Successful brands share a lot of common traits. They hold themselves to certain values, they’re transparent with their audience and authentic in their intentions. All culminating to build a positive brand image. But what helps these brands differentiate from one another?

Sure, values, transparency and authenticity are essential to maintaining brand identity and consistency. But really creating an effective presence on and off of social media demands a personality from your brand.

Also called the “face” of a brand, the personality maintains a consistent tone and communication style across all of your social media accounts. This can be challenging for larger brands, but advisors have a distinct advantage.

The Advisor Advantage

When it comes to creating a “face”, larger brands are limited by their size. They often take up mascots and characters to project their brand’s personality and values. Insurance companies and restaurants are great at this, think Geico, Progressive, McDonald’s and Wendy’s. An odd list, to say the least, but they all utilize a character to represent their brand.

Instead, advisors have two options when it comes to creating a personality for your brand:

- Option One: You or a member of your team becomes the “face” of the brand

- Option Two: You create a personality behind the firm’s logo, and reinforce it through consistency

Though option two doesn’t have the same immediate advantages, it can still be done, as shown from the larger brands above. So, to really dive into this topic further, let’s look at some examples of brands that use both approaches, breaking down what works and how advisors can leverage different methods to improve social engagement, increase their social following and enhance overall brand presence.

1. Use Humor To Increase Engagement

Wendy’s social media accounts are well known among marketers. Where other brands might use a traditional approach with a professional voice for social media, Wendy’s opted for a personal approach.

Their social media marketing is transparent, which makes it not feel like marketing. Emojis, joke surveys and popular culture references give Wendy’s Twitter page a distinct, casual personality.

References to other social media platforms and the increasing use of video plays into social media marketing trends while drawing attention to Wendy’s actual products:

The success of Wendy’s social media caused competitors to follow suit. With massive brands like McDonald’s creating a similar, witty voice for their Twitter account:

The personality behind these brands works so well because they adhere to the principles of effective social media marketing while standing out by appearing non-corporate. We’ve discussed that users go on social to escape, relax and socialize. By leveraging all three user needs, the brands above generate greater engagement to their accounts through mentions, comments and shares.

How Advisors Can Leverage Humor:

Many of the posts above function because these brands have a massive following. After all, there were nearly 14,000 McDonald’s in the U.S. alone as of 2018. That’s an incredible reach outside of social media. But, there are three key things advisors can learn from these brands and adopt into their own social media strategies.

- Use humor to connect with your audience’s interests or relate to something relevant

- Don’t be afraid to adopt a casual tone when discussing services

- Show some personality, talk about family, tell a joke or share an interesting story

Dave Zoller, well known for his advice on social, provides a great example below. Using a casual, relatable and timely subject, Dave adds a bit of humor to his account. Advisors can similarly leverage humor to draw attention to their services or to ask a question, improving shareability and the likelihood of comments, therefore improving the post’s engagement.

2. Collaborate With Brands that Share an Audience

Your social media strategy should always consider your audience’s interests, especially if you have a shared hobby amongst your audience members. Interests are a great way to personalize and differentiate, allowing you to create a social media following on more than one topic.

Looking at Wendy’s Twitter feed again we can assume a large number of audience members are gamers:

By collaborating with Twitch, a well know live stream platform for gamers, Wendy’s was able to engage their audience on multiple platforms. Alternatively, something simple, like this message from Progressive, can tap into shared interests and trending topics to make the brand top of mind for some users:

Tapping into the shared hobbies of your audience members can be a great way to personalize your posts and connect with them. Just make sure your interest is authentic, as using a hobby as a marketing tactic can sometimes backfire if your audience believes their interest is being used against them. Wendy’s example works because their social presence references internet culture as a whole, while progressive shows genuine interest by demonstrating they’re aware of the entire season.

How Advisors Can Leverage Audience Interests:

Advisors may not be able to collaborate with other platforms in the same way as the brands above, but they can discuss their interests in other posts. Similar to the tip from above, advisors can reference their own passions and hobbies to engage their audience from a different perspective.

