should do business with them, and more.

This was a mistake because it’s far more effective to let people come to their own conclusions. It’s also why website visitors view phrases like “we operate with integrity” or “we’re honest and hardworking” as red flags to be avoided.

If you want to get more clients from your website, you need to structure it in such a way so people naturally conclude what you want them to conclude.

P.S. If you want to see my proven website marketing process, go here: The Client-Getting Website

Content Marketing

31. Content should advance the conversation with prospective clients.

A big mistake I see financial advisors making with content marketing is making content for content’s sake. Many people think all they have to do is create amazing content and the clients will roll in. This isn’t the case.

Content should have a clear next step. People need to be told exactly what to do after consuming your content. Don’t get people all dressed up with no place to go.

32. Pay attention to what people do instead of what they say.

What people say and what they do are two different things.

People say they want the lowest price. Yet, what phones do these people have? Probably iPhones, which are not the cheapest phones on the market.

People say they’d rather watch a documentary instead of reality television. However, here are some of the most popular television shows of all time: “The Real World,” “The Bachelor,” “Keeping Up With Kardashians,” and “Flavor of Love.”

People also say they want information. Yet, based on what I’ve seen, purely informational content (aka hard teaching) has low conversion rates compared to entertaining and engaging content. Allow me to give you an example from The Advisor Coach…

I once conducted a webinar with an audience of 300 financial advisors and delivered nothing but pure information. There was no entertainment whatsoever. All I did was give facts, data, and statistics about what works and what doesn’t in marketing. I taught my butt off.

Then, I made an offer… and got crickets.

Hmmm.

A few weeks later, I did another webinar with another audience of roughly 300 financial advisors (from the same traffic source) and gave the same general presentation with a lot more entertainment and humor in it.

Then, I made the same offer and had several people say “yes.”

Coincidence? I don’t think so.

33. Content marketing can make you lazy.

This happens when people mistakenly believe content marketing is free. They think it costs nothing to publish a podcast episode, share a blog article, or create a lead magnet.

I consider myself fortunate because I cut my teeth studying direct mail marketers. That’s an entirely different ballgame because it costs money to send stuff through the mail. For instance, a single direct mail promotion might cost two or three dollars per recipient.

Imagine if it cost you two dollars to get in front of each of your website visitors. Would you approach content marketing differently?

34. The best content connects to other content.

This is one of the best tips I can give you. Most people are probably going to ignore it, so don’t be like most people…

Let’s say you’ve written some articles for your blog. Those articles should link to other pieces of content from you. If people are consuming your content, they obviously like it. Give them more of it. Give them more opportunities to take you up on what you offer.

The most successful companies in the world follow this principle. Spotify does it when its suggests music for you. YouTube does it when it gives video recommendations. Amazon does it with product recommendations. These companies don’t just give you whatever you’re consuming and call it a day. They give you more opportunities to engage with them. This isn’t a coincidence.

35. Data should inform your decisions.

This tip can apply to all the categories, but I’m putting it in the content marketing category because your most successful content pieces should influence the content you create going forward.

For example, if you find that a blog post about a particular topic is generating 50% of all your website traffic, you have proof of concept and should create more content about that topic. Likewise, if you have content that falls flat on its face, you should take it in stride and avoid making the same mistake in the future.

LinkedIn Marketing

36. Tracking your metrics is critical for LinkedIn success.

What I’m about to say may seem painfully obvious to some people, but I’m amazed by how many advisors still don’t “get” it…

Marketing is math.

The name of the game is to put one unit in (time, money, energy, etc.) and get more than one unit back. You do that by knowing your numbers. Just as you would never create a budget or savings plan without knowing certain numbers, you should never approach any marketing strategy without some sense of how the numbers going to work in your favor. Especially on LinkedIn. For example, here are some important numbers to know…

-

Your connection acceptance rate. If you send 100 connection requests to people in your niche, how many of those people accept your request?

