Consumer-related earnings come fast and furious this week, with five large-cap names reporting full-year results. On Tuesday, the market will hear from Ross Stores and the new “market darling” Target, followed by discount-retail-store Dollar Tree. Costco and Kroger will round out the week on Thursday reporting at the market close and just before opening respectively.

- Ross Stores Inc. (NASDAQ: ROST) 2nd March

- Target Corporation (NYSE: TGT) 2nd March

- Dollar Tree Inc. (NASDAQ: DLTR) 3rd March

- Costco Wholesale Corp. (NASDAQ: COST) 4th March

- Kroger Company (NYSE: KR) 4th March

Analysts are eagerly awaiting news from Target, whose stock is up over 73% in the last 12 months and far ahead of the other names reporting results this week. Target seems to be ahead of the pack primarily thanks to years of investments in e-commerce, which proved particularly useful during the Covid-19 pandemic. The company's earnings growth boomed 73.3% and 106% in its latest two quarters, far above the three-year average of 17%.

Finscreener.org reports that Target has a target price of $206.73 per share, which is a 12.70% potential upside from the last closing price. Only deep discounters, Dollar Tree and Costco have higher stock price potential upside at 21.52% and 18.65%, respectively. These stocks have primarily moved sideways in the last 12 months, so analysts and investors will need to see that management has a credible plan to propel these stocks forward, especially if the Covid-19 pandemic lasts longer than currently anticipated.

Analysts Anticipate a Strong 2021

Wall Street Analysts will closely examine companies’ forward-looking statements and forecasts to gauge if this year will be a boom for a sector that has suffered from severe operating cash flow deterioration. Last year was undoubtedly rough for the retail industry in general. According to S&P Global, 51 US retail companies went bankrupt in 2020, the highest amount in the last ten years. Only 2010 was close with 48 announced US retail bankruptcies compared to a low of just 20 in 2014.

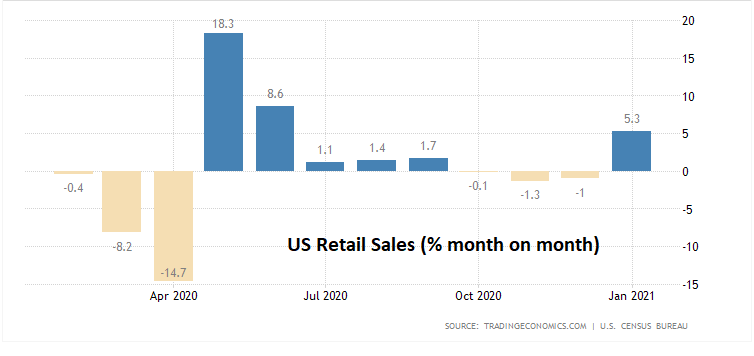

On the macroeconomic front, February US retail sales are not due for release until 16th March, but the market will closely watch with economists expecting 2.1% growth in monthly retail spending. January was solid with a 5.3% increase after three previous months of declines and three months prior of weak growth. Economists put January's strong growth down to new government stimulus checks that helped to boost consumer spending. Retail sales growth will need to show continued upward momentum for retail-related stocks to deliver on analysts' 2021 earnings expectations.

Related: Home Depot vs. Lowes: Does Home Depot Offer Value Now?

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.