In this example, Joe Duran discusses specific football teams, appealing to his sports-minded audience while alluding to his LA preference.

Alternatively, you can collaborate with other advisors to reach a larger audience, drawing attention to the content of one another, rather than interests. The post from Marty Bicknell below does just that by retweeting Jon Beatty’s post to build the awareness of both audiences:

When adopting this approach, don’t worry about immediately figuring out your audience’s interests. Instead, focus on creating one personal post a week. This could be a commentary on a recent sporting event, a new hobby or a family photo. Then, see what resonates with your audience and do more of that. During this period, also consider using different content types. Everything doesn’t need to be a blog. You can utilize video, create an infographic or post a relevant gif. You may find they enjoy something you wouldn’t have expected. Don’t be afraid to experiment.

3. Shine a Spotlight on Related Posts

A snowball effect occurs when a brand creates a personality on social media and engages with its audience. Users see when a brand engages, and if that brand has a particular personality behind it, users can use the brand to spotlight their own posts.

Continuing from our examples above. We see users on Twitter referencing Mcdonald’s using the same humor as the brand:

By retweeting this post, McDonald’s draws attention to this user’s interaction and incentives others to do the same. Engagement like this builds reciprocity, as users seek to interact with the brand further, creating more engagement.

How Advisors Can Leverage Related Posts:

As a platform, social media is designed to be just that, social. It may be difficult to be mentioned or linked to, especially when you are just starting to build your social following. But a great starting point is to simply engage with the content that you want to be recognized for. Find like-minded users and respond to their posts, link to their blogs and react to their content.

As discussed earlier, engaging in this fashion builds reciprocity. Let’s take this post from Joe Duran as an example:

Here Joe is responding to a post from Steve Sanduski in which Steve has shined a spotlight on Joe. The feedback loop created by this sort of interaction allows each advisor to draw attention to their platform while tapping into the audience of another.

Commenting and responding to the content of others is also best done through a personal account. Though it can be done through a brand account, it often feels more disconnected unless that brand has done the work to build a personality behind their logo.

4. Adjust Content and Messaging for Each Platform

Instead of posting the same content to different social platforms, successful brands will adjust their content, tone and delivery to fit the expectations of the chosen platform.

For example, Wendy’s LinkedIn page creates a much more professional atmosphere, in direct opposition to their other social channels:

Context and consistency here are key. And, though the above example does deviate from the usual marketing strategy, it only does so for the context of the social platform, whereas we can see Wendy’s marketing is similar across three of the other big four, Facebook, Instagram and Twitter.

This is because their marketing strategy is appropriate and effective on these three platforms, more so than LinkedIn.

How Advisors Can Adjust Content and Messaging for Each Platform:

Consider the type of content and personality the face of your firm will project, then decide which platform would best serve this personality. Per the example above, Wendy’s has a LinkedIn profile, but they post far less content on LinkedIn than other channels where their audience is more active. For advisors, this means understanding the general content and audience that is receptive to financial content on each social media platform:

- Facebook: Community-based content, age 50+

- Instagram: personal image and story-based content, age 30-50

- LinkedIn: Business advice and info, Networking professionals, sales managers and entrepreneurs