-

Your appointment-setting rate. If you engage 100 people in your niche, how many of them set appointments with you?

-

Your client conversion rate. If you set appointments with 100 people, how many of them become clients?

Once you know the answers to those questions, LinkedIn becomes a fun game. A game where you can practically get clients on command. The only limit is how consistent you’re willing to be.

37. Vanity metrics are nice, but they’re not correlated with more clients.

Look at the photo below. You can see how one of my LinkedIn posts received 74,659 impressions…

But guess how many financial advisors I helped as a result of that post? Zero.

Yet, posts with smaller reaches have led to multi-thousand-dollar business engagements. Don’t lose sleep if your posts aren’t getting thousands of impressions, hundreds of likes, and so on. Trust me when I say that people are noticing you and your content.

LinkedIn is a wonderful platform because it allows you to put your beautiful face and headline in front of hundreds of people with the click of a button. Besides…

38. The money is in the inbox.

So many financial advisors have hopped on the LinkedIn bandwagon. They’re following influencers, engaging with prospective clients, and posting tons of content. None of that stuff is bad in and of itself, but these advisors often leave out a critical element…

Direct messaging.

Put simply, financial advisors who succeed on LinkedIn are heavy users of its direct messaging capabilities. But you don’t have to take my word for it. Because, according to Putnam’s 2020 Social Advisor Survey, 94% of advisors seeing success on social media (getting new clients) are using direct messaging capabilities.

This means if you’ve been sold this idea that all you need to do is post endless pieces of content, you’ve been sold a lie.

The right way to get clients with LinkedIn is to use your content to strengthen your direct messages…

To engage with people to drive direct messages…

And to use other people’s content as a way to break the ice… in direct messages.

Why? Because the money’s in the mailbox.

(Shameless plug: as far as I know, How To Get Clients With LinkedIn is the only system in the entire world that was created with this in mind.)

Everything you do should either increase the chances of having a conversation or make the conversation better when it happens. Most LinkedIn programs fail because they’re not designed to foster this critical component.

The only thing that matters is talking with prospective clients. All roads should lead to that happening.

39. You don’t need LinkedIn Premium, but it helps.

I went years without using LinkedIn’s premium plan. I’ve also taught tens of thousands of financial advisors how to get clients with LinkedIn using nothing but LinkedIn’s free features. However, I’ll be the first to admit that having a premium plan helps for a few reasons…

First, having the “Premium” badge makes it likelier that people will accept your connection request. If you’re regularly sending connection requests, this conversion boost can help Premium pay for itself.

Second, Sales Navigator is awesome. The advanced searches help you find exactly who you want… you can create lists of prospects… you can integrate it with your CRM… you can add notes within LinkedIn… and so much more.

40. Talk like a human being.

All too often, I see financial advisors sabotaging themselves by appearing robotic online. What do I mean?

I mean using cold, standoffish language that doesn’t seem like anything a live human being would use. I see it all the time on LinkedIn when financial advisors send messages like:

“Good evening, I would like to express my gratitude for connecting. I am a fee-only financial advisor who assists pre-retirees with financial planning to ensure maximum retirement satisfaction. Is there a time at which you are available to converse about this subject?”

Ugh. 🙄

If you wouldn’t talk like that in person, don’t talk like that online.

ALSO READ: 5 LinkedIn Tips For Financial Advisors

P.S. If you want to connect with me on LinkedIn, here's my profile: James Pollard's LinkedIn Profile

Business Philosophy

41. Strive to be a doer, not a viewer.

There are two types of people in this world…

“Viewers” and “doers”.

Viewers are people who VIEW information and never use it. These aren’t bad people, by any means. They’re just regular people with employee mindsets who can’t wait to get home to binge-watch Netflix and eat Cheetos.

(And many of them can’t apply the information because of a deep-rooted fear of success. Yes, this is a real thing, and I’ve seen it many times. People are literally afraid of making more money, having more time off, etc.)

