Investors are also gearing up for earnings season, which kicks off this Friday, and folks are eager to hear about last quarter’s profits as well as the outlook for the top and bottom lines. But while equities are exuberant, yields and the dollar are tightening financial conditions, as strong economic data pares back Fed easing expectations. Indeed, rate watchers have removed another 50-basis point reduction from the table in November, favoring a 25, while also considering a pause that now sports odds of 15%. Meanwhile, across the Pacific in Beijing, Chinese stocks have given back a large chunk of their recent rally, as appetites for further stimulus measures go unsatisfied.

September Inflation Eases Slightly

The release of the Consumer Price Index (CPI) was expected to reflect price increases of 0.2% month over month (m/m) and 2.4% year over year (y/y) for September. If my hotter-than-consensus figures materialize, they would arrive near August’s 0.2% m/m and 2.5% y/y rates. Core prices, which exclude food and energy, likely rose 0.3% m/m and 3.3% y/y. The m/m core result would be in-line on a m/m basis but 10 bps hotter y/y relative to the previous month. I’m anticipating that shelter, food, medical care, transportation services and automobiles supported price pressures while costs for gasoline, energy services (electricity and heating) and apparel offered relief to households.

A Friendly Fed Supports Equities

The S&P 500 is now up 22% this year and reached a fresh all-time high this morning amidst broad-based help across sectors. All US equity benchmarks are gaining this session as the Russell 2000, Dow Jones Industrial, Nasdaq 100 and S&P 500 indices are up 0.8%, 0.7%, 0.5% and 0.5%. Industry breadth is strongly positive with 8 out of 11 components in the green and led by financials, technology and energy; they’re up 0.9%, 0.9% and 0.8%. On the other hand, the laggards are comprised of utilities, real estate and communication services, which are losing 0.6%, 0.2% and 0.1%.

Rates Aren’t Jolly Though

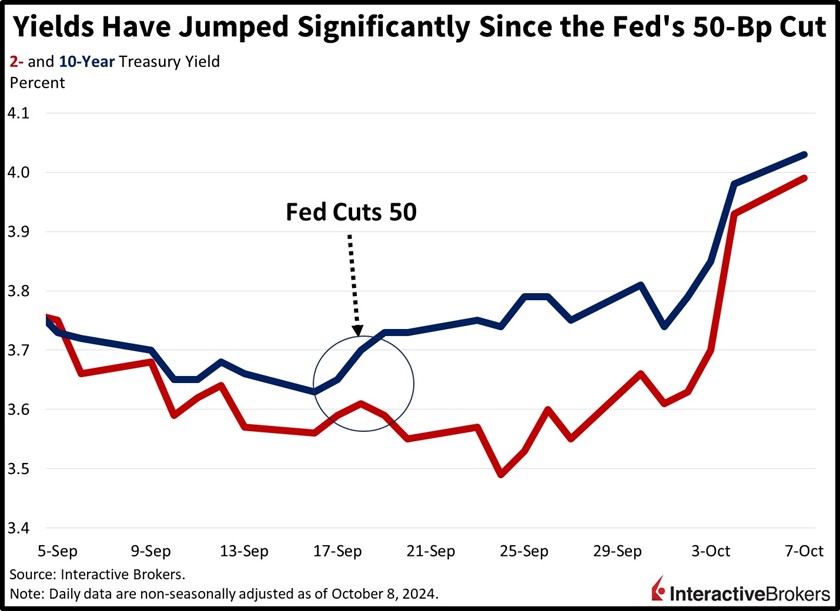

But yields are pointing to some trouble on the horizon considering that they’ve jumped significantly since the Fed’s 50 basis point (bps) cut. Indeed, both the 2- and 10-year Treasury maturities now carry 4 handles as they change hands at 4.01% and 4.05%, 4 and 3 bps loftier on the session. Rates may move further this afternoon and tomorrow as the Treasury gears up for $39 billion and $22 billion auctions for 10- and 30-year securities. The dollar is taking its cue from yields, with its gauge up 31 bps and the greenback appreciating relative to most of its counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian currencies. While loftier borrowing costs aren’t weighing on the equity market, they are hampering the commodity complex. Copper, crude oil, gold and silver are lower by 1.6%, 1.1%, 0.3% and 0.1%, but lumber is bucking the trend, gaining 0.7%. WTI crude is changing hands at $73.05 per barrel as hopes of aggressive stimulus from Beijing underwhelm while Middle East hostilities have yet to disrupt oil supplies in a major way.

A Deeper Look at Climbing Bond Yields

While analysts anticipate a decline in price pressures over the short-term, rising Treasury yields imply that bond investors fear that the Federal Reserve has thrown gasoline on the inflation fire by slashing its key benchmark 50 bps last month. On September 17, or the day before the Fed action, yields across the curve were lower than they are today by roughly 40 bps.

Forecast Traders Expect Hot Core CPI

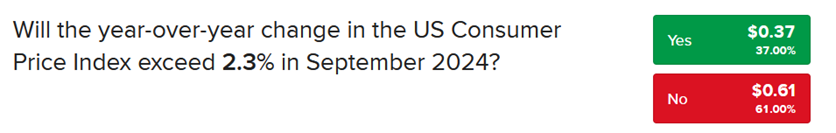

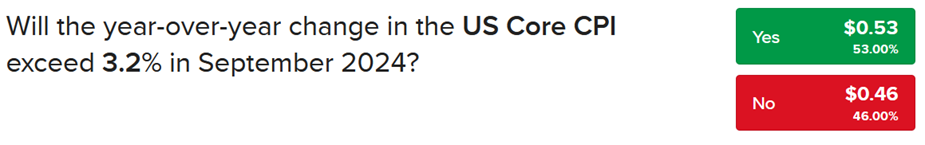

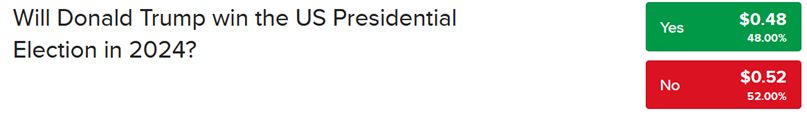

IBKR ForecastTrader participants, however, appear to have a muted outlook for inflation, pricing a 37% probability that September’s headline CPI will exceed 2.3%. Turning to core CPI, however, participants are expecting a higher than consensus figure, with a 53% chance of a figure north of 3.2%. Finally, for the dead heat presidential election, folks still expect Vice President Harris to occupy the Oval Office as she’s favored with odds of 52%.

Source: ForecastEx

Related: Long-Term Yields Surge to 2-Month Highs After Strong Jobs Report