- Twitter: Recent events and trends, reporters and journalists

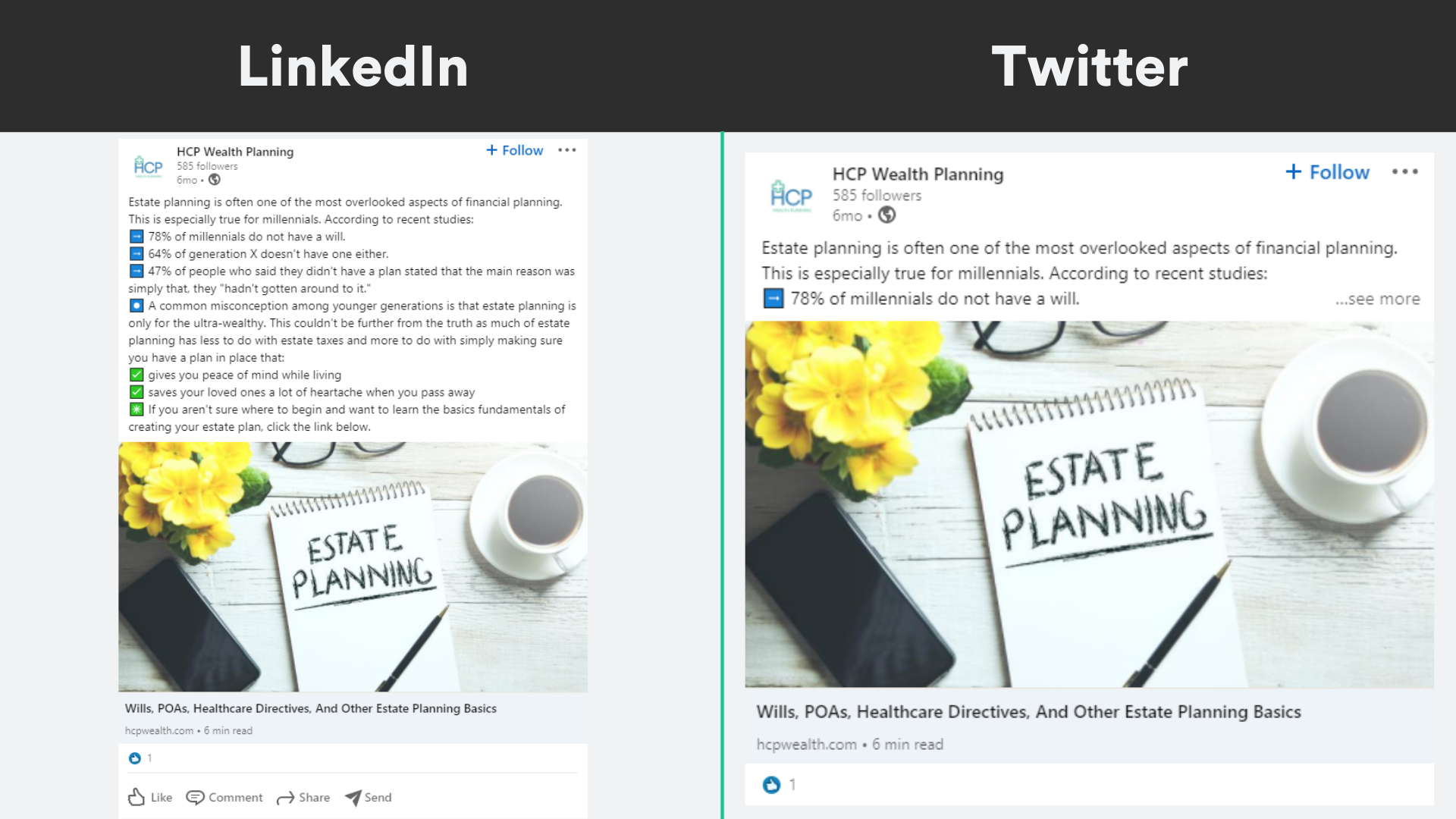

This example from HCP Wealth Planning shows how advisors can utilize similar material while adjusting the context and approach of their message to fit the appropriate social platform:

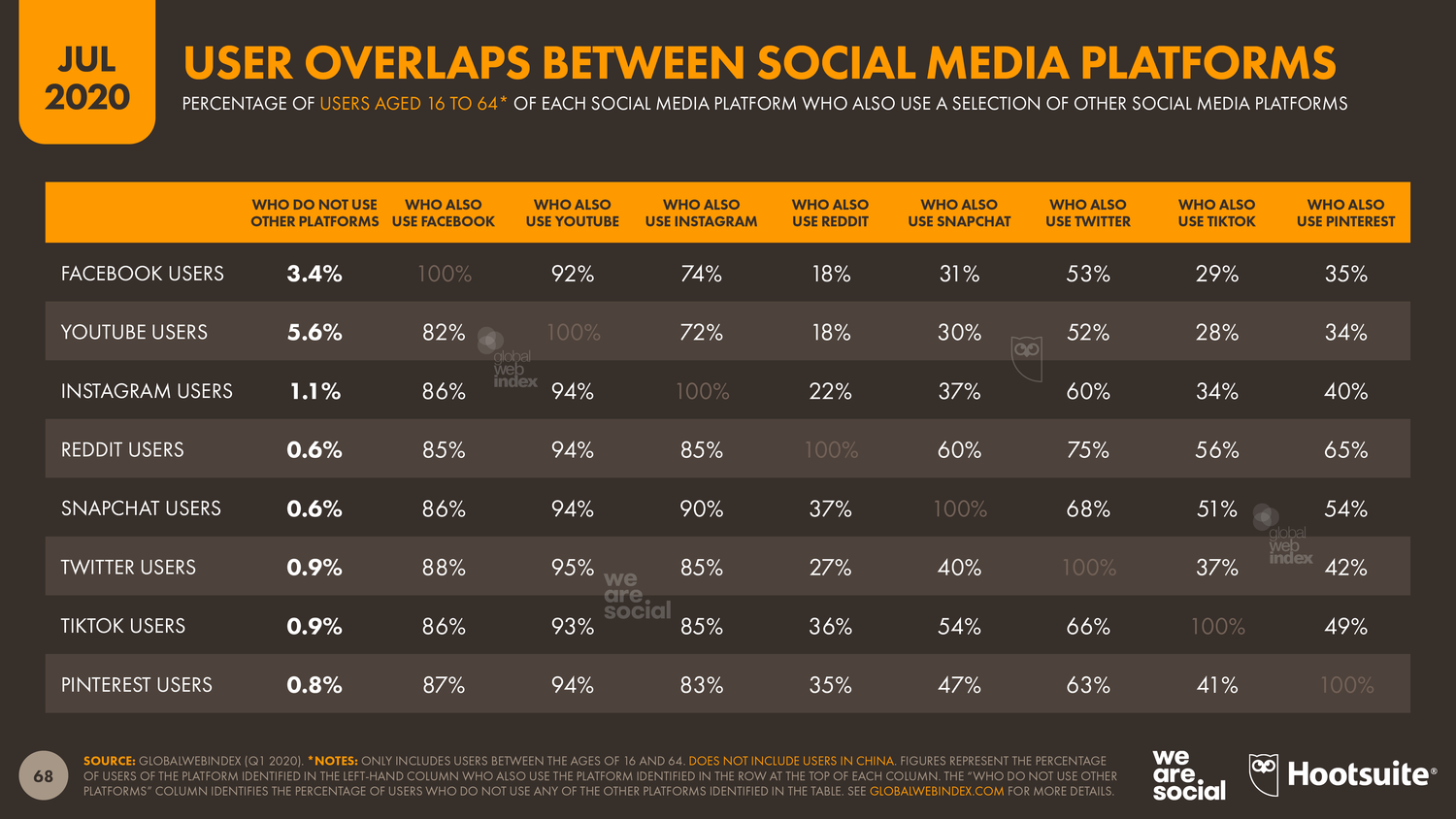

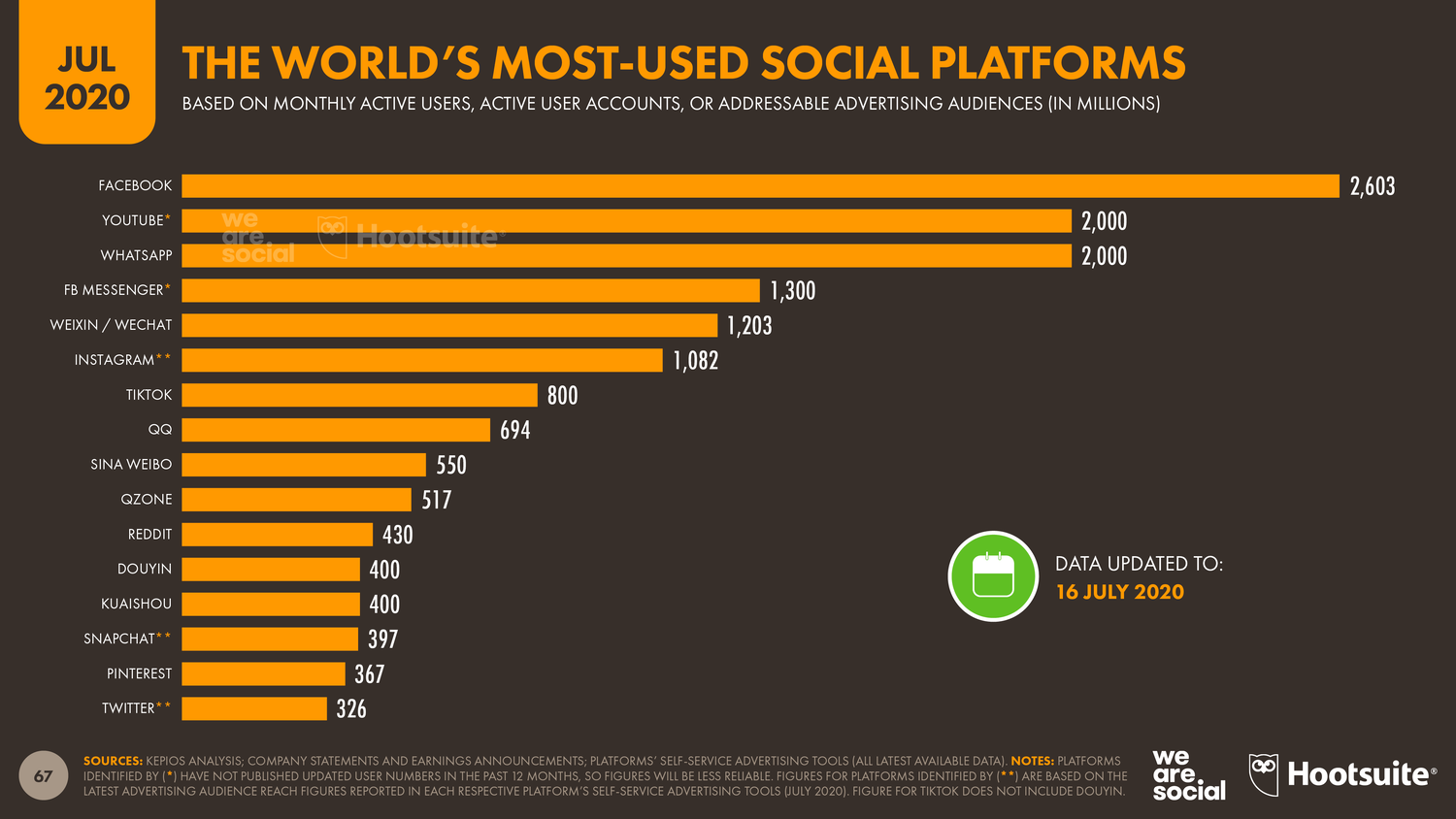

- In some cases, you will find the audience across two or more social channels is relatively similar. After all, according to Datareportals 2020 social media report, many users are on a variety of social platforms:

-

Also, if you’re not sure which social platform to start on, or you’re trying to focus to save time, then consider Facebook. According to the same 2020 social media report from Datareportal, Facebook is the number one social media platform, by a significant margin:

Wrapping It Up

Successful social media is a driving force for many brands. For advisors, it’s an opportunity to attract leads, become a knowledge source or thought leader and diversify from the competition. Creating a face for your brand is the best way to accomplish these goals. But, remember, even if your brand does not have a “face”, or you’re uncomfortable with that level of transparency, there are several strategies you can utilize to garner the same success by learning from much larger brands. Make sure you understand the strategies above as you work to increase engagement and build a following on social media.

Related: Five Principles for Financial Advisors to Get New Clients in 2021 From Digital Marketing