Doers are the opposite. Here are two examples of doers…

The first one is an advisor named Sam from Northwestern Mutual. I’m not revealing his last name or his profile picture for privacy reasons. But he says I literally saved his business in January.

Here’s another one…

This is an advisor named Douglas Oliver, who told me he literally can’t handle any new business. He’ll hit $3,000,000 GDC this year and cannot get enough trained staff to grow any faster.

42. Don’t be a dopamine junkie.

I’m notorious for blacklisting financial advisors who cancel my monthly paper-and-ink newsletter. If they’re not willing to stay committed, I don’t want them back. When we get a cancellation (which is rare) we block the IP address and email address, and put the person on a blacklist we cross-reference every time someone joins. Don’t believe me? Here’s the blacklist…

Am I being a jerk about this? Am I losing money? Nope and nope. Because anyone who joins any high-quality newsletter (not just mine) only to quit has the wrong mindset and should have never subscribed.

Quitters are dopamine junkies. They get a hit of dopamine when they subscribe. They feel good about investing in themselves and think they’re doing something positive. In reality, nothing happens until they implement the information.

Pick something that works and stick with it until you get results.

If you're interested in checking out the newsletter, here it is: The James Pollard Inner Circle Newsletter

43. Litmus tests allow you to separate good prospects from bad ones.

Here is a concept few people understand, and even fewer people implement…

It’s the concept of using litmus tests within your business.

For example, I once attended a webinar with a group of 44 business owners who were all crushing it in their respective spaces. To attend the webinar, you had to deposit $1,000. And when I saw the deposit requirement, I knew I had to attend.

Why?

Because the hefty deposit was a litmus test separating serious people from everyone else. Here’s a sampling of who was there…

- Someone making $230,000 per month directly from a lead magnet to email marketing sequence.

- Someone making $100,000 per month helping new moms lose their baby weight.

- Someone making $1,000,000 per month helping attorneys get more cases.

Lots of people were whining and complaining about the deposit requirement. Their thinking was that the webinar should’ve been free to attend. These are the same people who throw hissy fits when asked to pay for a product or service. I’m glad they didn’t attend.

Oh, and guess what the attendance rate was for this webinar?

100%.

Yep, that’s right. Every single person who plunked down a thousand bucks showed up.

That’s incredible because the average webinar attendance rate is 40%.

🤯

It’s incredible to see what can happen when a litmus test is used.

Now, how can you use this idea in your business? Let’s brainstorm…

You could include specific instructions for contacting you through your website. Anyone who ignores the instructions should get ignored by you.

You could create a policy to avoid doing business with anyone who ghosts your initial meeting without an explanation. In my experience, people who no-show meetings without a valid reason almost always end up causing headaches.

You could create a lead magnet or some sort of deliverable for prospective clients to read before meeting with you. People who don’t read it will reveal themselves as not 100% sold on you, your company, and/or your value proposition. As such, you could tailor your approach to get them on board.

I could go on.

In any case, having litmus tests sprinkled throughout your business is a great idea because it helps separate the good prospects from the bad ones.

44. Focusing solely on “best practices” can hurt you.

The term “best practices” gets thrown around a lot in the financial advice industry. There are magazines, blog articles, YouTube videos, and podcasts dedicated to this concept.

But what if these “best practices” are hurting you?

Behavioral researcher Wendy Joung was interested in seeing whether certain types of training programs are more effective than others at minimizing errors in judgment on the job.

She wanted to know if focusing on past errors others have made would provide better training than focusing on how others had made good decisions in the past.

She tested her hypothesis on firefighters.

In the study, a training and development session that contained several case studies was given to the firefighters.

One group learned from case studies that described real-life situations in which other firefighters made poor decisions that led to negative consequences.

The other group learned from case studies in which firefighters avoided negative consequences through good decision-making.

Joung found that firefighters who underwent the error-based training showed improved judgment and were able to think more adaptively than those who underwent the error-free training.

The science is clear…

Any form of training that focuses exclusively on “best practices” is NOT as effective.

45. Written marketing plans are correlated with success.

Succeeding as a financial advisor involves a lot of moving parts. There’s prospecting, choosing a niche, gaining technical expertise, and so on. You’ve undoubtedly heard about those things before. Heck, I’ve covered them in this article. Yet, there’s still one thing that instantly separates the top 20% of financial advisors from everyone else.

What is it?

It’s a plan.

I think Benjamin Franklin put it best when he said: “If you fail to plan, you are planning to fail.”

Think about this…

According to the consulting firm CEG Worldwide, 80% of advisors producing $1 million or more have written plans. Those making $75,000 or less have written plans only 7% of the time.

46. Sometimes you need to shut up and follow directions.

Back in 2015, I bought a book called “Video Poker - Optimum Play” by Dan Paymar.

I studied it from start to finish and took pages of notes.

It told me exactly how to play perfect video poker, including which machines to look for to find a better edge.

(If you’re thinking about doing this today, don’t bother. Only certain machines gave players an edge when played perfectly, and only a handful of casinos had these machines. Today, they’re virtually nonexistent.)

After reading that book and - most importantly - implementing the material, I made decent money.

I started off slowly. I must have averaged $5-10 per hour in winnings at first. As I increased my bankroll, I probably earned around $50 per hour.

That might not sound like much, but I also used my casino player’s card to track my play. And since I played so much, I got free rooms, free meals, free drinks, and free show tickets. My wife and I had some amazing date nights.

Why am I telling you about this? Because…

I didn’t think I was smarter than the system.

I didn’t second-guess the book.

And I didn’t let it sit on the shelf.

I used the information and benefitted.

I help financial advisors for a living, and I wish more advisors thought this way.

Just. Follow. The. Darn. Directions.

47. Your culture is influencing you.

I’ve been writing this article while bopping around the Gulf Coast. Most of my time has been spent in Louisiana and Mississippi. I’ve written and talked a lot about how cultures vary across the country, and these states are perfect examples. For example, I was in Nevada a few months ago. Locals describe the heat there as “dry” heat because Nevada has some of the lowest humidity levels in the country. Well, let me tell you…

The heat here in the bayou is definitely NOT dry. It’s humid.

Also, I learned that Nevada is one of the least-educated states in America. So is Mississippi (sorry Mississippi).

Inspired by that fact, my wife and I went on a Googling binge. We searched stuff like…

“States with the worst traffic.”

“States with the best nightlife.”

“States with the best beaches.”

And for kicks and giggles, we Googled, “states with the most alcoholics.”

Guess what state has the most drinkers? Well, according to a 2020 study conducted by the Robert Wood Johnson Foundation, it’s Wisconsin.

The state with the fewest drinkers is Utah. That doesn’t surprise me. It’s followed by West Virginia and then Mississippi.

So, even though Wisconsinites might have a better education than Mississippians, at least the fine folks down here aren’t hitting the bottle every night.

Again, this is all about culture. Different states have massive differences between them.

And you know what I’ve discovered?

Success has a culture, too.

Imagine living in Wisconsin your whole life, where nearly a quarter of adults drink excessively. You would think that’s normal when it’s not.

The same thing happens with attaining success, and vice-versa. If you hang around people who have never accomplished much, it becomes your culture. The same is true if you associate with people who are growing their net worth, maintaining their physical health, and loving their families.

Most people would DO better if they KNEW better.

48. Most people are too busy earning a living to make any money.

Here’s one of my favorite quotes…

“All of humanity’s problems stem from man’s inability to sit quietly in a room.” - Blaise Pascal

Every so often, I will sit with a pen and paper (and my phone in airplane mode) to think about my life. I think about my personal goals, my business goals, and the progress I’ve made so far. I think about things I can add, things I can eliminate, and things I can delegate.

The highest and best use of your magnificent mind is to aim it at a specific goal or purpose. Chatter is not thinking. Neither is replaying the same tired thoughts again and again.

Your thinking time should be used to consciously move closer to your goals.

The sad truth is that most people are too busy earning a living to make any money.

Look, I get it. I really do.

The world is engineered to keep us busy. You have client meetings, paperwork to shuffle, emails to send, and phone calls to make. On top of that, you might have a spouse to keep happy, kids to keep fed, and all the stuff that comes with it. Sports, plays, music lessons, and so on.

“Time for myself? Ha, don’t make me laugh,” you might be thinking.

Again, most people are too busy earning a living to make any money. They’re too distracted to sit alone and do nothing but think.

You don’t have to do two hours, either. You can start with five minutes. You can find a quiet spot and set a timer on your phone. Then, you can pick one challenge you’d like to solve in your business and work through it in your mind.

Maybe you find a solution, maybe you don’t. Either way, you will make progress.

If you’re not willing to put in the time to get what you want out of life then you should reconsider how badly you want it.

49. Simplicity is better than complexity.

I’m no stranger to criticism (because I have a no-holds-barred, take-no-prisoners approach to marketing), but I’ve never understood this criticism…

“James, your marketing advice is too simple.”

Maybe I’m wrong but I think simplicity is a wonderful thing.

I’ve always found it odd that some people have weird urges to make things harder for themselves. They overthink, overanalyze, and overengineer their business’s most basic problems.

One theory is that, deep down, these people believe they don’t deserve success unless they struggle for it. They make things difficult so they feel worthy if/when they accomplish their goals.

Another theory is that complication provides people with excuses for mistakes and sub-par performances. They create a fictitious win-win situation where they feel excused if they do poorly and feel praised if they do well.

Yet another theory says that they're addicted to the fight-or-flight mechanism which comes from facing a challenge. In previous centuries, the fight-or-flight response was useful because it allowed us to take instant action whenever we were in mortal peril. Since modern lifestyles rarely provide needs for this mechanism, people create excess stress in their lives to trigger it.

No matter the theory, I have no desire to make things more complicated than necessary. If I can get maximum results with a simple approach, so be it. Let everyone else chase complexity.

50. Strategy wins the game, not tactics.

Here’s a piece of advice from former chess World Champion Anatoly Karpov…

Karpov is considered the greatest chess strategist of all time. His archrival Garry Kasparov (who you might recognize from his battle against IBM’s chess-playing computer Deep Blue) is considered the greatest tactician of all time.

If you listen to my Financial Advisor Marketing podcast, you know I’m always yapping about the difference between strategies and tactics. So, I was eager to see how these two men described the difference.

And in an interview, Karpov put it this way:

“Strategy is knowing what to do when there is nothing to do. Tactics are knowing what to do when there is something to do.”

Whoa. 🤯

He’s so right.

Put another way, strategy is WHAT you do. Tactics are HOW you do it.

I liken it to an employee vs. owner mindset. The employee wants to be told what to do. He/she wants a list of tactics on which to execute. The owner, on the other hand, is the one making the list. As such, the owner is responsible for the strategy.

Now, let’s tie this back to financial advisors getting more clients…

There are tons of coaches, consultants, and marketing agencies out there who can give you tactics. Tactics are a dime a dozen.

For example, I saw an article about how financial advisors can improve their blogging results. The article focused on tactics such as formatting, font size, white space, and so on.

Changing these things is like digging faster. And before I dig faster, I want to ask…

“Am I digging in the right place?”

The tacticians NEVER ask that question. Which means they’re gambling. They’re crossing their fingers and hoping that they’re doing the right things at the right times.

If tactics are individual chess pieces, strategy is how you move them across the board. This means strategy is what wins the game.

Related: 5 Things Preventing Financial Advisors From Being Successful